UK Education Market

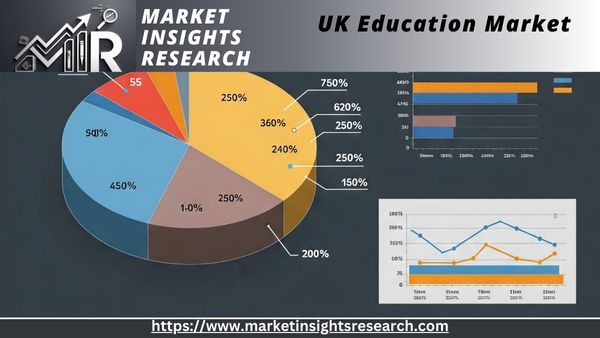

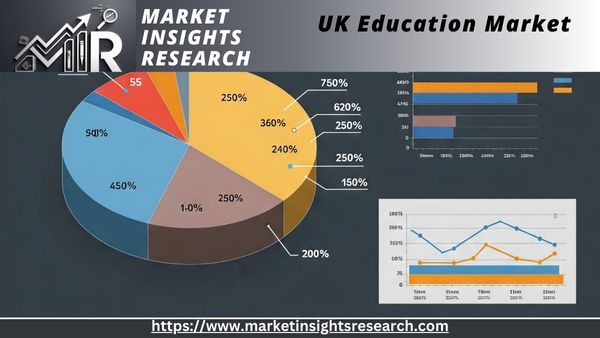

The UK education market was valued at approximately GBP 129.4 billion in 2025 and is projected to exceed GBP 204.8 billion by 2035, growing at a CAGR of 4.7%. Digital learning, international collaboration, and modular micro-credentials are emerging as strong trends. Virtual reality (VR), AI tutors, and gamified platforms are enhancing student engagement and performance across age groups.

Reports Description

The UK education market is undergoing a major transformation, fueled by digital disruption, internationalization, and policy reforms. From early childhood to higher education and vocational training, educational institutions are embracing technology, personalized learning, and global engagement. This report explores the evolving dynamics, investment trends, and innovations reshaping the future of the UK’s education sector.

Download Sample Ask for Discount Request Customization

Market Significant Growth Factors

Key drivers include rising demand for digital and blended learning models, increased international student enrollment, government investments in skills development, and the expansion of EdTech platforms. The growing emphasis on employability, digital literacy, and lifelong learning is also reshaping curricula and institutional strategies. Post-Brexit education policy shifts and a focus on inclusion and accessibility further influence market dynamics.

Report Scope

|

Parameter

|

Details

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025–2035

|

|

Market Size in 2025

|

GBP 129.4 Billion

|

|

Projected Market Size

|

GBP 204.8 Billion by 2035

|

|

CAGR (2025–2035)

|

4.7%

|

|

Regions Covered

|

UK (by internal regions), U.S., Europe, Asia Pacific, China

|

|

Segments Covered

|

Education Type, Delivery Mode, Demographics, Offering, Region

|

|

Key Deliverables

|

Market Forecasts, Policy Impacts, EdTech Adoption, Strategic Outlook

|

Download Sample Ask for Discount Request Customization

Report Coverage & Deliverables

-

Revenue projections and market size (2025–2035)

-

Segment-wise analysis by institution type, technology, and learner demographics

-

Regional insights and policy impact analysis

-

Competitive landscape and EdTech startup ecosystem

-

Investment trends, future outlook, and actionable insights

Recent Developments

-

In March 2025, Pearson UK launched an AI-powered adaptive learning platform for secondary schools.

-

In February 2025, the University of Edinburgh expanded its global virtual campus with hybrid learning programs.

-

In late 2024, the UK government announced GBP 2.1 billion funding toward digital infrastructure in public schools.

Regional Insights

London remains the hub for international education and EdTech innovation, while regional universities across the North and Midlands are expanding access and vocational training. Scotland and Wales are implementing localized policies that emphasize bilingual education and community development.

End-Use Insights

The market serves learners across K–12, higher education, vocational training, and corporate learning. While K–12 focuses on foundational knowledge and hybrid delivery models, higher education is investing in research, global partnerships, and tech-enabled campuses. Vocational training is gaining momentum for its alignment with workforce readiness and reskilling.

Deployment Insights

Education is delivered via physical classrooms, fully online platforms, and blended environments. Post-COVID, blended learning has become the dominant mode, especially in universities and corporate training. Cloud-based platforms and LMS (Learning Management Systems) ensure scalability and real-time tracking.

Process Insights

Core educational processes now include digital curriculum design, interactive assessment systems, data analytics in learning, and remote classroom management. AI and automation are playing increasing roles in personalized learning pathways, student progress tracking, and administrative workflows.

Offerings Insight

-

Traditional Academic Programs (GCSE, A-Levels, Undergraduate, Postgraduate)

-

Online Courses & Certifications

-

Corporate L&D Platforms

-

EdTech Solutions (LMS, AR/VR, Adaptive Learning Engines)

-

Tutoring Services & Exam Prep

U.S. Market Trends

U.S. education providers are forming partnerships with UK universities for transatlantic degree programs and credit exchanges. Demand for UK-based online certifications and micro-degrees is growing among American professionals seeking international exposure.

Europe Trends

European students continue to enroll in UK institutions post-Brexit, especially through transnational education hubs. The Bologna Process remains influential, encouraging harmonized qualifications and cross-border student mobility.

Germany Trends

Germany’s dual education model inspires UK vocational institutions to innovate. Collaborative programs between German and UK engineering and tech schools are on the rise, particularly in sustainability and digital transformation sectors.

Download Sample Ask for Discount Request Customization

Asia Pacific Trends

Asia Pacific students, especially from India and Southeast Asia, are a major demographic in UK universities. UK institutions are expanding campus footprints in Singapore, Malaysia, and Australia to serve regional learners more directly.

China Trends

UK-China academic partnerships focus on research collaboration, dual degrees, and STEM-focused curricula. Despite regulatory complexities, Chinese student enrollment in UK institutions remains strong, particularly in science, business, and AI disciplines.

Key Players

UK Education Market Segmentation

|

Segment

|

Categories

|

|

By Education Type

|

K–12, Higher Education, Vocational Training, Corporate Learning

|

|

By Delivery Mode

|

In-Person, Online, Blended Learning

|

|

By Demographic

|

Domestic Students, International Students, Adult Learners, Workforce Upskilling

|

|

By Offering

|

Academic Degrees, Certifications, Online Courses, EdTech Tools, Tutoring Services

|

|

By Region

|

London, South East, Midlands, North England, Scotland, Wales, Northern Ireland

|