Commercial Earth Observation (CEO) Market Size - By Component (Satellite, Software, Services), By Application, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Global Forecast, 2023 – 2032

Published Date: February - 2025 | Publisher: MRA | No of Pages: 240 | Industry: Aerospace | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Sample Ask for Discount Request CustomizationCommercial Earth Observation (CEO) Market Size - By Component (Satellite, Software, Services), By Application, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Global Forecast, 2023 – 2032

Commercial Earth Observation (CEO) Market Size

Commercial Earth Observation Market size was valued at USD 4.2 billion in 2022 and is anticipated to grow at a CAGR of over 8% by 2032 due to the increased collaboration between governments and private companies for satellite deployment & data sharing.

Furthermore, the integration of Earth observation data with Artificial Intelligence (AI) and Machine Learning (ML) technologies is enhancing data analysis capabilities, opening up new opportunities in various applications. The increasing need for accurate geospatial data for urban planning, disaster management, and environmental protection. Also, technological advancements, such as the development of high-resolution satellites and AI-powered data analytics

_Market1.jpg)

Download Sample Ask for Discount Request Customization

Commercial earth observation refers to the use of satellite technology, software, and related services to collect, process & analyze data about the Earth's surface, atmosphere, and oceans. This data is used for various applications including mapping & surveying, agriculture, environmental monitoring, natural resource exploration, security & intelligence, and more.

| Report Attribute | Details |

|---|---|

| Base Year | 2022 |

| Commercial Earth Observation (CEO) Market Size in 2022 | USD 4.2 Billion |

| Forecast Period | 2023 to 2032 |

| Forecast Period 2023 to 2032 CAGR | 8% |

| 2032 Value Projection | USD 10 Billion |

| Historical Data for | 2018 to 2022 |

| No. of Pages | 200 |

| Tables, Charts & Figures | 218 |

| Segments covered | Component, Application and Region |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Download Sample Ask for Discount Request Customization

The high cost of satellite development, launch, and maintenance can limit the accessibility of Earth observation data for some organizations. The industry is highly competitive with numerous satellite operators vying for business share, leading to pricing pressures. Data privacy concerns and regulatory issues related to satellite imagery are other major factors that can impede industry gains.

COVID-19 Impact

The COVID-19 pandemic had substantial impacts on the industry. Lockdowns and restrictions disrupted supply chains and reduced the workforce, affecting satellite deployment & data collection. However, the pandemic also highlighted the importance of Earth observation data for monitoring environmental changes and responding to crises. It accelerated the adoption of remote sensing technologies and increased the demand for data related to agriculture, climate change & disaster management.

Commercial Earth Observation Market Trends

The development of small satellites including CubeSats is making space more accessible for startups and research institutions. Data analytics platforms that process and interpret Earth observation data are becoming increasingly sophisticated. Increasing global concerns for environmental issues including climate change and deforestation have driven the use of Earth observation for sustainability and conservation efforts. Organizations leverage satellite data to track deforestation, monitor emissions, and assess the impact of climate change.

Commercial Earth Observation Market Analysis

Learn more about the key segments shaping this market

Download Sample Ask for Discount Request Customization

Imagine a world where farmers could use satellite images to see exactly where their crops need water, fertilizer, or pest control. That's the power of Earth observation data in agriculture! This amazing technology lets farmers and businesses keep an eye on their fields, predict crop yields, and manage their land in a sustainable way. In fact, in 2022, the agriculture segment of the Earth observation market brought in about $1 billion. Farmers can now use data from satellites to do things likeWater their crops just the right amount, saving water and money. Fertilize their soil only where it's needed, reducing waste and environmental harm. Track pests and diseases early on, protecting their crops without using too many chemicals. This technology is not just a cool gadget. It's helping farmers grow more food with fewer resources and less damage to the environment. That's a win-win for everyone!

Learn more about the key segments shaping this market

The commercial Earth observation market is like a huge pie, and it's split into three main slicessatellites, software, and services. The satellite slice was the biggest in 2022, gobbling up over 40% of the pie. And it's only going to grow bigger, hitting a whopping USD 4 billion by 2032. Why the big buzz about satellites? It's all about their eyes in the sky. Satellites are like super-advanced spy glasses, but instead of spying on your neighbors, they're watching our planet from space. And they're getting way better at it. We're not just talking about blurry pictures anymore. These new satellites have got super-sharp vision, able to spot things as small as a kitchen table. That means we can see all kinds of details about our Earth, like where cities are growing, how infrastructure is holding up, and even how to plan for natural disasters. Another cool thing about satellites is that the playing field is getting more level. In the past, only huge companies and governments could afford to launch them. But now, we've got these smaller and cheaper satellites called CubeSats and nanosatellites. It's like anyone with a good idea can get their own satellite up there and start collecting data.

Looking for region specific data?

Download Sample Ask for Discount Request Customization

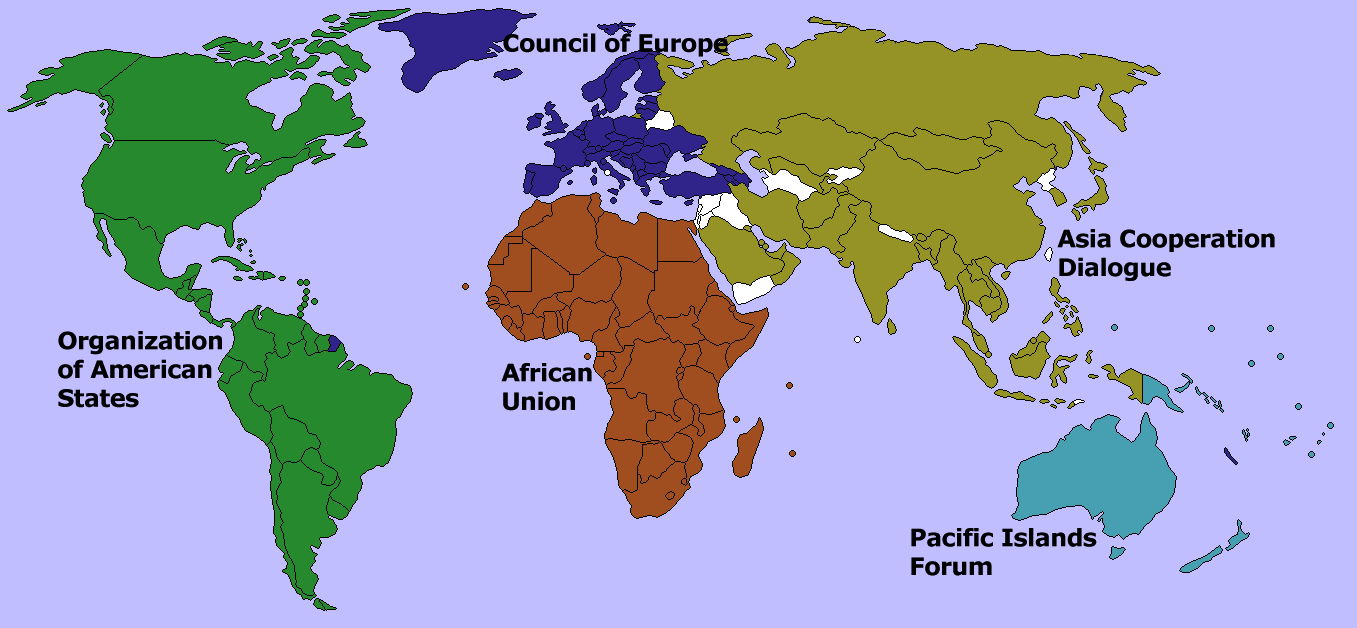

North America held a significant share of over 35% in the commercial earth observation market in 2022. North America, particularly the U.S., has a thriving commercial space industry with numerous satellite operators and launch providers. This industry's evolution has led to an increase in the availability and affordability of CEO data. The presence of major space agencies, a robust commercial space sector, and a growing demand for Earth observation data in agriculture & disaster management. The region hosts many companies and startups focused on developing & utilizing advanced satellite technology, sensors, and data analytics.

Commercial Earth Observation (CEO) Market Share

The Commercial Earth Observation CEO market is highly competitive owing to the presence of key players such as

Commercial Earth Observation (CEO) Industry News

- In March 2023, Satellogic partnered with SkyFi, an EO data provider. SkyFi offers an app that allows individual users to operate satellites from their devices to acquire the precise location they are interested in. The partnership with Satellogic will allow SkyFi users to directly access Satellogic’s thirty-strong satellite constellation

The CEO market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) from 2018 to 2032, for the following segments

Click here to Buy Now Section of this Report

By Component, 2018 – 2032

- Satellite

- Software

- Services

By Application, 2018 – 2032

- Mapping & surveying

- Agriculture

- Environmental monitoring

- Natural resource exploration

- Security & intelligence

- Others

The above information is provided for the following regions and countries

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- GCC

- South Africa

- Rest of MEA

Related Reports

- Military Tent & Shelter Market - By Type (Rigid, Non-rigid), By Manpower Capacity (Single Person, Two Person, More Than ...

- Electronic Warfare Market - By Platform (Airborne, Naval, Ground-Based), By Product, By Frequency (High Frequency, Ultra...

- Electronic Warfare Market - By Platform (Airborne, Naval, Ground-Based), By Product, By Frequency (High Frequency, Ultra...

- Satellite Modem Market Size, By Channel Type (Single Channel Per Carrier (SCPC) Modem, Multiple Channel Per Carrier (MCP...

- In-flight Entertainment & Connectivity Market - By Product (Hardware, Connectivity, Content), By Aircraft Type (Narrow-b...

- Missile Guidance System Market Size - By Launch Platform (Air-to-Air, Air-to-Surface, Surface-to-Air, Anti-ship, Anti-ta...

Table of Content

Table of Content

Report Content

Chapter 1 Methodology & Scope

1.1 Market scope & definition

1.2 Base estimates & calculations

1.3 Forecast calculation.

1.4 Data Sources

1.4.1 Primary

1.4.2 Secondary

1.4.2.1 Paid sources.

1.4.2.2 Public sources

Chapter 2 Executive Summary

2.1 Commercial Earth Observation (CEO) market 360º synopsis, 2018 - 2032

2.2 Business trends

2.3 Regional trends

2.4 Component trends

2.5 Application trends

Chapter 3 Commercial Earth Observation (CEO) Market Insights

3.1 Impact on COVID-19

3.2 Russia- Ukraine war impact

3.3 Industry ecosystem analysis

3.4 Vendor matrix

3.5 Profit margin analysis

3.6 Component & innovation Landscape

3.7 Patent analysis

3.8 Key news and initiatives

3.8.1 Partnership/Collaboration

3.8.2 Merger/Acquisition

3.8.3 Investment

3.8.4 Product launch & innovation

3.9 Regulatory Landscape

3.10 Impact forces

3.10.1 Growth drivers

3.10.1.1 Growing demand for geospatial information

3.10.1.2 Advancements in satellite technology

3.10.1.3 Environmental monitoring and climate change mitigation

3.10.1.4 Expanding Commercial Space Sector

3.10.1.5 Precision agriculture

3.10.2 Industry pitfalls & challenges

3.10.2.1 High cost of satellite development

3.10.2.2 Data privacy concerns

3.11 Growth potential analysis

3.12 Porter’s analysis

3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2022

4.1 Introduction

4.2 Company market share, 2022

4.3 Competitive analysis of major market players, 2022

4.3.1 Company 1

4.3.2 Company 2

4.3.3 Company 3

4.3.4 Company 4

4.3.5 Company 5

4.3.6 Company 6

4.3.7 Company 7

4.4 Competitive positioning matrix, 2022

4.5 Strategic outlook matrix, 2022

Chapter 5 Commercial Earth Observation (CEO) Market, By Component (USD Million)

5.1 Key trends, by Component

5.2 Satellite

5.3 Software

5.4 Services

Chapter 6 Commercial Earth Observation (CEO) Market, By Application, (USD Million)

6.1 Key trends, by Application

6.2 Mapping and surveying

6.3 Agriculture

6.4 Environmental monitoring

6.5 Natural resource exploration

6.6 Security and intelligence

6.7 Others

Chapter 7 Commercial Earth Observation (CEO) Market, By Region

7.1 Key trends, by region

7.2 North America

7.2.1 U.S.

7.2.2 Canada

7.3 Europe

7.3.1 UK

7.3.2 Germany

7.3.3 France

7.3.4 Italy

7.3.5 Spain

7.3.6 Rest of Europe

7.4 Asia Pacific

7.4.1 China

7.4.2 India

7.4.3 Japan

7.4.4 South Korea

7.4.5 ANZ

7.4.6 Rest of Asia Pacific

7.5 Latin America

7.5.1 Brazil

7.5.2 Mexico

7.5.3 Rest of Latin America

7.6 MEA

7.6.1 GCC

7.6.2 Rest of MEA

Chapter 8 Company Profiles

8.1 Airbus

8.2 BAE Systems

8.3 Ball Corporation

8.4 Lockheed Martin

8.5 Maxar Technologies

8.6 Northropp Grumman

8.7 Planet

8.8 Raytheon Techologies

8.9 SARsat Arabia

8.10 Satellogic

8.11 Serco Middle East

8.12 Spectator

8.13 Thales Group

8.14 The Boeing Company

- Airbus S.A.S.

- The Boeing Company

- Thales Group

List Tables Figures

Will be Available in the sample /Final Report. Please ask our sales Team.

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy