Global Aircraft Fuel Cell Market Outlook (2025–2035) Industry analysis covering market size, competitive landscape, and key trends by region. Segmentation includes fuel types (hydrogen, hydrocarbon, others), power output (0-100 kW, 100 kW-1 MW, above 1 MW), and aircraft types (fixed-wing, rotary-wing, UAVs, AAM).

Published Date: March - 2025 | Publisher: Market Insights Research | No of Pages: 455 | Industry: Aerospace and Defence | Format: Report available in PDF / Excel Format

View Details Buy Now 4950 Download Sample Ask for Discount Request CustomizationGlobal Aircraft Fuel Cell Market Overview

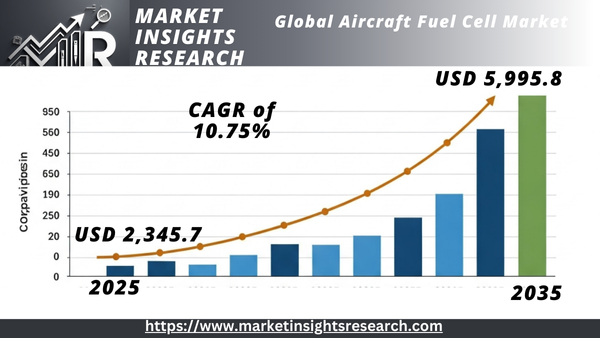

The global aircraft fuel cell market was valued at USD 2,345.7 million in 2025 and is projected to reach USD 5,995.8 million by 2035, expanding at a CAGR of 10.75% during the forecast period from 2025 to 2035.

Aircraft fuel cells play a crucial role in the aviation sector by providing clean and efficient energy for various aviation applications. These fuel cells utilize an electrochemical process to convert the chemical energy of fuel into electricity, offering a sustainable alternative to traditional power sources.

In the aviation industry, fuel cells are increasingly being integrated into propulsion systems, enhancing fuel efficiency while reducing environmental impact. Additionally, they serve as auxiliary power units (APUs), supplying energy to aircraft systems during ground operations and reducing reliance on conventional engines.

Download Sample Ask for discount Requset customization

Aircraft Fuel Cell Market Growth Factors

Advancements in Fuel Cell Technology

Ongoing innovations in fuel cell technology are significantly driving market expansion. Research and development efforts are focused on enhancing the efficiency, durability, and overall performance of fuel cells. Advances in materials, design, and manufacturing processes have led to higher energy conversion rates, increased electrical output, and extended fuel cell lifespan.

Moreover, improvements in system integration and control technologies are increasing the reliability and adaptability of fuel cell systems. Leading industry players are making substantial investments in R&D to optimize fuel cell economics, making them more cost-effective and commercially viable. The declining costs of fuel cells further accelerate their adoption across multiple aviation applications.

With technological progress, fuel cell technology is becoming more robust, offering substantial long-term fuel cost savings. This increased efficiency is expected to propel the market forward throughout the forecast period.

Rising Demand for Fuel-Efficient Aircraft

The growing demand for fuel-efficient aircraft is a primary driver of the aircraft fuel cell market. Airlines worldwide are prioritizing strategies to lower operational costs and minimize environmental impact, making fuel cells a promising solution for the aviation industry.

The increased utilization of aircraft fuel cells as backup power sources in emergency situations is further boosting adoption. These systems ensure the uninterrupted operation of critical aircraft functions, including communications, navigation, and safety equipment. As fuel cells enhance both safety and reliability, their demand is anticipated to surge over the coming years.

Additionally, the rising environmental concerns and stringent emission regulations have heightened the need for sustainable aviation solutions. Government, commercial, and business aviation sectors are all showing increasing interest in fuel cell technology as they strive to meet carbon reduction targets.

Government Regulations and Incentives

Supportive government policies and incentives are expected to drive substantial market growth. Many nations have implemented stringent environmental regulations to curb carbon emissions in the aviation sector.

Countries including the U.S., Germany, France, Japan, and India have introduced financial incentives, tax breaks, and subsidies for airlines investing in fuel-efficient aircraft technologies. These initiatives are fostering the adoption of fuel cell systems, accelerating the industry's shift toward greener aviation solutions. The rising preference for jet fuel cells further supports market expansion, with governments promoting cleaner energy alternatives through policy measures.

Aircraft Fuel Cell Market Restraints

Challenges in Hydrogen Storage and Cooling

One of the primary obstacles to market growth is the storage and cooling of hydrogen fuel used in fuel cells. Hydrogen has a low energy density, necessitating large storage tanks or complex compression and liquefaction systems. These storage solutions contribute to increased aircraft weight and volume, affecting overall fuel efficiency and payload capacity. Additionally, hydrogen's flammability poses safety concerns, requiring advanced containment and safety measures.

The high costs associated with hydrogen storage solutions further hinder widespread adoption, particularly in cost-sensitive aviation applications. Overcoming these technical and logistical challenges remains critical to unlocking the full potential of fuel cell technology in aircraft.

Complex Design and Integration Processes

Integrating fuel cell technology into aircraft involves highly complex and expensive design processes. The installation requires specialized equipment, advanced engineering, and skilled labor, significantly increasing overall system costs.

Furthermore, improper management of heat dissipation can reduce fuel cell efficiency and cause potential system damage. Advanced thermal management solutions are necessary to address these challenges. The high costs and technical complexity of fuel cell integration pose barriers to market growth, limiting adoption in certain segments of the aviation industry.

Aircraft Fuel Cell Market Opportunities

Advancements in HPTEM Technology Driving Market Expansion

Innovations in High Proton Transport Electrolyte Membrane (HPTEM) technology are paving the way for enhanced fuel cell performance in the aviation sector. HPTEM technology boasts superior proton conductivity, ensuring efficient ion transport within fuel cells, thereby improving energy conversion efficiency and overall system output.

One of the key advantages of HPTEM technology is its adaptability to a wide range of operating temperatures, making it ideal for various aircraft conditions. Its increased reliability and efficiency contribute to greater durability in fuel cell systems. Additionally, advancements in HPTEM materials and manufacturing techniques enhance resistance to degradation from extreme temperatures, fuel contaminants, and circuit failures.

Another significant benefit of HPTEM technology is its enhanced durability, which reduces the frequency of repairs and component replacements. This translates into lower maintenance costs and reduced system downtime. These economic benefits make HPTEM-based fuel cell systems a cost-effective solution, creating lucrative growth opportunities in the aircraft fuel cell market.

Download Sample Ask for discount Requset customization

Aircraft Fuel Cell MarketSegmentation Analysis

By Aircraft Type

The aircraft fuel cell market is categorized into fixed-wing aircraft, rotary-wing aircraft, unmanned aerial vehicles (UAVs), and advanced air mobility (AAM) systems. Among these, the UAV segment is expected to dominate the market during the forecast period.

Unmanned aerial vehicles are widely utilized for surveillance, mapping, logistics, and remote sensing applications. These UAVs require lightweight and high-energy-density power solutions, making fuel cells an attractive option due to their ability to provide extended flight times compared to conventional battery-powered systems.

Fuel cells offer advantages such as low noise levels, minimal vibrations, and superior performance in low-temperature environments, making them particularly suitable for military surveillance and security operations. UAVs rely on long endurance and extended range capabilities, which fuel cells efficiently support by delivering consistent and reliable power, enabling prolonged flight durations without frequent refueling or recharging.

By Power Output

The market is further segmented based on power output, with the 0-100 kW segment anticipated to hold a substantial market share during the forecast period. This segment aligns with the growing trend of electric aviation, as advancements in fuel cell technology have improved energy efficiency, sustainability, and cost-effectiveness within this power range.

Fuel cells in the 0-100 kW range are gaining traction due to their ability to deliver reliable and cost-efficient energy, making them a competitive alternative to conventional power sources. The increasing adoption of UAVs and small aircraft across various industries is fueling demand for fuel cells within this power segment.

Compact and lightweight power solutions are crucial for meeting the specific operational requirements of these aircraft. The 0-100 kW fuel cell systems provide a highly efficient and dependable energy source, making them an optimal choice for smaller aviation platforms.

Aircraft Fuel Cell MarketRegional Analysis

The aircraft fuel cell market is analyzed across key regions, including North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America. Among these, Asia Pacific is projected to experience the fastest growth during the forecast period, driven by several critical factors.

The region is witnessing a strong push toward sustainable aviation solutions, with increasing investments in urban air mobility and advanced aerodynamic technologies. Countries like China and India are making significant strides in the aerospace industry, with large-scale investments supporting technological advancements. The presence of leading aircraft manufacturers and component suppliers further cements Asia Pacific's dominant position in the market.

North America holds the second-largest share in the aircraft fuel cell market, fueled by substantial research and development investments in fuel cell technology. The United States, Canada, and Mexico are leading contributors to innovation in this space, benefiting from funding and initiatives led by the U.S. Department of Energy (DOE). Market players are actively working on fuel cell components for rotorcraft, further expanding the region’s influence in the industry.

In Europe, governments are setting ambitious goals to reduce carbon emissions, prompting the adoption of hydrogen fuel cell technology in aviation. Many European nations are focusing on next-generation energy solutions to achieve their sustainability targets, creating significant opportunities for fuel cell manufacturers to expand in the region.

Aircraft Fuel Cell MarketRecent Developments

-

January 2023 – ZeroAvia successfully conducted a flight test of a 600 kW hydrogen-electric propulsion system on a Dornier 228 aircraft.

-

February 2023 – Airbus and CFM International announced plans to test hydrogen-powered engines on the A380, a major step toward zero-emission aviation.

-

May 2022 – Airbus established the Zero Emissions Development Center (ZEDC) in Filton, United Kingdom. This state-of-the-art facility is dedicated to the design and development of hydrogen fuel systems for next-generation aircraft.

List of the key players in the Aircraft Fuel Cell Market

ZeroAvia

Ballard Power Systems

Intelligent Energy Ltd.

Doosan Mobility Innovation

GKN Aerospace

Piasecki Aircraft Corporation

ElringKlinger AG

PowerCell Sweden AB

H3 Dynamics

Honeywell International Inc.

Hydrogenics Corporation

Toshiba Energy Systems & Solutions Corporation

Aircraft Fuel Cell Market Report Scope

Below is a detailed breakdown of the Aircraft Fuel Cell Market report scope

|

Category |

Details |

|

Market Size & Forecast |

- Historical Data2019 - 2023 - Forecast Data2024 - 2035 - Market Revenue (USD Million) - CAGR (%) for the Forecast Period |

|

Market Segmentation |

- By Aircraft TypeFixed-Wing, Rotary-Wing, UAVs, Advanced Air Mobility (AAM) - By Power Output0-100 kW, 100-500 kW, Above 500 kW - By ComponentFuel Cell Stack, Balance of Plant (BoP), Hydrogen Storage, Power Electronics - By End-Use ApplicationPropulsion System, Auxiliary Power Unit (APU) - By Fuel TypeHydrogen Fuel Cells, SOFC, PEMFC - By RegionNorth America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Market Dynamics |

- Growth DriversAdvancements in Fuel Cell Technology, Demand for Fuel-Efficient Aircraft, Government Incentives - Restraints & ChallengesHydrogen Storage and Cooling Challenges, High Development Costs - Opportunities & Emerging TrendsDevelopment of HPTEM Technology, Integration of AI & IoT in Fuel Cells |

|

Competitive Landscape |

- Market Share Analysis of Key Players - Company Profiles, Product Portfolio, and Recent Developments - Mergers & Acquisitions, Collaborations, and Strategic Alliances |

|

Technological Innovations |

- Advancements in Fuel Cell Efficiency - Role of Hydrogen Storage & Infrastructure - Emerging Lightweight & Compact Fuel Cell Technologies |

|

Regulatory Framework & Policies |

- Government Initiatives and Subsidies for Fuel-Efficient Aviation - Environmental Regulations and Carbon Emission Reduction Mandates |

Download Sample Ask for discount Requset customization

The Aircraft Fuel Cell Market is segmented based on the following key factors

1. By Aircraft Type

-

Fixed-Wing Aircraft (Commercial, Military, Business Jets)

-

Rotary-Wing Aircraft (Helicopters)

-

Unmanned Aerial Vehicles (UAVs)

-

Advanced Air Mobility (AAM) Aircraft (eVTOL, Urban Air Mobility)

2. By Power Output

-

0 - 100 kW

-

100 - 500 kW

-

Above 500 kW

3. By Component

-

Fuel Cell Stack

-

Balance of Plant (BoP)

-

Hydrogen Storage & Distribution Systems

-

Power Electronics & Control Systems

4. By End-Use Application

-

Primary Propulsion System

-

Auxiliary Power Unit (APU)

5. By Fuel Type

-

Hydrogen Fuel Cells

-

Solid Oxide Fuel Cells (SOFC)

-

Proton Exchange Membrane Fuel Cells (PEMFC)

6. By Region

-

North America (U.S., Canada, Mexico)

-

Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

-

Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of Asia-Pacific)

-

Middle East & Africa

-

Latin America

Related Reports

- Airborne Collision Avoidance System Market - By Type (ACAS I & TCAS I, ACAS II & TCAS II, Portable Collision Avoidance S...

- Aircraft Gearbox Market - By Type (Accessory Gearbox, Reduction Gearbox, Actuation Gearbox, Tail Rotor Gearbox, Auxiliar...

- Torpedo Market, By Type (Heavyweight Torpedoes, Lightweight Torpedoes), By Propulsion (Thermal Propulsion, Electric Prop...

- Inertial Navigation System Market Size - By Component (Accelerometers, F Gyroscopes, Algorithms & Processors), By End Us...

- Nanosatellite and Microsatellite Market - By Component (Hardware, Software, Launch Services), By Orbit (Low Earth Orbit ...

- Rockets and Missiles Market - By Product (Missiles, Rockets), By Speed (Subsonic, Supersonic, Hypersonic), By Propulsion...

Table of Content

Table of Contents: Aircraft Fuel Cell Market Report

|

Section No. |

Section Title |

|

1. Executive Summary |

Overview of Market Trends, Key Statistics, and Summary of Key Findings |

|

2. Introduction |

Market Definition, Research Scope, and Assumptions |

|

3. Research Methodology |

Research Approach, Data Sources, and Validation Process |

|

4. Market Dynamics |

Market Drivers, Restraints, Challenges, and Opportunities |

|

5. Market Overview |

Industry Trends, Porter’s Five Forces Analysis, Value Chain Analysis |

|

6. Aircraft Fuel Cell Market Segmentation |

Detailed Breakdown by Aircraft Type, Power Output, Component, End-Use Application, Fuel Type, and Region |

|

6.1 By Aircraft Type |

Fixed-Wing, Rotary-Wing, UAVs, Advanced Air Mobility (AAM) |

|

6.2 By Power Output |

0-100 kW, 100-500 kW, Above 500 kW |

|

6.3 By Component |

Fuel Cell Stack, Balance of Plant (BoP), Hydrogen Storage, Power Electronics |

|

6.4 By End-Use Application |

Propulsion System, Auxiliary Power Unit (APU) |

|

6.5 By Fuel Type |

Hydrogen Fuel Cells, SOFC, PEMFC |

|

7. Regional Analysis |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

8. Competitive Landscape |

Key Player Market Share Analysis, Strategic Developments, Company Profiles |

|

9. Recent Developments |

Mergers & Acquisitions, Collaborations, Partnerships, Product Launches |

|

10. Technological Innovations |

Advancements in Fuel Cell Efficiency, Hydrogen Storage Solutions, AI & IoT in Fuel Cells |

|

11. Regulatory Framework & Policies |

Environmental Regulations, Government Incentives, and Aviation Policies |

List Tables Figures

NA

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy