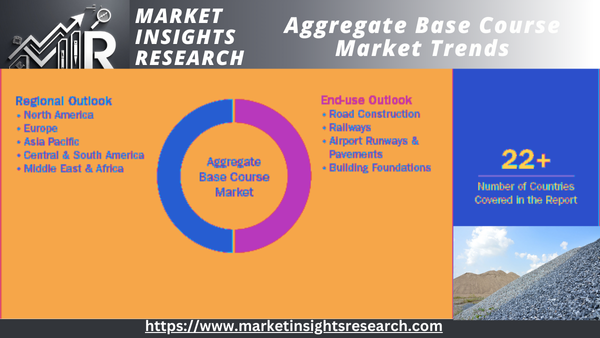

Aggregate Base Course Market Size, Share & Trends Analysis Report By End Use (Road Construction, Railways), By Region (North America, Asia Pacific, Europe, Central & South America, MEA), And Segment Forecast

Published Date: April - 2025 | Publisher: MRA | No of Pages: 220 | Industry: advance materials | Format: Report available in PDF / Excel Format

View Details Buy Now 2999 Download Sample Ask for Discount Request CustomizationAggregate Base Course Market Trends

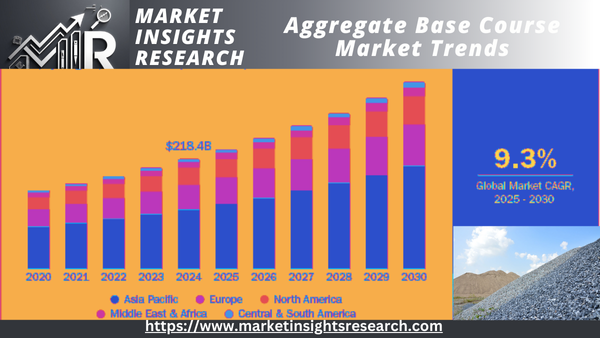

The size of the global aggregate base course market was estimated at USD 218.37 billion in 2024 and is projected to grow at a CAGR of 9.3% during the period from 2025 to 2030, fueled by the fast growth of infrastructure development projects across the globe. Road construction, highways, railways, and airport runways are being increasingly invested in by governments and the private sector, which is heavily driving the demand for aggregate base materials. Urbanization and population growth are also driving the need for expansion and upkeep of transportation systems, which depend on high-quality aggregates for durability and structural integrity. Moreover, technological advancements in construction and sustainable aggregate production using recycled materials are driving market growth by minimizing environmental footprint while ensuring structural performance.

Download Sample Ask for Discount Request Customization

The increasing investments in smart city schemes and large-scale urban planning efforts are largely propelling the global aggregate base course market. Most of the developing economies are giving maximum emphasis to building up-to-date road networks, bridges, and high-speed rail networks for improving connectivity and economic development. This influx of infrastructure growth is placing more emphasis on good-quality aggregate base materials with the potential for durability and load-bearing capability. The increased requirement for better rural road networks to promote transportation in isolated areas is also contributing to market demand, with governments assigning high budgets to road expansion and repair initiatives.

This growth is also attributed to the development of the construction industry, especially commercial and industrial construction. The swift increase in warehouse construction, logistics centers, and manufacturing plants requires strong road and pavement foundation, thus increasing the demand for aggregate base materials. In addition, the growing use of sophisticated geotechnical engineering methods, including soil stabilization and reinforced aggregate bases, is further boosting the market by increasing road durability and performance. With growing concerns over extreme weather conditions and climate change, there is also an increasing need for high-strength aggregates with the ability to resist temperature changes, heavy rainfalls, and seismic activities.

Report Coverage & Deliverables

PDF report & online dashboard will enable you to understand

Competitive benchmarking

Historical data & projections

Company revenue splits

Regional prospects

Recent trends & dynamics

Order a Free Sample Report

The Grand Library - BI Enabled Market Research Database

Market Concentration & Features

The global aggregate base course market has a moderate to high degree of market concentration, with a combination of large multinational companies and regional suppliers vying for market share. Innovation in the market is mainly centered on the creation of sustainable and high-performance materials, such as the utilization of recycled aggregates and innovative binding agents to improve durability and minimize environmental footprint. The market has experienced consistent rates of mergers and acquisitions, as major players aim to increase geographical presence and improve supply chain efficiency. Firms are investing more in sophisticated production methods and automation to enhance quality control and cost savings, fueling further consolidation in the industry.

Regulatory structures have a significant influence on the market, with strict environmental regulations controlling quarrying activities, material procurement, and transport emissions. Governments in different regions are encouraging the use of recycled aggregates and sustainable building materials, shaping market trends. While there are few direct service substitutes for aggregate base courses, alternative construction technologies, like soil stabilization and geosynthetic reinforcements, are increasingly being adopted in particular applications. The end-use intensity of the market is high, with road construction, infrastructure development, and commercial developments being the major consumers, maintaining constant demand irrespective of economic downturns.

End Use Insights

The road construction segment led the market and held the highest revenue share of 55.0% in 2024. Technological innovation in construction equipment and material processing has enhanced the efficiency and accuracy of base course application. Advanced equipment allows for improved compaction and layering of aggregates, resulting in stronger, more durable road structures. Environmental concerns and sustainability are also driving the market, with more emphasis on the use of recycled aggregates and green construction methods. The road construction sector is increasingly using reclaimed asphalt pavement (RAP), crushed concrete, and other recycled materials in base courses to reduce environmental impact without sacrificing performance.

Railways segment is anticipated to expand tremendously at CAGR of 9.3% during the forecast period, promoted by rising need for long-lasting and stable material for foundational purposes in rail infrastructure. Aggregate base courses deliver structural support and load distribution necessary for railway tracks, which provides stability, duration, and security for the track. With the growth in high-speed rail networks, city transit systems, and freight routes in developing as well as developed countries, the demand for base materials of good quality that resist dynamic loads as well as hostile environmental conditions is gradually increasing.

Download Sample Ask for Discount Request Customization

Regional Insights

Asia Pacific Aggregate Base Course Market Trends

Asia Pacific led the market and held the maximum revenue share of around 54.31% in 2024, due to rapid urbanization, large infrastructure projects, and increasing road networks. India, Indonesia, and Vietnam are investing significantly in transportation infrastructure, such as highways, bridges, and railways, generating a robust demand for superior quality aggregate base materials. The support given by governments toward smart cities and environmentally friendly building practices also adds momentum to the market. Further, the growing usage of recycled aggregates to minimize environmental footprint and align with regulatory compliance is shaping market trends.

China Aggregate Base Course Market Trends

The aggregate base course market of China is chiefly driven by the country's huge infrastructure development programs, such as the Belt and Road Initiative (BRI), which stimulates the demand for highway and road construction. The nation's growing urban population and rising industrialization have fueled construction activity, and hence, an uninterrupted supply of aggregate material. Moreover, tight environmental laws have promoted the use of sustainable and environmentally friendly aggregates, further driving the market. The availability of many domestic players guarantees competitive pricing and large capacity production to serve rising demand.

North America Aggregate Base Course Market Trends

In North America, the aggregate base course market is bolstered by government investments in infrastructure and continuous maintenance of old roads and highways. Both the U.S. and Canada have major infrastructure rehabilitation initiatives for enhancing transportation infrastructure, boosting demand for high-performance aggregate materials. Increased emphasis on sustainable construction techniques, such as the utilization of recycled aggregates and improved stabilization methods, is further shaping the market. In addition, advancements in technology for material processing and quality control are improving efficiency and longevity in construction works.

U.S. Aggregate Base Course Market Trends

The U.S. market for aggregate base course is significantly influenced by federal and state-level investments to modernize infrastructure, such as the reconstruction of highways, bridges, and urban transportation infrastructure. The Bipartisan Infrastructure Law has committed a substantial amount of funding towards road construction, increasing the need for high-quality aggregate base materials. Also, increasing sustainability and conservation concerns are leading to more use of recycled aggregates and new materials. The industry is also seeing the integration of digital technologies, including automated material testing and quality control technologies, to increase efficiency and regulatory compliance.

Europe Aggregate Base Course Market Trends

European aggregate base course market is subjected to strict environmental legislation and sustainable policies to diminish carbon footprints in construction activities. The continent's emphasis on circular economy policy and green infrastructure has resulted in growing demand for recycled aggregates as well as replacement materials in construction. Large infrastructure projects, specifically across transportation and energy sectors on a large scale, are furthermore promoting consistent demand. Advances in aggregate processing technology and enhanced quality control procedures are also moulding the market dynamics.

Germany Aggregate Base Course Market Trends

Germany's total base course market is enhanced by its rigorous focus on quality infrastructure and accurate engineering in construction. Germany's investment in intelligent transportation systems, high-speed rail developments, and long-lasting road networks greatly enhances market demand. Moreover, Germany's rigorous environmental regulations promote the utilization of green materials, enhancing innovation in recycled aggregates and energy-efficient production technologies. The existence of prominent manufacturers of construction materials and research-driven innovation in aggregate performance further enhance market growth.

Latin America Aggregate Base Course Market Trends

In Latin America, the aggregate base course market is driven by increasing investments in road infrastructure and urban development schemes. Brazil, Mexico, and Argentina are making transportation network improvements a priority to spur economic growth, creating aggregate material demand. But regulatory hurdles, supply chain issues, and economic instability affect market stability. Growing usage of public-private partnerships (PPPs) in infrastructure projects will drive market opportunities, while measures to encourage sustainable construction practices are slowly gaining pace.

Middle East & Africa Aggregate Base Course Market Trends

Middle East & Africa aggregate base course market is driven mainly by high-scale infrastructure projects such as smart cities, transport networks, and industrial developments. In the Middle East, Saudi Arabia and the UAE are aggressively investing in massive projects such as NEOM and Expo infrastructure, driving demand for high-performance aggregates. In Africa, road connectivity and urbanization initiatives are driving market growth, with raw material availability and high transport costs still posing challenges. Sustainability efforts are starting to make an appearance too, with some governments actively promoting the use of alternative and recycled aggregates in building.

Key Aggregate Base Course Company Insights

Few of the key players in market are CRH, CEMEX S.A.B. de C.V

CRH plc is a top international building materials business based in Ireland, with a high level of market penetration. The business is specialized in the production and supply of a variety of construction materials, ranging from aggregates, cement, asphalt, to ready-mix concrete. CRH provides high-performance aggregate base course solutions designed for road building, infrastructure development, and commercial developments.

CEMEX S.A.B. de C.V., the Mexican multinational building materials corporation, is one of the industry's leading players. It supplies quality aggregates for infrastructure, road base, and sub-base, among others, guaranteeing long life and durability. Crushed stone, sand, and gravel make up the list of CEMEX products used extensively in construction applications.

Martin Marietta Materials, Inc., Vulcan Materials Company are among the emerging market players in aggregate base course business.

Martin Marietta Materials, Inc. is one of the top U.S.-based aggregate and heavy building material suppliers to the market. The organization provides a broad range of crushed stone, gravel, and sand that are required in road construction, highways, and foundation stabilization.

United States-headquartered Vulcan Materials Company is a market leader, providing crucial construction aggregates to numerous industries. They are expert manufacturers of high-grade crushed stone, sand, and gravel for use in road construction, airport runway construction, and industrial purposes.

Key Aggregate Base Course Companies

The following are the leading companies in the aggregate base course market. These companies collectively hold the largest market share and dictate industry trends.

- CRH

- CEMEX S.A.B. de C.V.

- Martin Marietta Materials, Inc.

- Vulcan Materials Company

- Heidelberg Materials

- Buzzi Unicem S.p.A.

- Summit Materials, Inc.

- Eurocement Group

- Breedon Group plc

Aggregate Base Course Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 237.96 billion |

|

Revenue forecast in 2030 |

USD 370.96 billion |

|

Growth rate |

CAGR of 9.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in Million Metric Ton, Revenue in USD Million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

End use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea |

|

Key companies profiled |

CRH; CEMEX S.A.B. de C.V.; Martin Marietta Materials, Inc.; Vulcan Materials Company; Heidelberg Materials; Buzzi Unicem S.p.A.; Summit Materials, Inc.; Eurocement Group; Breedon Group plc |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Download Sample Ask for Discount Request Customization

Global Aggregate Base Course Market Report Segmentation

Download Sample Ask for Discount Request Customization

-

End Use Outlook (Revenue, USD Million; Volume, Million Metric Ton; 2018 - 2030)

-

Road Construction

-

Railways

-

Airport Runways & Pavements

-

Building Foundations

-

-

Regional Outlook (Revenue, USD Million; Volume, Million Metric Ton; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Related Reports

- Butylated Hydroxytoluene (BHT) Market - By Application (Food, Animal Feed, Lubricating & Specialty Oils, Rubber, Persona...

- Nano Coating Market - By Type (Anti-Fingerprint Coatings, Anti-Microbial Coatings, Self-Cleaning Coatings, Anti-Corrosio...

- Anti-corrosion Coatings Market - By Product (Epoxy, Polyurethane, Acrylic, Alkyd, Zinc, Chlorinated Rubber), By Mode of ...

- Coil Coatings Market - By Product (Polyester, Silicone Modified Polyester, Polyvinylidene Fluorides, Polyurethane, Plast...

- High Purity Alumina Market - By Technology (Hydrolysis, HCL Leaching), By Product (4N, 5N, 6N), By Application (LED, Sem...

- Alpha Hydroxy Acid Market - By Product (Glycolic, Lactic, Citric), By Application (Cosmetics (Skincare, Hair Care, Makeu...

Table of Content

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumption

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook, 2024 (USD Billion)

2.2. Segmental Outlook

2.3. Competitive Insights

Chapter 3. Aggregate Base Course Market Variables, Trends & Scope

3.1. Market Lineage/Ancillary Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Sales Channel Analysis

3.3. Regulatory Framework

3.3.1. Analyst Perspective

3.3.2. Regulations & Standards

3.4. Market Dynamics

3.4.1. Market Driver Analysis

3.4.2. Market Restraint Analysis

3.4.3. Industry Opportunities

3.4.4. Industry Challenges

3.5. Business Environmental Tools Analysis: Aggregate Base Course Market

3.5.1. Porter’s Five Forces Analysis

3.5.1.1. Bargaining Power of Suppliers

3.5.1.2. Bargaining Power of Buyers

3.5.1.3. Threat of Substitution

3.5.1.4. Threat of New Entrants

3.5.1.5. Competitive Rivalry

3.5.2. PESTLE Analysis

3.5.2.1. Political Landscape

3.5.2.2. Economic Landscape

3.5.2.3. Social Landscape

3.5.2.4. Technology Landscape

3.5.2.5. Environmental Landscape

3.5.2.6. Legal Landscape

3.6. Market Disruption Analysis

Chapter 4. Aggregate Base Course Market: End Use Estimates & Trend Analysis

4.1. Key Takeaways

4.2. End Use Movement Analysis & Market Share, 2024 & 2030

4.3. Global Aggregate Base Course Market By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

4.4. Road Construction

4.4.1. Aggregate Base Course Market Estimates And Forecasts, by Road Construction, 2018 - 2030 (Million Metric Ton, USD Million)

4.5. Railways

4.5.1. Aggregate Base Course Market Estimates And Forecasts, by Railways, 2018 - 2030 (Million Metric Ton, USD Million)

4.6. Airport Runways & Pavements

4.6.1. Aggregate Base Course Market Estimates And Forecasts, by Airport Runways & Pavements, 2018 - 2030 (Million Metric Ton, USD Million)

4.7. Building Foundations

4.7.1. Aggregate Base Course Market Estimates And Forecasts, by Building Foundations, 2018 - 2030 (Million Metric Ton, USD Million)

Chapter 5. Aggregate Base Course Market: Regional Estimates & Trend Analysis

5.1. Key Takeaways

5.2. Regional Market Share Analysis, 2024 & 2030

5.3. North America

5.3.1. North America Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.3.2. North America Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.3.3. North America Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.3.4. U.S.

5.3.4.1. U.S. Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.3.4.2. U.S. Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.3.4.3. U.S. Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.3.5. Canada

5.3.5.1. Canada Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.3.5.2. Canada Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.3.5.3. Canada Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.3.6. Mexico

5.3.6.1. Mexico Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.3.6.2. Mexico Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.3.6.3. Mexico Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.4. Europe

5.4.1. Europe Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.2. Europe Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.3. Europe Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.4. Germany

5.4.4.1. Germany Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.4.2. Germany Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.4.3. Germany Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.5. UK

5.4.5.1. UK Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.5.2. UK Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.5.3. UK Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.6. France

5.4.6.1. France Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.6.2. France Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.6.3. France Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.7. Italy

5.4.7.1. Italy Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.7.2. Italy Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.7.3. Italy Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.8. Spain

5.4.8.1. Spain Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.8.2. Spain Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.4.8.3. Spain Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.5. Asia Pacific

5.5.1. Asia Pacific Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.5.2. Asia Pacific Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.5.3. Asia Pacific Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.5.4. China

5.5.4.1. China Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.5.4.2. China Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.5.4.3. China Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.5.5. India

5.5.5.1. India Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.5.5.2. India Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.5.5.3. India Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.5.6. Japan

5.5.6.1. Japan Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.5.6.2. Japan Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.5.6.3. Japan Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.5.7. South Korea

5.5.7.1. South Korea Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.5.7.2. South Korea Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.5.7.3. South Korea Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.6. Central & South America

5.6.1. Central & South America Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.6.2. Central & South America Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.6.3. Central & South America Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

5.7. Middle East & Africa

5.7.1. Middle East & Africa Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

5.7.2. Middle East & Africa Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

5.7.3. Middle East & Africa Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Chapter 6. Supplier Intelligence

6.1. Kraljic Matrix

6.2. Engagement Model

6.3. Negotiation Strategies

6.4. Sourcing Best Practices

6.5. Vendor Selection Criteria

Chapter 7. Competitive Landscape

7.1. Key Players, their Recent Developments, and their Impact on Industry

7.2. Competition Categorization

7.3. Company Market Position Analysis

7.4. Company Heat Map Analysis

7.5. Strategy Mapping, 2024

7.6. Company Listing

7.6.1. CRH

7.6.1.1. Company Overview

7.6.1.2. Financial Performance

7.6.1.3. Application Benchmarking

7.6.1.4. Strategic Initiatives

7.6.2. CEMEX S.A.B. de C.V.

7.6.2.1. Company Overview

7.6.2.2. Financial Performance

7.6.2.3. Application Benchmarking

7.6.2.4. Strategic Initiatives

7.6.3. Martin Marietta Materials, Inc.

7.6.3.1. Company Overview

7.6.3.2. Financial Performance

7.6.3.3. Application Benchmarking

7.6.3.4. Strategic Initiatives

7.6.4. Vulcan Materials Company

7.6.4.1. Company Overview

7.6.4.2. Financial Performance

7.6.4.3. Application Benchmarking

7.6.4.4. Strategic Initiatives

7.6.5. Heidelberg Materials

7.6.5.1. Company Overview

7.6.5.2. Financial Performance

7.6.5.3. Application Benchmarking

7.6.5.4. Strategic Initiatives

7.6.6. Buzzi Unicem S.p.A.

7.6.6.1. Company Overview

7.6.6.2. Financial Performance

7.6.6.3. Application Benchmarking

7.6.6.4. Strategic Initiatives

7.6.7. Summit Materials, Inc.

7.6.7.1. Company Overview

7.6.7.2. Financial Performance

7.6.7.3. Application Benchmarking

7.6.7.4. Strategic Initiatives

7.6.8. Eurocement Group

7.6.8.1. Company Overview

7.6.8.2. Financial Performance

7.6.8.3. Application Benchmarking

7.6.8.4. Strategic Initiatives

7.6.9. Breedon Group plc

7.6.9.1. Company Overview

7.6.9.2. Financial Performance

7.6.9.3. Application Benchmarking

7.6.9.4. Strategic Initiatives

List Tables Figures

List of Tables

Table 1 Aggregate Base Course Market Estimates And Forecasts, by Road Construction, 2018 - 2030 (Million Metric Ton, USD Million)

Table 2 Aggregate Base Course Market Estimates And Forecasts, by Railways, 2018 - 2030 (Million Metric Ton, USD Million)

Table 3 Aggregate Base Course Market Estimates And Forecasts, by Airport Runways & Pavements, 2018 - 2030 (Million Metric Ton, USD Million)

Table 4 Aggregate Base Course Market Estimates And Forecasts, by Building Foundations, 2018 - 2030 (Million Metric Ton, USD Million)

Table 5 North America Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 6 North America Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 7 North America Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 8 U.S. Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 9 U.S. Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 10 U.S. Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 11 Canada Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 12 Canada Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 13 Canada Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 14 Mexico Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 15 Mexico Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 16 Mexico Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 17 Europe Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 18 Europe Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 19 Europe Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 20 Germany Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 21 Germany Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 22 Germany Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 23 UK Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 24 UK Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 25 UK Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 26 France Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 27 France Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 28 France Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 29 Italy Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 30 Italy Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 31 Italy Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 32 Spain Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 33 Spain Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 34 Spain Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 35 Asia Pacific Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 36 Asia Pacific Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 37 Asia Pacific Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 38 China Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 39 China Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 40 China Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 41 India Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 42 India Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 43 India Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 44 Japan Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 45 Japan Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 46 Japan Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 47 South Korea Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 48 South Korea Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 49 South Korea Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 50 Central & South America Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 51 Central & South America Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 52 Central & South America Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

Table 53 Middle East & Africa Aggregate Base Course Market Estimates And Forecasts, 2018 - 2030 (Million Metric Ton, USD Million)

Table 54 Middle East & Africa Aggregate Base Course Market Estimates And Forecasts, By Product Type, 2018 - 2030 (Million Metric Ton, USD Million)

Table 55 Middle East & Africa Aggregate Base Course Market Estimates And Forecasts, By End Use, 2018 - 2030 (Million Metric Ton, USD Million)

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Primary Research Process

Fig. 4 Market Research Approaches - Bottom-Up Approach

Fig. 5 Market Research Approaches - Top-Down Approach

Fig. 6 Market Research Approaches - Combined Approach

Fig. 7 Market Snapshot

Fig. 8 Segmental Outlook

Fig. 9 Competitive Outlook

Fig. 10 Aggregate Base Course Market - Value Chain Analysis

Fig. 11 Aggregate Base Course Market - Sales Channel Analysis

Fig. 12 Market Drivers Impact Analysis

Fig. 13 Market Restraint Impact Analysis

Fig. 14 Industry Analysis - PORTERS

Fig. 15 Industry Analysis - PESTEL by SWOT

Fig. 16 End Use: Key Takeaways

Fig. 17 End Use: Market Share, 2024 & 2030

Fig. 18 Region, 2024 & 2030 (Million Metric Ton, USD Million)

Fig. 19 Regional Marketplace: Key Takeaways

Fig. 20 Kraljic Matrix

Fig. 21 Engagement Model

Fig. 22 Sourcing Best Practices

Fig. 23 Sourcing Best Practices

Fig. 24 Competition Categorization

Fig. 25 Company Market Positioning

Fig. 26 Strategy Mapping, 2024

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy