Smart Labelling in Logistics Market Size - By Component (Hardware, Software, Services), By Product (RFID Labels, NFC Labels, Electronic Shelf Labels (ESL)), By Deployment Type (Cloud-based, On-premises), By Company Size, By Application & Forecast, 2024 - 2032

Published Date: July - 2024 | Publisher: MIR | No of Pages: 240 | Industry: Packaging | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Sample Ask for Discount Request CustomizationSmart Labelling in Logistics Market Size

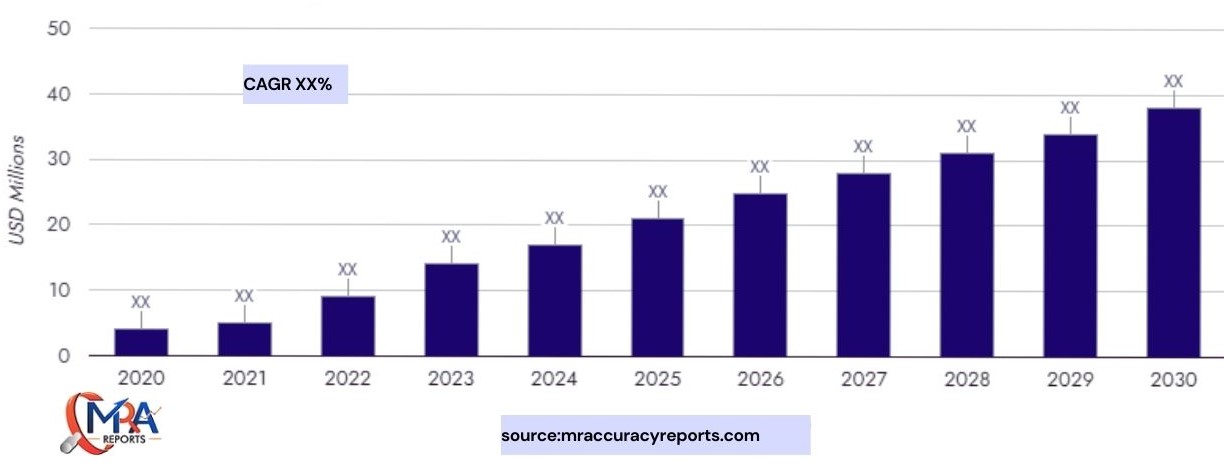

Smart Labelling in Logistics Market was valued at USD 7 billion in 2023 and is anticipated to grow at a CAGR of over 5% between 2024 and 2032.

To get key market trends

Imagine thisYou have a warehouse filled with a sea of products, pallets, and containers. How do you keep track of them all? Enter the incredible world of Radio Frequency Identification (RFID) technology, where tiny tags work like digital superheroes. These RFID tags are attached to your products, pallets, or containers. They're packed with information, just like little data passports. And here's the magicRFID readers can scan these tags from any angle, even through boxes and walls. It's like giving your products a superpower—they can tell you exactly where they are, whenever you need to know. This real-time superpower makes everything run smoother in your warehouse. You can see exactly what you have, where it is, and how it's moving. It's like having an eagle-eyed inventory tracker working around the clock, making sure everything's in the right place at the right time. No more scrambling to find lost items or dealing with misplaced deliveries. RFID lets you pinpoint your products instantly, saving you time, money, and a whole lot of stress. Plus, with RFID, you can kiss goodbye to manual labor and errors. The tags do all the heavy lifting for you, keeping track of your inventory with pinpoint accuracy. It's like having a digital army at your command, working tirelessly to make sure everything runs seamlessly. The beauty of RFID doesn't stop there. It also lets you analyze your supply chain like never before. You can see patterns, anticipate trends, and make smarter decisions about how you manage your inventory. It's like having a data superpower, giving you the insights you need to streamline your operations and grow your business.

| Report Attribute | Details |

|---|---|

| Base Year | 2023 |

| Smart Labelling in Logistics Market Size in 2023 | USD 7 Billion |

| Forecast Period | 2024 - 2032 |

| Forecast Period 2024 - 2032 CAGR | 5% |

| 2032 Value Projection | USD 11.15 Billion |

| Historical Data for | 2021 - 2023 |

| No. of Pages | 210 |

| Tables, Charts & Figures | 305 |

| Segments covered | Component, Product, Deployment Type, Company Size, Application |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The logistics sector is transforming through seamless exchange of data and real-time monitoring, enabled by the Internet of Things (IoT). The IoT-enabled devices, including sensors and smart tags, provide vital information about the state, location, and overall status of commodities along the supply chain. This integration enhances predictive maintenance by reducing downtime and increasing the asset usage. By tracking environmental variables, such as temperature and humidity, IoT aids in proactive problem-solving, route optimization, and product quality assurance. Expanding IoT integration improves the logistics ecosystem's transparency, efficiency, and responsiveness, eventually leading to increased customer satisfaction and operational excellence.

The implementation of RFID and IoT smart labelling technologies in logistics can incur high expenses, covering the cost of buying, setting up, and integrating RFID tags, readers, & IoT sensors with the current IT infrastructure. Additional expenses include costs for continuing maintenance, staff training, and software development. Widespread acceptance of these technologies may be constrained by the inability of small businesses to afford these upfront costs. Moreover, businesses may find it difficult to defend the expense, considering the possible long-term advantages of enhanced supply chain visibility and increased efficiency if the Return on Investment (ROI) is delayed.

Smart Labelling in Logistics Market Trends

Hey there! Listen up, the world of logistics is getting a major boost from blockchain technology. It's like a super-secure vault that keeps track of every move your stuff makes. This fancy ledger is shared by everyone involved, so there's no hiding any funny business. It records everything - from where your goods came from to where they're headed. This means no more lost shipments, no more wondering if what you're getting is the real deal. And there's more! Blockchain makes it easier to track your stuff, so you know where it is every step of the way. Perfect for when you're waiting for that new gadget! But that's not all. Blockchain is also helping companies follow the rules and settle any disagreements more smoothly. It's like a magic wand for transparency and accountability. Businesses are jumping on the blockchain train to make their supply chains rock-solid. For example, there's this awesome platform called TradeLens that uses blockchain to give everyone from the shipper to the customer a clear view of what's happening. It's like a GPS for your goods! So, there you have it. Blockchain is revolutionizing logistics by making supply chains more secure, transparent, and efficient. It's a game-changer for businesses and consumers alike.

Online shopping and omnichannel retailing are booming, and it's changing how we get our stuff. People want their deliveries fast, reliable, and flexible, so logistics companies are stepping up their game. They're turning to smart technology, like smart labels, to plan better routes, track packages in real time, and keep better tabs on what's in stock. They're also linking up different systems to make same-day or next-day delivery a reality. In this whole omnichannel world, where customers are shopping everywhere from their phones to physical stores, a smooth-running supply chain is crucial. That means logistics companies need to keep innovating and making their services better. Take Amazon, for example. They just poured a lot of money into their logistics setup. They're building more warehouses with smart gadgets and RFID technology to make deliveries quicker and handle the flood of online orders they get.

Smart Labelling in Logistics Market Analysis

Learn more about the key segments shaping this market

Based on component, the market is divided into hardware, software and services. The hardware segment dominates the market and is expected to reach over USD 5.11 billion by 2032.

- In the logistics smart labelling sector, hardware refers to the tools and parts required to put advanced labelling solutions into practice. Some of the important hardware component include IoT sensors, barcode printers, readers, and RFID tags. Real-time tracking and data collecting are made possible by RFID tags and IoT sensors, which offer vital information about the location, state, and movement of commodities.

- To ensure precise data collection and inventory management, barcode printers generate labels that are scanned by barcode readers. These hardware elements increase supply chain visibility, boost operational effectiveness, and reduce error rates. Businesses seeking to use smart labelling technology for better decision-making and streamlined logistics must invest in sturdy hardware.

Learn more about the key segments shaping this market

Based on application, the market is categorized into inventory management, asset tracking, parcel tracking & delivery, and cold chain monitoring. The parcel tracking & delivery segment is the fastest growing segment with a CAGR of over 6% between 2024 and 2032.

- Modern logistics requires parcel delivery and tracking to ensure that the shipments are efficiently tracked and controlled from the point of dispatch to the point of final delivery. Parcels are tagged and tracked in real-time using technologies, such as the RFID, GPS, and IoT, providing supply chain stakeholders information into their position and condition.

- This makes it possible to provide clients with timely information and precise delivery estimates. Cutting-edge tracking technologies minimize losses/theft, minimize delays, and optimize delivery routes. Moreover, they facilitate proactive problem-solving by promptly recognizing and resolving possible issues. Effective parcel tracking and delivery systems improve customer satisfaction by guaranteeing delivery processes that are transparent, dependable, and timely.

Looking for region specific data?

In 2023, North America took the lead in the global smart labelling market for logistics, claiming over 36% of the market share. The United States is a major player in this market, thanks to its advanced technologies and high adoption rates of innovative solutions. U.S.-based businesses are at the forefront of using blockchain, IoT, and RFID technologies to enhance supply chain visibility and efficiency. The country's thriving e-commerce sector also drives the need for robust logistics solutions, which is boosting the growth of smart labelling. Regulatory guidelines in the U.S. encourage the use of advanced labelling to improve compliance and traceability. Major IT companies and logistics providers in the U.S. are heavily investing in research and development to create cutting-edge labelling technologies. This leadership role fosters innovation in the smart labelling industry and helps set global standards.

China's vast industrial and e-commerce sectors are propelling the country's rapid advancement in the smart labelling market. RFID and IoT technology adoption is accelerated by the government's insistence on digital transformation and smart logistics infrastructure. China is a major player in this market as Chinese businesses are aggressively investing in automation and intelligent supply chain solutions to increase efficiency and satisfy the needs of global trade.

Japan plays a significant role in the smart labelling business owing to its emphasis on innovation and precision. Leading developers of innovative RFID and sensor technologies are Japanese businesses. The use of smart labelling systems is driven by the nation's emphasis on effective logistics and quality control. Furthermore, smart labelling contributes to improved supply chain visibility and traceability, which benefits Japan's robust automotive and electronics industries.

South Korea is a major player in the smart labelling sector, with a focus on technological integration and smart logistics. The nation's cutting-edge IT infrastructure facilitates the widespread use of IoT, RFID, and AI-driven logistics solutions. South Korean businesses are strengthening their position in the international market by utilizing these technologies to increase real-time tracking and inventory management, minimize costs, and streamline the supply chain.

Smart Labelling in Logistics Market Share

Honeywell International Inc and Zebra Technologies hold a significant share of over 20% in the market. Honeywell is a key player in the smart labelling market, providing a range of advanced technologies that enhance logistics operations. It provides reliable solutions, such as barcode scanners, mobile computers, and RFID devices, that enhance inventory management, boost operational effectiveness, and guarantee compliance. Real-time data capture is made possible by Honeywell's smart labeling systems, which enhance supply chain visibility and traceability. Its creative method helps companies improve resource usage, reduce errors, and streamline workflows, which increases customer happiness and productivity in logistical operations.

Zebra Technologies specializes in providing cutting-edge smart labelling solutions for logistics and supply chain applications. It provides a full range of devices, such as RFID readers, positioning technologies, and barcode printers. Businesses may increase operational efficiency, inventory accuracy, asset tracking and management using Zebra's solutions. By emphasizing data visibility and connection, it enables firms to address changing client requirements in a competitive market, while streamlining procedures and cutting costs. Global logistics operations are being revolutionized by Zebra Technologies' cutting-edge smart labeling technologies.

Smart Labelling in Logistics Market Companies

Major players operating in the smart labelling in logistics industry are

- Avery Dennison

- Honeywell International Inc.

- Impinj

- Oracle Corporation

- Sato Holdings

- Smartrac N.V.

- Zebra Technologies

Smart Labelling in Logistics Industry News

- In September 2023, DHL and IBM partnered to integrate blockchain technology into DHL's smart labelling solutions. The objective of this collaboration is to transform supply chain management by enhancing transparency, security, and traceability throughout logistical processes. DHL improves data integrity and visibility using blockchain, enabling stakeholders to trace shipments securely, confirm authenticity, and expedite customs procedures. The key industry issues including operational inefficiencies, regulatory compliance, and counterfeit prevention are addressed by this integration. By implementing blockchain technology, DHL is demonstrating its dedication to innovation in logistics and establishing new benchmarks for efficiency and trust in international supply chains.

- In September 2021, Avery Dennison obtained the How2Recycle® mark for RFID paper hang tags, making it the first and only pre-qualified smart labels provider. How2Recycle has assigned the label based on several aspects, including applicable law, sortation (MRF package flow), collection (access to recycling), reprocessing (technical recyclability), and end markets. This development is the result of many years of research and development conducted by Avery Dennison Smartrac to create a special blend of materials, adhesives, and inlay construction. This allows RFID labels to be recycled with other paper-based materials and can be combined with any other residential recycling stream.

The smart labelling in logistics market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD billion) from 2021 to 2032, for the following segments

Click here to Buy Section of this Report

Market, By Component

- Hardware

- Software

- Services

Market, By Product

- RFID labels

- NFC labels

- Electronic Shelf Labels (ESL)

- Others

Market, By Deployment Type

- Cloud-based

- On-premises

Market,

By Company

Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

Market, By Application

- Inventory management

- Asset tracking

- Parcel tracking and delivery

- Cold chain monitoring

- Others

The above information is provided for the following regions and countries

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

Related Reports

- Hempcrete Market Size - By Type (Wood, Hempcrete, Rammed Earth), By Construction Phase (New Construction, Retrofit and R...

- Window and Door Frame Market - By Type (Door Frame, Window Frame), By Material (Metal, Wood, Glass, Composite, uPVC, Oth...

- Civil Engineering Market - By Service (Planning & Design, Construction Management, Maintenance, and Others [Consultancy,...

- Cranes Rental Market Size - By Product (Mobile Crane [Truck Loader Crane, Rough Terrain Crane, All Terrain Crane, Crawle...

- Structural Health Monitoring Market Size - By Offering (Hardware, Software, Service), By Type (Wired SHM Systems, Wirele...

- Fire Rated Glass Market Size - By Glass Type (Wired Glass, Ceramic Glass, Tempered Glass, Intumescent Glass, Laminated G...

Table of Content

Will be Available in the sample /Final Report. Please ask our sales Team.

List Tables Figures

Will be Available in the sample /Final Report. Please ask our sales Team.

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy