Aircraft EMI Shielding Market Size, Share and COVID-19 Impact Analysis, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2024 – 2032

Published Date: March - 2025 | Publisher: MRA | No of Pages: 240 | Industry: Aerospace | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Sample Ask for Discount Request CustomizationAircraft EMI Shielding Market Size, Share and COVID-19 Impact Analysis, Regional Outlook, Growth Potential, Competitive Market Share & Forecast, 2024 – 2032

Aircraft EMI Shielding Market Size

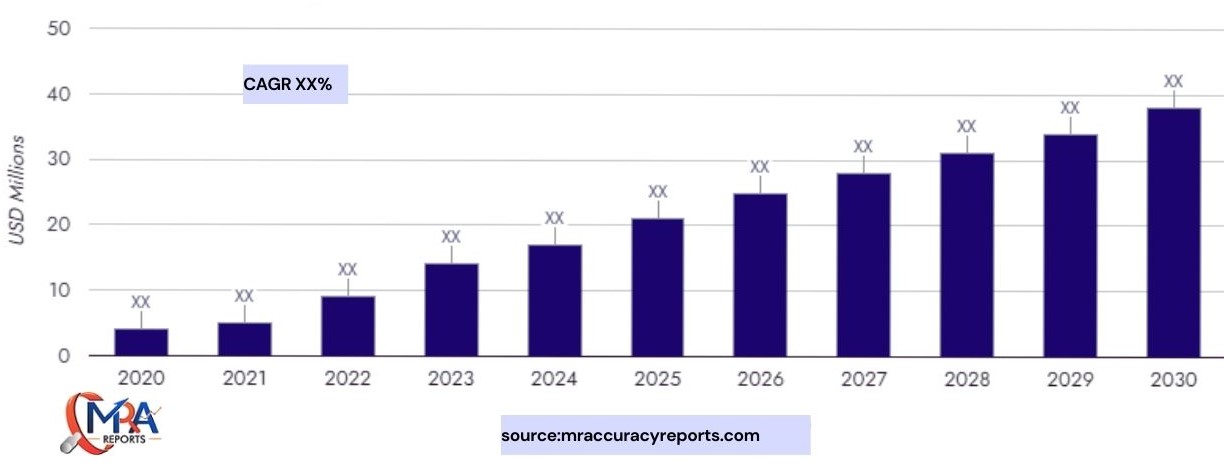

Global Aircraft EMI Shielding Market was valued at USD 1.1 billion in 2023 and is anticipated to project robust growth in the forecast period with a CAGR of 7.31% through 2029.

Download Sample Ask for Discount Request Customization

Aircraft EMI Shielding Market is anticipated to record substantial growth from 2023 to 2029 owing to the rising use of advanced electronics equipment in aircraft. Aircraft EMI shielding prevents random signals as well as waves from frying sensitive electronics. It is considered essential for all types of aircraft to assist in the proper functioning of electronic systems without causing any disturbance. New developments in EMI shielding technologies will influence the global aircraft fleet. The growing rate of manufacturing activities by key aircraft players is also among the prominent factors impacting the aircraft EMI shielding industry growth.

The transition towards sustainable solutions in the aviation industry is boosting the demand for electric and hybrid-electric aircraft, presenting new challenges in electromagnetic interference management. These innovative aircraft rely heavily on advanced electronic systems as they require robust EMI shielding to ensure safe and reliable operation. To that end, the surging focus of manufacturers on investing in specialized shielding materials and technologies tailored to the unique needs of electric aircraft will drive the industry expansion.

Aircraft EMI Shielding Market Trends

The world is buzzing with nations ramping up their military aircraft stockpiles to keep pace with the ever-evolving arms race. Governments are pulling out all the stops with increased defense spending and geopolitical tensions driving the need to fly high. Take India, for example. The government has rolled out the welcome mat for investors by reforming its economy and upgrading industries. And guess who's ready to party? Boeing, that's who! The U.S. aircraft giant is doubling down on India's aviation sector, both commercial and military. Now, these modern aircraft are packed with smart electronic systems that power everything from communication to navigation and other crucial stuff. But with all these electronics whirring away, there's a need for serious protection against electromagnetic interference (EMI) that can disrupt communication and foul up operations. That's where the demand for top-notch EMI shielding solutions comes in.

Aircraft EMI Shielding Market Analysis

In terms of aircraft type, the aircraft EMI shielding industry from the commercial aircraft segment is slated to depict lucrative growth through 2032 owing to the escalating demand for air travel worldwide. With the rising number of passengers and flights, airlines are continuously upgrading their fleets with modern aircraft featuring advanced electronic systems. These systems require reliable EMI shielding to ensure uninterrupted communication, navigation, and entertainment onboard. To that end, manufacturers are coming up with lightweight and effective EMI shielding materials to meet the stringent safety and performance requirements of commercial airliners, propelling the segment growth.

How EMI Shielding is Keeping Our Planes Flying Safe In the world of aircraft, electronic gadgets are everywhere, from radar systems to communication devices. But with so many electrical components crammed into a small space, there's a risk of electrical interference, known as electromagnetic interference (EMI). EMI can mess with signals and cause all sorts of problems, like communication failures or even system crashes. That's why EMI shielding is so important. It's like a superhero cloak that protects these vital electronics from electrical noise. Shielding the Equipment When it comes to EMI shielding, the equipment itself is a key player. Manufacturers use special materials and design techniques to keep interference from causing a fuss. This means using things like conductive coatings and enclosures that act as barriers, keeping the electronic signals nice and cozy inside the devices. Aircraft Getting More Tech-Savvy As planes get smarter and more advanced, they also get more wired up. This means that the use of EMI shielding has become absolutely crucial. With all those extra gadgets, the risk of interference is higher than ever. Asia Pacific Leading the Shielding Race The Asia Pacific region is the undisputed champ when it comes to aircraft EMI shielding. They're making more and more planes at home, and their defense spending is off the charts. This means a growing demand for military aircraft, which tend to have more advanced electronics and therefore need more shielding. Passenger Planes Need Shielding Too It's not just military aircraft that need EMI protection. As more and more people get up in the air, the number of passenger planes is booming. This means that the demand for EMI shielding is going to keep soaring. Shielding Our Skies EMI shielding is a silent hero in the world of aviation. It keeps our planes flying safely and smoothly, without any unwanted electrical surprises. So next time you fly, give a silent cheer for the EMI shielding that's protecting you from electrical gremlins.

Technological advancements, investments, and new product launches along with strategic growth initiatives like partnerships, acquisitions, and mergers are actively adopted by leading aircraft EMI shielding industry players. To illustrate, PPG Industries has been providing innovative solutions to protect aircraft electronics from electromagnetic interference for ensuring safety and reliability in aviation operations.

Some of the global aircraft EMI shielding firms include -

- PPG Industries

- The 3M company

- Parker Hannifin

- W.L Gore & Associates

- Laird PLC

Aircraft EMI Shielding Industry News

- In June 2023, Dow Inc. and FIRST (For Inspiration and Recognition of Science and Technology) collaborated to expand their robotic competition program.

What Information does this report contain?

Historical data coverage 2018 to 2023; Growth Projections 2024 to 2032.

Expert analysis industry, governing, innovation and technological trends; factors impacting development; drawbacks, SWOT.

6-7 year performance forecasts major segments covering applications, top products and geographies.

Competitive landscape reporting market leaders and important players, competencies and capacities of these companies in terms of production as well as sustainability and prospects.

Table of Content

- Introduction

- Product Overview

- Key Highlights of the Report

- Market Coverage

- Market Segments Covered

- Research Tenure Considered

- Research Methodology

- Methodology Landscape

- Objective of the Study

- Baseline Methodology

- Formulation of the Scope

- Assumptions and Limitations

- Sources of Research

- Approach for the Market Study

- Methodology Followed for Calculation of Market Size & Market Shares

- Forecasting Methodology

- Executive Summary

- Market Overview

- Market Forecast

- Key Regions

- Key Segments

- Impact of COVID-19 on Global Aircraft EMI Shielding Market

- Global Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis (Commercial Aircraft, Military Aircraft, Regional Aircraft, General Aviation, Helicopter, UAV)

- By Application Market Share Analysis (Aircraft Equipment, Aircraft Structural, Aircraft Bonding)

- By Product Type Market Share Analysis (Gaskets, Cable Overbraids, Laminates, Tapes and Foils, Conductive Coatings and Paints, Others)

- By Regional Market Share Analysis

- Asia-Pacific Market Share Analysis

- Europe & CIS Market Share Analysis

- North America Market Share Analysis

- South America Market Share Analysis

- Middle East & Africa Market Share Analysis

By Company

Market Share Analysis (Top 5 Companies, Others - By Value, 2023)

- Global Aircraft EMI Shielding Market Mapping & Opportunity Assessment

- By Aircraft Type Market Mapping & Opportunity Assessment

- By Application Market Mapping & Opportunity Assessment

- By Product Type Market Mapping & Opportunity Assessment

- By Regional Market Mapping & Opportunity Assessment

- Market Size & Forecast

- Asia-Pacific Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- By Country Market Share Analysis

- China Market Share Analysis

- India Market Share Analysis

- Japan Market Share Analysis

- Indonesia Market Share Analysis

- Thailand Market Share Analysis

- South Korea Market Share Analysis

- Australia Market Share Analysis

- Rest of Asia-Pacific Market Share Analysis

- Asia-PacificCountry Analysis

- China Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- India Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Japan Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Indonesia Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Thailand Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- South Korea Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Australia Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- China Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- Europe & CIS Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- By Country Market Share Analysis

- Germany Market Share Analysis

- Spain Market Share Analysis

- France Market Share Analysis

- Russia Market Share Analysis

- Italy Market Share Analysis

- United Kingdom Market Share Analysis

- Belgium Market Share Analysis

- Rest of Europe & CIS Market Share Analysis

- Europe & CISCountry Analysis

- Germany Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Spain Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- France Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Russia Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Italy Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- United Kingdom Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Belgium Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Germany Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- North America Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- By Country Market Share Analysis

- United States Market Share Analysis

- Mexico Market Share Analysis

- Canada Market Share Analysis

- North AmericaCountry Analysis

- United States Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Mexico Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Canada Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- United States Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- South America Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- By Country Market Share Analysis

- Brazil Market Share Analysis

- Argentina Market Share Analysis

- Colombia Market Share Analysis

- Rest of South America Market Share Analysis

- South AmericaCountry Analysis

- Brazil Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Colombia Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Argentina Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Brazil Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- Middle East & Africa Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- By Country Market Share Analysis

- South Africa Market Share Analysis

- Turkey Market Share Analysis

- Saudi Arabia Market Share Analysis

- UAE Market Share Analysis

- Rest of Middle East & Africa Market Share Analysis

- Middle East & AfricaCountry Analysis

- South Africa Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Turkey Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- Saudi Arabia Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- UAE Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- By Value

- Market Share & Forecast

- By Aircraft Type Market Share Analysis

- By Application Market Share Analysis

- By Product Type Market Share Analysis

- Market Size & Forecast

- South Africa Aircraft EMI Shielding Market Outlook

- Market Size & Forecast

- SWOT Analysis

- Strength

- Weakness

- Opportunities

- Threats

- Market Dynamics

- Market Drivers

- Market Challenges

- Market Trends and Developments

- Competitive Landscape

- Company Profiles (Up to 10 Major Companies)

- Kitagawa Industries Co. Ltd.

- Company Details

- Key Product Offered

- Financials (As Per Availability)

- Recent Developments

- Key Management Personnel

- Parker Hannifin Corporation

- Company Details

- Key Product Offered

- Financials (As Per Availability)

- Recent Developments

- Key Management Personnel

- W.L. Gore & Associates

- Company Details

- Key Product Offered

- Financials (As Per Availability)

- Recent Developments

- Key Management Personnel

- 3M Company

- Company Details

- Key Product Offered

- Financials (As Per Availability)

- Recent Developments

- Key Management Personnel

- Laird Technologies, Inc.

- Company Details

- Key Product Offered

- Financials (As Per Availability)

- Recent Developments

- Key Management Personnel

- PPG Industries Inc.

- Company Details

- Key Product Offered

- Financials (As Per Availability)

- Recent Developments

- Key Management Personnel

- Henkel AG & Co. KGaA

- Company Details

- Key Product Offered

- Financials (As Per Availability)

- Recent Developments

- Key Management Personnel

- Boyd Corporation

- Company Details

- Key Product Offered

- Financials (As Per Availability)

- Recent Developments

- Key Management Personnel

- Hollingsworth & Vose Company

- Company Details

- Key Product Offered

- Financials (As Per Availability)

- Recent Developments

- Key Management Personnel

- Tech-Etch Inc.

- Company Details

- Key Product Offered

- Financials (As Per Availability)

- Recent Developments

- Key Management Personnel

- Kitagawa Industries Co. Ltd.

- Company Profiles (Up to 10 Major Companies)

- Strategic Recommendations

- Key Focus Areas

- Target Regions

- Target Aircraft Type

- Target Application

- Key Focus Areas

16. About Us & Disclaimer

- PPG Industries

- The 3M company

- Parker Hannifin

- W.L Gore & Associates

- Laird PLC

Related Reports

- Automatic Weapons Market - By Type (Fully Automatic, Semi-Automatic), By Product (Rifles, Machine Guns, Launcher, Cannon...

- Airborne Collision Avoidance System Market - By Type (ACAS I & TCAS I, ACAS II & TCAS II, Portable Collision Avoidance S...

- Aircraft Gearbox Market - By Type (Accessory Gearbox, Reduction Gearbox, Actuation Gearbox, Tail Rotor Gearbox, Auxiliar...

- Torpedo Market, By Type (Heavyweight Torpedoes, Lightweight Torpedoes), By Propulsion (Thermal Propulsion, Electric Prop...

- Inertial Navigation System Market Size - By Component (Accelerometers, F Gyroscopes, Algorithms & Processors), By End Us...

- Nanosatellite and Microsatellite Market - By Component (Hardware, Software, Launch Services), By Orbit (Low Earth Orbit ...

Table of Content

Will be Available in the sample /Final Report. Please ask our sales Team.

List Tables Figures

Will be Available in the sample /Final Report. Please ask our sales Team.

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy