Neuromorphic Computing Market, By Component (Hardware, Software, Services), By Deployment (Edge, Cloud), By Application (Image recognition, Signal recognition, Data mining) By End-use Industry & Forecast, 2024 – 2032

Published Date: April - 2025 | Publisher: MIR | No of Pages: 240 | Industry: Media and IT | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Sample Ask for Discount Request CustomizationNeuromorphic Computing Market Size

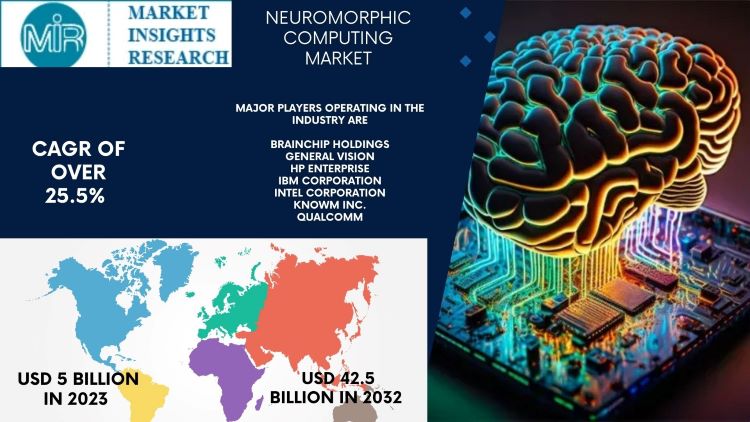

Neuromorphic Computing Market was valued at over USD 5 billion in 2023 and is expected to register a CAGR of over 25.5% between 2024 and 2032. The capacity to conduct large-scale neural network simulations makes scalability a key growth driver for the neuromorphic computing sector.

Scalable neuromorphic systems provide the flexibility to increase computational capacity without losing efficiency as demand rises for processing massive volumes of data in AI and machine learning applications. Neuromorphic computing is an appealing option for sectors requiring sophisticated, high-performance computing capabilities because of its scalability, which guarantees adaptation to changing computational needs. In September 2022, Intel Corporation collaborated with the Italian Institute of Technology and the Technical University of Munich to introduce a new neural network-oriented object learning method. This partnership aims to use neuromorphic computing through an interactive online object-learning approach to enable robots to learn new objects instance with better speed and accuracy after deployment.

The need for effective and scalable substitutes for traditional computer architectures is the driving force behind the increasing demand for brain-inspired computing solutions. The growing dependence of industries on artificial intelligence and machine learning applications has made it apparent that systems that emulate the brain's energy efficiency and parallel processing capacity are essential. As businesses look for cutting-edge solutions for challenging real-time data processing problems and complicated computational activities, neuromorphic computing is expected to expand in popularity as it provides viable paths for meeting these needs.

| Report Attribute | Details |

|---|---|

| Base Year | 2023 |

| Neuromorphic Computing Market Size in 2023 | USD 5 Billion |

| Forecast Period | 2024 - 2032 |

| Forecast Period 2024 - 2032 CAGR | 25.5% |

| 2032 Value Projection | USD 42.5 Billion |

| Historical Data for | 2021 – 2023 |

| No. of Pages | 200 |

| Tables, Charts & Figures | 345 |

| Segments covered | Component, deployment, application, end-use industry, and region |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Download Sample Ask for Discount Request Customization

A major obstacle in the market is the complexity of designing and programming neuromorphic devices. Neuromorphic computer designs imitate the complex neural networks seen in the brain, in contrast to standard computing structures, which use organized algorithms. Some prerequisites include hardware engineering, computer science, and neuroscience expertise. It is challenging to design effective algorithms and translate them onto hardware, which lengthens development cycles and raises costs. This intricacy may prevent widespread acceptance and restrict the market's potential for expansion.

Neuromorphic Computing Market Trends

The market for neuromorphic computing is expanding quickly as companies look for machine learning and AI solutions that are more effective. Neuromorphic systems provide increased processing power and energy efficiency by modeling the structure of the brain. In order to address the computational demands of complicated tasks while maximizing energy usage, neuromorphic computing presents a possible solution. The demand for advanced AI applications is expanding across industries, including healthcare, finance, and automotive.

By integrating neuromorphic computing with edge computing, data processing capabilities in real-time are brought to the network's edge, negating the need for data transmission to centralized servers. To reduce latency and enable faster response times for important applications like autonomous vehicles, industrial automation, and augmented reality, calculations are carried out closer to data sources such as IoT devices or sensors.

Neuromorphic Computing Market Analysis

Learn more about the key segments shaping this market

Download Sample Ask for Discount Request Customization

Based on component, the market is divided into hardware, software, and services. The hardware segment is expected to reach over USD 23.5 billion by 2032.

- Hardware components are experiencing growth in the neuromorphic computing market due to increasing demand for specialized chips and processors tailored to mimic the brain's neural networks.

- These components are essential for implementing efficient and scalable neuromorphic systems. Advancements in hardware technologies, such as neuromorphic chips with spiking neural networks and memristors, are driving innovation and expanding the capabilities of neuromorphic computing, thus fueling market growth.

Learn more about the key segments shaping this market

Based on deployment, the market is segmented into edge and cloud. The edge segment is expected to register a CAGR of over 31% over the forecast period.

- Edge deployment brings computing resources closer to data sources, reducing the time it takes for data to travel to centralized servers and back. This is crucial for applications requiring real-time processing, such as autonomous vehicles and industrial automation.

- Edge computing minimizes the need to transmit sensitive data over networks, enhancing privacy and security by keeping data closer to its source and reducing exposure to potential cyber threats.

Looking for region specific data?

Download Sample Ask for Discount Request Customization

North America dominated the global market in 2023 with over 30% of the total revenue share. The neuromorphic computing market is expanding in North America because of the region's strong ecosystem of tech firms, top research universities, and significant investments in the semiconductor and artificial intelligence sectors. The area also gains from a highly trained labor pool, conducive regulatory frameworks, and robust government backing for R&D projects. All of these elements work together to make the region a leader in neuromorphic computing technology adoption and innovation, which supports the industry's expansion in North America.

Neuromorphic Computing Market Share

Intel Corporation and IBM Corporation held a significant share of over 15% in the neuromorphic computing industry in 2023. Intel Corporation is a leading provider of neuromorphic computing solutions, leveraging its expertise in semiconductor technologies. The company offers neuromorphic chips and platforms tailored for AI and machine learning applications. Intel's products enable efficient processing of complex data with low power consumption, driving advancements in areas such as edge computing, autonomous systems, and pattern recognition, thus shaping the future of computing.

IBM Corporation, a leading player in neuromorphic computing, offers a range of solutions leveraging its expertise in AI and semiconductor technologies. Their offerings include neuromorphic hardware development, software frameworks for neural network simulations, and consulting services for integrating neuromorphic systems into various applications. IBM aims to advance the field with innovative solutions tailored to meet diverse industry needs.

Neuromorphic Computing Market Companies

Major players operating in the industry are

- BrainChip Holdings

- General Vision

- HP Enterprise

- IBM Corporation

- Intel Corporation

- Knowm Inc.

- Qualcomm

Neuromorphic Computing Industry News

- In January 2023, IBM launched an energy-efficient AI chip built with 7nm technology. The AI hardware accelerator chip supports a variety of model types while achieving leading-edge power efficiency. The chip technology can be scaled and used for commercial applications to train large-scale models in the cloud to security and privacy efforts by bringing training closer to the edge and data closer to the source.

- In October 2022, Intel announced a three-year agreement with U.S. based Sandia National Laboratories (Sandia) to explore the value of neuromorphic computing for scaled-up computational problems. This agreement includes continued large-scale neuromorphic research on Intel’s upcoming next-generation neuromorphic architecture and the delivery of Intel’s largest neuromorphic research system to date, which could exceed more than 1 billion neurons in computational capacity.

The neuromorphic computing market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) from 2018 to 2032, for the following segments

Click here to Buy Section of this Report

Market, By Component

- Hardware

- Software

- Services

Market, By Deployment

- Edge

- Cloud

Market, By Application

- Image recognition

- Signal recognition

- Data mining

- Others

Market, By End-use Industry

- Consumer Electronics

- Automotive

- Healthcare

- Military & Defense

- Industrial

- Others

The above information is provided for the following regions and countries

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

Related Reports

- Metaverse for Automotive Market Size - By Component (Hardware, Software, Services), By Technology (Virtual Reality, Augm...

- SVOD Market Size - By Content (General Entertainment, Niche Content, Original Programming), By Pricing Model (Premium, A...

- Multimodal AI Market Size - By Component (Solution, Service), By Technology (Machine Learning, Natural Language Processi...

- AVOD Market Size - By Content (Movies, TV Shows, Original Series, News, Sports, User-generated Content), By Platform (S...

- Premium Finance Market - By Type (Life Insurance, Non-life Insurance), By Interest Rate (Fixed Interest Rate, Floating I...

- Gift Cards Market - By Type (Closed-loop Gift Cards, Open-loop Gift Cards), By Distribution Channel (Online, Offline), B...

Table of Content

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Neuromorphic Computing Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Million)

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.4. Neuromorphic Computing Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political Landscape

3.4.2.2. Economic and Social Landscape

3.4.2.3. Technological Landscape

3.4.2.4. Environmental Landscape

3.4.2.5. Legal Landscape

Chapter 4. Neuromorphic Computing Market: Application Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Neuromorphic Computing Market: Application Movement Analysis, 2023 & 2030 (USD Million)

4.3. Signal Processing

4.3.1. Signal Processing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4. Image Processing

4.4.1. Image Processing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5. Data Processing

4.5.1. Data Processing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6. Object Detection

4.6.1. Object Detection Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.7. Others

4.7.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Neuromorphic Computing Market: Deployment Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Neuromorphic Computing Market: Deployment Movement Analysis, 2023 & 2030 (USD Million)

5.3. Edge

5.3.1. Edge Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4. Cloud

5.4.1. Cloud Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Neuromorphic Computing Market: Component Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Neuromorphic Computing Market: Component Movement Analysis, 2023 & 2030 (USD Million)

6.3. Hardware

6.3.1. Hardware Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4. Software

6.4.1. Software Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5. Services

6.5.1. Services Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Neuromorphic Computing Market: End Use Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Neuromorphic Computing Market: End Use Movement Analysis, 2023 & 2030 (USD Million)

7.3. Consumer Electronics

7.3.1. Consumer Electronics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4. Automotive

7.4.1. Automotive Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5. Healthcare

7.5.1. Healthcare Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6. Military & Defense

7.6.1. Military & Defense Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.7. Others

7.7.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Neuromorphic Computing Market: Regional Estimates & Trend Analysis

8.1. Neuromorphic Computing Market Share, By Region, 2023 & 2030, USD Million

8.2. North America

8.2.1. North America Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.2.2. U.S.

8.2.2.1. U.S. Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.2.3. Canada

8.2.3.1. Canada Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.2.4. Mexico

8.2.4.1. Mexico Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3. Europe

8.3.1. Europe Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.2. UK

8.3.2.1. UK Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.3. Germany

8.3.3.1. Germany Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.4. France

8.3.4.1. France Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4. Asia Pacific

8.4.1. Asia Pacific Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.2. China

8.4.2.1. China Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.3. Japan

8.4.3.1. Japan Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.4. India

8.4.4.1. India Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5. South America

8.5.1. South America Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.2. Brazil

8.5.2.1. Brazil Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6. Middle East and Africa

8.6.1. Middle East and Africa Neuromorphic Computing Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis by Key Market Participants

9.2. Company Categorization

9.3. Company Heat Map Analysis

9.4. Company Profiles

9.4.1. Brain Corporation

9.4.1.1. Participant’s Overview

9.4.1.2. Financial Performance

9.4.1.3. Product Benchmarking

9.4.1.4. Recent Developments/ Strategic Initiatives

9.4.2. CEA-Leti

9.4.2.1. Participant’s Overview

9.4.2.2. Financial Performance

9.4.2.3. Product Benchmarking

9.4.2.4. Recent Developments/ Strategic Initiatives

9.4.3. General Vision Inc.

9.4.3.1. Participant’s Overview

9.4.3.2. Financial Performance

9.4.3.3. Product Benchmarking

9.4.3.4. Recent Developments/ Strategic Initiatives

9.4.4. Hewlett Packard Enterprise Development LP

9.4.4.1. Participant’s Overview

9.4.4.2. Financial Performance

9.4.4.3. Product Benchmarking

9.4.4.4. Recent Developments/ Strategic Initiatives

9.4.5. HRL Laboratories, LLC

9.4.5.1. Participant’s Overview

9.4.5.2. Financial Performance

9.4.5.3. Product Benchmarking

9.4.5.4. Recent Developments/ Strategic Initiatives

9.4.6. IBM

9.4.6.1. Participant’s Overview

9.4.6.2. Financial Performance

9.4.6.3. Product Benchmarking

9.4.6.4. Recent Developments/ Strategic Initiatives

9.4.7. Intel Corporation

9.4.7.1. Participant’s Overview

9.4.7.2. Financial Performance

9.4.7.3. Product Benchmarking

9.4.7.4. Recent Developments/ Strategic Initiatives

9.4.8. Knowm Inc.

9.4.8.1. Participant’s Overview

9.4.8.2. Financial Performance

9.4.8.3. Product Benchmarking

9.4.8.4. Recent Developments/ Strategic Initiatives

9.4.9. Qualcomm Technologies, Inc.

9.4.9.1. Participant’s Overview

9.4.9.2. Financial Performance

9.4.9.3. Product Benchmarking

9.4.9.4. Recent Developments/ Strategic Initiatives

9.4.10. SAMSUNG

9.4.10.1. Participant’s Overview

9.4.10.2. Financial Performance

9.4.10.3. Product Benchmarking

9.4.10.4. Recent Developments/ Strategic Initiatives

9.4.11. Vicarious

9.4.11.1. Participant’s Overview

9.4.11.2. Financial Performance

9.4.11.3. Product Benchmarking

9.4.11.4. Recent Developments/ Strategic Initiatives

List Tables Figures

Will be Available in the sample /Final Report. Please ask our sales Team.

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy