Sustainable Aerosol Packaging Market Size, Share & Trends Analysis Report By Product Type (Aluminum & Steel, rPET, Polylactic Acid, Polyhydroxyalkanoates, Paper-Based), By End Use, By Region, And Segment Forecast

Published Date: April - 2025 | Publisher: MRA | No of Pages: 229 | Industry: Chemical & Material Research | Format: Report available in PDF / Excel Format

View Details Buy Now 2999 Download Sample Ask for Discount Request CustomizationSustainable Aerosol Packaging Market Size & Trends

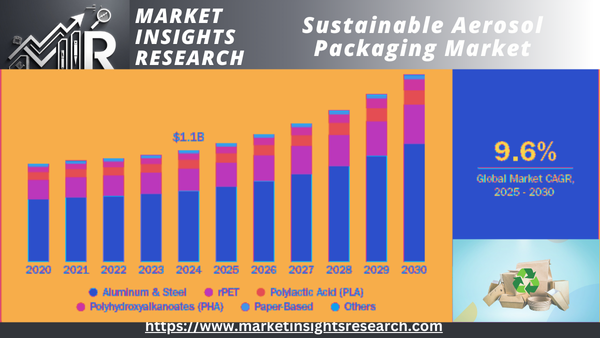

The size of the global sustainable aerosol packaging market was valued at USD 1.09 billion in 2024 and is projected to advance at a CAGR of 9.56% during 2025-2030. The growth in the market is largely attributed to rising environmental awareness and strict regulations that seek to curb plastic usage and enhance recyclability. Further, governments and regulatory authorities globally are enforcing policies to support the use of environmentally friendly packaging options, thereby accelerating product demand.

Download Sample Ask for Discount Request Customization

Moreover, changing consumer behavior is also a major factor in driving the demand for sustainable aerosol packaging. Consumers today are giving more importance to products that match their environmental ethos, and as a result, companies are competing to provide eco-friendly packaging solutions.

Businesses are also reacting by investing in research and development to produce recyclable and biodegradable aerosol packaging solutions. For instance, Beiersdorf's move to use at least 50% recycled aluminum in its deodorant cans and minimize material usage is a testament to the industry's focus on sustainability. Such initiatives not only meet consumer demand but also give brands a competitive advantage in the sustainable aerosol packaging market.

Businesses are investing in the development of non-flammable, low-GWP (Global Warming Potential) propellants such as compressed air, nitrogen, or carbon dioxide to replace traditional hydrocarbon-based propellants. Second, innovations in materials such as post-consumer recycled (PCR) aluminum, biodegradable plastics, and refillable containers are enabling more sustainable product forms. These solutions not only lessen the environmental impact but also preserve performance and functionality, promoting take-up by both brands and consumers.

Global FMCG, personal care, and cosmetics businesses are making commitments to minimize plastic waste, lower carbon emissions, and adopt sustainable packaging for product ranges. These corporate ambitions are driving businesses to move towards more sustainable aerosol formats as part of their overall brand strategy and stakeholder reporting. The pressure is also being driven by growing investor and consumer scrutiny, ensuring sustainable packaging is not only an environmental imperative but also a competitive and reputational win.

However, the high cost and limited scalability of eco-friendly materials and technologies pose a challenge to the industry growth. Sustainable alternatives such as bio-based plastics, recyclable aluminum, or low-GWP propellants often come with higher production and sourcing costs compared to conventional materials. For many small- and mid-sized manufacturers, the transition to greener solutions can be economically challenging, especially without large-scale infrastructure or subsidies.

Report Coverage & Deliverables

PDF report & online dashboard will assist you in understanding

Competitive benchmarking

Historical data & projections

Company revenue splits

Regional prospects

Latest trends & dynamics

Request a Free Sample Copy

The Grand Library - BI Enabled Market Research Database

Product Type Insights

The aluminum & steel category posted the highest revenue share of more than 63.63% in 2024 based on their strength, recyclability, and barrier nature. In sustainability contexts, these metals have a significant edge-indefinite recyclability without degradation in quality. While more brands engage in circular economy values, consumption of post-consumer recycled (PCR) steel and aluminum for aerosol cans has increased in leaps and bounds. These two metals are extremely popular in sectors such as household cleaning, personal care, and cosmetics due to their high-quality appearance and role in safeguarding contents from light, oxygen, and moisture.

Polyhydroxyalkanoates (PHA) is anticipated to grow at the highest CAGR of 10.6% through the forecast period because they are among the most sustainable plastic substitute options for aerosol packaging. PHAs biodegrade naturally in the marine and soil environments, hence ideal for single-use or low-lifespan applications where environmental leakage is an issue. PHAs are being considered in the aerosol sector for low-pressure systems, wipes, and parts of packaging where biodegradability is a compelling selling factor.

PET is taking center stage in the sustainable aerosol packaging space because it is lightweight and with increased availability of recycled plastic streams. As companies producing consumer goods move away from virgin plastics, rPET is a greener alternative that works across many spray and dispensing systems. It finds particular applications in personal care, hair care, and hygiene products where there is a need for clarity, flexibility, and lower carbon content.

PLA, a biodegradable thermoplastic made from renewable materials like corn starch or sugarcane, is becoming an exciting material for sustainable aerosol packaging. It is attractive to environmentally friendly brands that want to decrease dependence on fossil-fuel-based plastics. PLA has excellent rigidity and transparency and is ideal for non-pressurized spray bottles and low-pressure aerosol systems in applications like personal care and natural cleaning products.

End Use Insights

Personal care & cosmetics achieved the largest market share of 41.50% in 2024, fueled by the demand from consumers for eco-friendly beauty and hygiene products. Deodorants, hair sprays, dry shampoos, and facial sprays conventionally depend on aerosol packaging for usability and performance. As environmental consciousness increases among millennials and younger generations, companies are compelled to minimize plastic consumption and carbon footprints and enhance recyclability. Companies are responding by moving towards aluminum cans with a high PCR content, refillable systems, and bio-based packaging that achieves the appearance and feel of premium packaging but is more sustainable.

Household products are expected to expand at the highest CAGR of 10.1% over the forecast period. As indoor air quality, packaging waste, and exposure to chemicals are increasingly scrutinized, brands are putting emphasis on green propellants and recyclable materials in a bid to enhance product safety and sustainability. Demand for low-emission aerosols and reusable dispensing units has increased significantly, particularly in environmentally friendly homes and urban regions.

The use of aerosols in the food & beverage industry in products like whipped cream, cooking oils, and flavor sprays is also changing with more emphasis on food-safe, eco-friendly packaging materials. Aluminum aerosol cans are the market leaders in this business because of their superior barrier characteristics and safety record. But rising concerns regarding packaging waste and food safety are forcing producers to find recyclable, non-toxic, and lightweight options that meet food-grade standards.

The medical & pharmaceutical industry is a niche but expanding sustainable aerosol packaging market, especially for products such as inhalers, antiseptic sprays, and topical medications. Although product sterility, efficacy, and safety continue to be the primary concerns, there is rising pressure to make medical aerosol devices less environmentally harmful. Efforts toward substituting HFA (hydrofluoroalkane) propellants for lower-GWP options and recyclable or bio-based packaging materials are becoming prevalent, particularly for over the counter (OTC) health-related products.

Download Sample Ask for Discount Request Customization

Regional Insights Assistant

Asia Pacific Aerosol packaging in the sustainable context led the market and held the highest revenue share of more than 43.23% in 2024 and is expected to register the highest CAGR of 9.9% during the forecast period. It is driven by urbanization, growing middle-class populations, and rising environmental concerns-particularly for nations such as China, India, Japan, and South Korea. The need for sustainable packaging is increasing in personal care, cleaning, and food markets. Recycling infrastructure is still in the development stages in some areas of the region, but policy changes and foreign investment are enhancing sustainable packaging environments.

China sustainable aerosol packaging market held a large revenue share of 61.18% in 2024. The government of China has launched mandates to lower single-use plastics, promote material recycling, and facilitate green manufacturing initiatives, which have a direct impact on the uptake of sustainable aerosol packaging. Key Chinese FMCG players are reacting with plans to add rPET, PLA, and recyclable aluminum to their packaging offerings.

The Indian sustainable aerosol packaging market is driven by a mix of regulatory changes, urbanization, and increasing consumer environmental awareness. The Indian government's initiative towards plastic waste minimization, as well as the emergence of sustainability-focused startups and consumer companies, is facilitating a change in the packaging environment. While the market remains nascent relative to more advanced geographies, demand for natural personal care, herbal sprays, and organic food aerosols is expanding rapidly.

North America Sustainable Aerosol Packaging Market Trends

North America is a leading region in the sustainable aerosol packaging market, fueled by strong regulatory environments, well-developed recycling infrastructure, and high consumer knowledge of environmental concerns. The U.S. and Canada have witnessed an increasing demand for environmentally friendly personal care, household, and food products, leading packaging companies to implement recyclable materials, low-GWP propellants, and refillable systems.

U.S. Sustainable Aerosol Packaging Market Trends

The U.S. sustainable aerosol packaging market has the largest market share in North America, supported by its wide product range and robust R&D infrastructure. Top brands in the personal care, cleaning, and pharmaceutical industries are driving demand for aluminum cans with high PCR content, eco-propellants, and biodegradable packaging options.

Europe Sustainable Aerosol Packaging Market Trends

Europe dominates the global market for sustainable aerosol packaging led by forward-looking environmental policies and strong consumer purchasing power for environmental products. European Union's Circular Economy Action Plan, Single-Use Plastics Directive, and Green Deal are revolutionizing packaging by requiring recyclability, materials reduction, and lifecycle analysis. This has fostered an increasing adoption of PCR content aluminum aerosols, rPET, PLA, and BoV technologies among major industries.

Germany's sustainable aerosol packaging market growthis significantly fueled bystrong environmental regulations, industrial leadership, and consumer activism. With German companies being among the biggest producers and exporters of personal care and cleaning products in the EU, they are innovating fast with biodegradable polymers, refillable aluminum systems, and COâ‚‚-neutral manufacturing processes.

Central & South America Sustainable Aerosol Packaging Market

Central & South America is slowly adopting sustainable aerosol packaging, driven by environmental campaigns, regulatory progress, and greater brand responsibility. Brazil, in fact, has been proactive in encouraging recycling and material recovery programs, which favor the use of recyclable metals and bio-based plastics in packaging use.

The sustainable aerosol packaging market in Brazil is anticipated to grow over the forecast period. ABRE, along with other green NGOs, is actively promoting sustainable design principles across sectors. Being one of the leading manufacturers of household and cosmetics products, Brazil's market is seeing increased interest in recycled content aluminum aerosol cans, eco-propellants, and biodegradable material.

Middle East & Africa Sustainable Aerosol Packaging Market

The Middle East & Africa region is just beginning to embrace sustainable aerosol packaging, but there is growing momentum as awareness and regulatory pressures mount. The UAE and South Africa are among the countries that are launching environmental policies for plastic waste reduction and recycling. These trends are making it a conducive environment for lightweight, recyclable, and bio-based aerosol packaging solutions.

Key Sustainable Aerosol Packaging Company Insights

The competitive landscape of the sustainable aerosol packaging industry is becoming more dynamic, fueled by innovation, brand differentiation, and regulatory evolution. Strategic collaborations between consumer brands and packaging firms are also on the increase, with the objective of co-creating tailored sustainable formats. As consumer demand increases and regulatory pressure builds, competition is moving toward who can provide scalable, compliant, and affordable green options, and sustainability is becoming a central differentiator in market positioning.

In April 2025, Koehler Paper and Wimbée launched a 100% cardboard cap for aerosol cans. Koehler NexCoat Smart, an advanced flexible packaging paper, forms the basis of the innovation. The innovative material greatly improves the cap's performance and durability without compromising on sustainable design. As regulatory forces and consumer attitudes trend toward sustainability, such innovations are a major milestone toward minimizing plastic waste without diminishing functionality or aesthetic appeal.

Key Sustainable Aerosol Packaging Companies

The following are the leading companies in the sustainable aerosol packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Signature Filling Company, LLC.

- Koehler Paper

- Weener Plastics

- Ball Corporation

- Crown Holdings, Inc.

- Trivium Packaging

- Lindal Group

- Tubex GmbH

- Montebello Packaging

- CCL Container

- Nussbaum Matzingen AG

- Precision Valve Corporation

Sustainable Aerosol Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.16 billion |

|

Revenue forecast in 2030 |

USD 1.83 billion |

|

Growth rate |

CAGR of 9.56% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, end use, region |

|

States scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Key companies profiled |

Signature Filling Company, LLC.; Koehler Paper; Weener Plastics; Ball Corporation; Crown Holdings, Inc.; Trivium Packaging; Lindal Group; Tubex GmbH; Montebello Packaging; CCL Container; Nussbaum Matzingen AG; Precision Valve Corporation |

|

Customization scope |

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Download Sample Ask for Discount Request Customization

Global Sustainable Aerosol Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sustainable aerosol packaging market report based on product type, end use, and region

-

Product Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Aluminum & Steel

-

rPET

-

Polylactic Acid (PLA)

-

Polyhydroxyalkanoates (PHA)

-

Paper-Based

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Personal Care & Cosmetics

-

Household Products

-

Food & Beverages

-

Pharmaceutical & Medical

-

Automotive

-

Other End Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Related Reports

- Glycerol Market Size - By Product Type (Crude, Refined), By Source (Biodiesel, Fatty Acids, Fatty Alcohols, Soap Industr...

- Flat Glass Market - By Product (Basic Float, Laminated, Insulating, Tempered), By Application (Automotive [OEM, Aftermar...

- Electrical Steel Market - By Product (Grain Oriented, Non-Grain-Oriented), By Application (Large Power Transformers, Dis...

- Lithium Cobalt Oxide Market - By Grade (Industrial, Battery), Application (Consumer electronic, Electric vehicle, Medica...

- Conductive Polymers Market – By Conduction Mechanism (Composites Inherently Conductive Polymers, Conducting Polymer), ...

- Dimethyl Terephthalate Market - By Form (Solid, Liquid), Grade (Technical, Reagent, Pure, Synthesis), Application, End u...

Table of Content

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.1.1. Market Segmentation

1.1.2. Market Definition

1.2. Research Scope & Assumptions

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. MIR Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

1.7. List of Abbreviations

Chapter 2. Executive Summary

2.1. Market Snapshot, 2024 (USD Million)

2.2. Segmental Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Global Sustainable Aerosol Packaging Market Variables, Trends, and Scope

3.1. Market Lineage Outlook

3.2. Penetration & Growth Prospect Mapping

3.3. Industry Value Chain Analysis

3.3.1. Raw Material Trends

3.3.2. Raw Material Price Analysis

3.3.3. Profit Margin Analysis of Key Value Chain Participants

3.4. Average Price Trend Analysis, 2018 - 2030 (USD/Kg)

3.4.1. Key Factors Influencing Pricing

3.5. Technology Trends

3.6. Regulatory Framework

3.6.1. Policies and Incentive Plans

3.6.2. Standards and Compliances

3.6.3. Regulatory Impact Analysis

3.7. Supply & Demand Gap Analysis, 2024

3.8. Sustainability Trends

3.8.1. Impact of Circular Economy

3.9. Market Dynamics

3.9.1. Market Driver Analysis

3.9.2. Market Restraint Analysis

3.9.3. Market Opportunity Analysis

3.9.4. Market Challenge Analysis

3.10. Business Environment Analysis

3.10.1. Porter’s Five Forces Analysis

3.10.2. PESTEL Analysis

Chapter 4. Global Sustainable Aerosol Packaging Market: Product Type Estimates & Trend Analysis

4.1. Key Takeaways

4.2. Product Type Movement Analysis & Market Share, 2024 & 2030

4.2.1. Aluminum & Steel

4.2.1.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

4.2.2. rPET

4.2.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

4.2.3. Polylactic Acid (PLA)

4.2.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

4.2.4. Polyhydroxyalkanoates (PHA)

4.2.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

4.2.5. Paper-Based

4.2.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

4.2.6. Others

4.2.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Chapter 5. Global Sustainable Aerosol Packaging Market: End Use Estimates & Trend Analysis

5.1. Key Takeaways

5.2. End Use Movement Analysis & Market Share, 2024 & 2030

5.2.1. Personal Care & Cosmetics

5.2.1.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

5.2.2. Household Products

5.2.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

5.2.3. Food & Beverages

5.2.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

5.2.4. Pharmaceutical & Medical

5.2.5. Automotive

5.2.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

5.2.6. Other End Uses

5.2.6.1. Market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Chapter 6. Global Sustainable Aerosol Packaging Market: Regional Estimates & Trend Analysis

6.1. Key Takeaways

6.2. Regional Movement Analysis & Market Share, 2024 & 2030

6.3. North America

6.3.1. North America Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.3.2. U.S.

6.3.2.1. U.S. Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.3.3. Canada

6.3.3.1. Canada Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.3.4. Mexico

6.3.4.1. Mexico Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.4. Europe

6.4.1. Europe Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.4.2. Germany

6.4.2.1. Germany Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.4.3. UK

6.4.3.1. UK Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.4.4. France

6.4.4.1. France Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.4.5. Italy

6.4.5.1. Italy Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.4.6. Spain

6.4.6.1. Spain Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.5. Asia Pacific

6.5.1. Asia Pacific Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.5.2. China

6.5.2.1. China Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.5.3. India

6.5.3.1. India Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.5.4. Japan

6.5.4.1. Japan Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.5.5. Australia

6.5.5.1. Australia Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.5.6. South Korea

6.5.6.1. South Korea Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.6. Central & South America

6.6.1. Central & South America Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.6.2. Brazil

6.6.2.1. Brazil Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.6.3. Argentina

6.6.3.1. Argentina Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.7. Middle East & Africa

6.7.1. Middle East & Africa Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.7.2. Saudi Arabia

6.7.2.1. Saudi Arabia Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.7.3. UAE

6.7.3.1. UAE Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

6.7.4. South Africa

6.7.4.1. South Africa Sustainable Aerosol Packaging Market Estimates & Forecasts, 2018 - 2030 (USD Million) (Kilotons)

Chapter 7. Competitive Landscape

7.1. Key Global Players & Recent Developments & Their Impact on the Industry

7.2. Company/Competition Categorization

7.3. Vendor Landscape

7.3.1. List of Suppliers and Key Value Chain Partners

7.3.2. List of Potential Customers

7.4. Company Market Position Analysis

7.5. Company Heat Map Analysis

7.6. Strategy Mapping

7.6.1. Expansions

7.6.2. Mergers & Acquisitions

7.6.3. Collaborations/Partnerships/Agreements

7.6.4. New Product Launches

7.6.5. Others

Chapter 8. Company Listing (Overview, Financial Performance, Products Overview)

8.1. Signature Filling Company, LLC.

8.1.1. Company Overview

8.1.2. Financial Performance

8.1.3. Product Benchmarking

8.2. Koehler Paper

8.3. Weener Plastics

8.4. Ball Corporation

8.5. Crown Holdings, Inc.

8.6. Trivium Packaging

8.7. Lindal Group

8.8. Tubex GmbH

8.9. Montebello Packaging

8.10. CCL Container

8.11. Nussbaum Matzingen AG

8.12. Precision Valve Corporation

List Tables Figures

List of Tables

Table 1 Sustainable Aerosol Packaging market estimates and forecasts, by Aluminum & Steel, 2018 - 2030 (USD Million) (Kilotons)

Table 2 Sustainable Aerosol Packaging market estimates and forecasts, by rPET, 2018 - 2030 (USD Million) (Kilotons)

Table 3 Sustainable Aerosol Packaging market estimates and forecasts, by Polylactic Acid (PLA), 2018 - 2030 (USD Million) (Kilotons)

Table 4 Sustainable Aerosol Packaging market estimates and forecasts, by Polyhydroxyalkanoates (PHA), 2018 - 2030 (USD Million) (Kilotons)

Table 5 Sustainable Aerosol Packaging market estimates and forecasts, by Paper-Based, 2018 - 2030 (USD Million) (Kilotons)

Table 6 Sustainable Aerosol Packaging market estimates and forecasts, by Others, 2018 - 2030 (USD Million) (Kilotons)

Table 7 Sustainable Aerosol Packaging market estimates and forecasts, in Personal Care & Cosmetics, 2018 - 2030 (USD Million) (Kilotons)

Table 8 Sustainable Aerosol Packaging market estimates and forecasts, in Household Products, 2018 - 2030 (USD Million) (Kilotons)

Table 9 Sustainable Aerosol Packaging market estimates and forecasts, in Food & Beverages, 2018 - 2030 (USD Million) (Kilotons)

Table 10 Sustainable Aerosol Packaging market estimates and forecasts, in Pharmaceutical & Medical, 2018 - 2030 (USD Million) (Kilotons)

Table 11 Sustainable Aerosol Packaging market estimates and forecasts, in Automotive, 2018 - 2030 (USD Million) (Kilotons)

Table 12 Sustainable Aerosol Packaging market estimates and forecasts, in Other End Uses, 2018 - 2030 (USD Million) (Kilotons)

Table 13 North America Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 14 North America Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 15 North America Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 16 U.S. Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 17 U.S. Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (Units) (USD Million) (Kilotons)

Table 18 U.S. Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (Units) (USD Million) (Kilotons)

Table 19 Canada Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 20 Canada Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 21 Canada Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 22 Mexico Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 23 Mexico Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 24 Mexico Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 25 Europe Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 26 Europe Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 27 Europe Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 28 Germany Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 29 Germany Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 30 Germany Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 31 UK Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 32 UK Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 33 UK Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 34 France Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 35 France Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 36 France Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 37 Italy Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 38 Italy Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 39 Italy Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 40 Spain Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 41 Spain Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 42 Spain Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 43 Asia Pacific Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 44 Asia Pacific Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 45 Asia Pacific Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 46 China Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 47 China Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 48 China Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 49 Japan Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 50 Japan Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 51 Japan Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 52 India Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 53 India Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 54 India Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 55 Australia Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 56 Australia Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 57 Australia Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 58 South Korea Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 59 South Korea Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 60 South Korea Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 61 Central & South America Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 62 Central & South America Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 63 Central & South America Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 64 Brazil Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 65 Brazil Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 66 Brazil Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 67 Argentina Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 68 Argentina Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 69 Argentina Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 70 Middle East & Africa Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 71 Middle East & Africa Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 72 Middle East & Africa Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 73 Saudi Arabia Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 74 Saudi Arabia Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 75 Saudi Arabia Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 76 UAE Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 77 UAE Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 78 UAE Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

Table 79 South Africa Sustainable Aerosol Packaging market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 80 South Africa Sustainable Aerosol Packaging market estimates and forecasts, by Product Type, 2018 - 2030 (USD Million) (Kilotons)

Table 81 South Africa Sustainable Aerosol Packaging market estimates and forecasts, by End Use, 2018 - 2030 (USD Million) (Kilotons)

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Primary Research Process

Fig. 4 Market Research Approaches - Bottom-Up Approach

Fig. 5 Market Research Approaches - Top-Down Approach

Fig. 6 Market Research Approaches - Combined Approach

Fig. 7 Sustainable Aerosol Packaging Market- Market Snapshot

Fig. 8 Sustainable Aerosol Packaging Market- Segment Snapshot

Fig. 9 Sustainable Aerosol Packaging Market- Competitive Landscape Snapshot

Fig. 10 Sustainable Aerosol Packaging Market: Penetration & Growth Prospect Mapping

Fig. 11 Sustainable Aerosol Packaging Market: Value Chain Analysis

Fig. 12 Sustainable Aerosol Packaging Market: Porter’s Five Force Analysis

Fig. 13 Sustainable Aerosol Packaging Market: PESTEL Analysis

Fig. 14 Sustainable Aerosol Packaging Market: Product Type Movement Analysis, 2024 & 2030

Fig. 15 Sustainable Aerosol Packaging Market: End UseMovement Analysis, 2024 & 2030

Fig. 16 Sustainable Aerosol Packaging Market: Regional Movement Analysis, 2024 & 2030

Fig. 17 Sustainable Aerosol Packaging Market: Company Positioning Analysis

Fig. 18 Sustainable Aerosol Packaging Market: Market Dashboard Analysis

Fig. 19 Sustainable Aerosol Packaging Market: Strategy Mapping

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy