Trace Minerals in Feed Market- Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Zinc, Iron, Cobalt, Copper, Manganese, Others), By Livestock (Poultry, Ruminants, Swine, Aquatic Animals, Others), By Form (Dry, Liquid), By Chelate Type (Amino Acids, Proteinates, Polysaccharide Complexes, Others), By Region and Competition 2018-2028

Published Date: February - 2025 | Publisher: MIR | No of Pages: 320 | Industry: Agriculture | Format: Report available in PDF / Excel Format

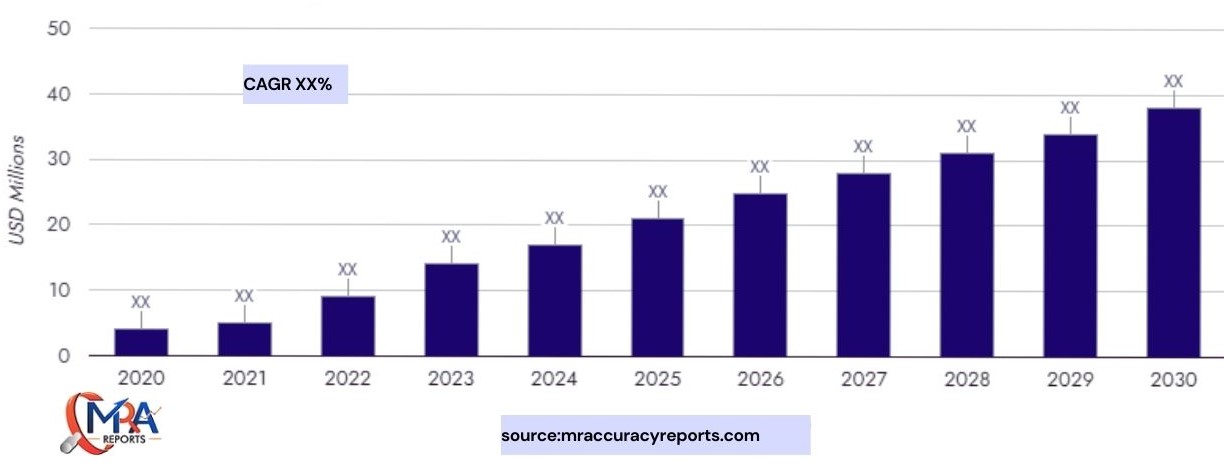

View Details Buy Now 2890 Download Sample Ask for Discount Request CustomizationTrace Minerals in Feed Market Size was estimated at 1.96 (USD Billion) in 2024. The Trace Minerals in Feed Industry is expected to grow from 2.03 (USD Billion) in 2025 to 2.77 (USD Billion) by 2034. The Trace Minerals in Feed Market CAGR (growth rate) is expected to be around 3.5% during the forecast period (2025 - 2034).

In 2021, the compound feed production in South Korea amounted to approximately 19 million tonnes.

Download Sample Ask for Discount Request Customization

Rising Production of Compound Feed

Compound feed production is the process of combining several elements, such as minerals, protein meals, grains, and vitamins, to produce a feed for livestock that is nutritionally balanced. In the animal agriculture sector, compound feed is frequently utilized since it offers a practical and affordable solution to address the dietary demands of animals. Compound feed production has been steadily increasing due to the growing demand for animal protein, increasing livestock and poultry populations, and the adoption of modern animal production practices. Animals continue to contribute significantly to the world's food supply. Animal feeds have thus grown in importance as a part of the integrated food chain. A significant portion of meeting consumer demand for animal protein such as milk, meat, eggs, and other livestock products, depends on the availability of a consistent supply of suitable, economical, and secure compound feeds. As a result, there is a growing need for more feed supplies, sources, and alternatives due to the huge growth in the demand for livestock products. Another factor that contributes is the adoption of intensive farming and the use of automated feeding processes which require large quantities of compound feed.

Moreover, customized compound feed formulations have been created as a result of technological advancements and the use of precision nutrition, which can improve animal performance and lower feed waste.

Additionally, appropriate dietary intensity is one of the costliest feed formulation ingredients in animal diets. To overcome this issue, manufacturers are improving their quality and safety while maintaining their cost-effectiveness in response to the increased demand for safe and nutrient-rich animal feed. The use of trace minerals in feed results in improved animal productivity, growth, performance, and other advantages. As a result, it is becoming a practical and affordable method for increasing animal output for long-term food security.

For instance, according to the International Feed Industry Federation (IFIF), annual compound feed production has reached 0.9 billion tonnes, globally.

According to IFIF, in 2020, Compound feed production in the USA was more than 215.79 MT.

Download Sample Ask for Discount Request Customization

Furthermore, in 2023, The Food and Agriculture Organization of the United Nations (FAO) in collaboration with the Ministry of Agriculture, Land and Fisheries in Trinidad and Tobago, the University of the West Indies (UWI), St. Augustine Campus, and Fera Science Ltd., focused on production and use of the black soldier fly (BSF), as an alternative source of high-quality protein for poultry and aquaculture feed.

Download Free Sample Report Growing Demand for Animal Nutrients in Livestock Production

The adoption of animal nutrients in livestock production is fueled by growing consumer awareness on the importance of high-quality standards in foods, including meat and other animal protein products, as well as increasing awareness about providing adequate nutrition levels in animal feed for improving the health and productivity of livestock. Eggs, dairy goods, and meat products are included in livestock-based products. The addition of animal nutrients in feed to the diet of livestock aids in the provision of enough vitamins, minerals, and protein supplements to improve nutrition, resulting in better production of livestock-based products like milk and meat. The demand for animal nutrients in feed is being driven by a rise in the acceptance and consumption of dairy and meat products as well as the sales of items derived from livestock.

For instance, in 2020,

Moreover, deficits in particular minerals, including Calcium acids in the diet for cattle help in reproductive performance improvements.

Livestock farmers provide proper nutrients to animals which help in improving animal performance and reduce the risk of diseases, resulting in sustainable and more efficient livestock production.

In addition, advanced research in animal nutrition led to the development of more specialized animal nutrient products. Enzymes, probiotics, and prebiotics are used to improve animal health and increase nutrient absorption whereas the use of chelated and organic minerals aids in improving mineral bioavailability and reducing environmental waste.

Therefore, the increasing demand for animal protein, the need to improve animal productivity and efficiency, and the advancements in animal nutrition research and technology, resulting in increasing demand for animal nutrients are leading to the growth of Global

Download Sample Ask for Discount Request Customization

Amino Acids will be the Key Chelate Type

Amino acids act as the Insulation blocks for animal protein synthesis and are essential for enhancing both the quality and quantity of meat. An adequate amount of protein is one of the most important developments in animal nutrition. An amino acid contains proteins and polypeptides that support improved growth rate, help in increasing production, and reduces incidences of disease in animals. In addition to promoting growth and nitrogen retention in cattle, it also helps animals maintain a balanced amino acid pattern. Many amino acids are given as supplements to farmed animals to increase their productivity. Amino acids such as DL-methionine, L-threonine, and L-lysine help to improve the synthetic efficiency of protein in animal feed and also helps+ to break down the food. Amino acids enter the small intestine where it is absorbed easily into the bloodstream.

For instance, ADM Animal Nutrition launched PROPLEX T, a high-concentrate protein, provides flexibility in ration formulation due to the lower inclusion rate needed to achieve targeted levels of essential amino acids.

Thus, the use of amino acids as a chelating source in animal feed is a market propelling factor in the forecast period.

A modest deficit in trace minerals might result in a significant decline in performance and output. Many minerals play extremely distinct yet frequently diverse roles as they

Recent Developments

- In November 2022, Alltech opened a trace mineral production facility in Vietnam.

- Kemin industries expanded encapsulation capabilities at the manufacturing site in Italy in November 2022.

- In December 2021, Società San Marco S.R.L. provided liquid feed supplements for poultry.

- Balchem Animal Nutrition & Health launched the Purachol Choline chloride line in January 2021.

Market Segmentation

Global Trace Minerals in Feed Market is segmented based , livestock, form, chelate type, and region. Based on type, the market is categorized into zinc, iron, cobalt, copper, manganese, and others. Based on livestock, the market is fragmented into poultry, ruminants, swine, aquatic animals, and others. Based on form, the market is segregated into dry and liquid. Based on chelate type, the market is divided into amino acids, proteinates, polysaccharide complexes, and others. Based on region, the market is divided into North America, Europe, Asia Pacific, South America, Middle East & Africa,

By Company

.Key players in this market include

- Cargill, Incorporated

- Archer-Daniels-Midland Company (ADM)

- BASF SE

- Bluestar Adisseo Co., Ltd

- Koninklijke DSM N.V.

- Nutreco N.V.

- Alltech

- Zinpro

- Orffa

- Novus International

- Kemin Industries, Inc.

- Lallemand, Inc.

- Virbac

- Global Animal Nutrition

- Dr. Eckel Animal Nutrition GmbH

Company Profiles

Titan Biotech Limited, Balchem Inc., Novus International, Inc., Alltech, Inc., Kemin Industries, Inc., Global Animal Products, Inc., Società San Marco S.R.L., BASF SE, Zinpro Corp., Orffa International Holding B.V. are some of the key players of Global Trace Minerals in Feed Market.

|

Attribute |

Details |

|

Base Year |

2022 |

|

Historic Data |

2018 – 2021 |

|

Estimated Year |

2023 |

|

Forecast Period |

2024 – 2028 |

|

Quantitative Units |

Revenue in USD Million, and CAGR for 2018-2022 and 2023-2028 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type Livestock Form Chelate Type |

|

Regional scope |

North America, Europe, Asia Pacific, South America, Middle East & Africa |

|

Country scope |

United States; Mexico; Canada; France; Germany; United Kingdom; Spain; Italy; China; India; South Korea; Japan; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

Titan Biotech Limited, Balchem Inc., Novus International, Inc., Alltech, Inc., Kemin Industries, Inc., Global Animal Products, Inc., Società San Marco S.R.L., BASF SE, Zinpro Corp., Orffa International Holding B.V. |

|

Customization scope |

10% free report customization with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Read More Releated Report-

Sprinkler Irrigation System Market

farming Market

Related Reports

- North America Plant Extracts Market By Product Type (Oleoresins, Essential Oils, Flavonoids, Alkaloids, Carotenoids, Oth...

- Forage Analysis Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Method (Physical M...

- Humic Based Biostimulants Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (...

- Controlled Release Fertilizers Market – Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By T...

- Larvicide Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented by Target (Mosquitoes, Flie...

- Pyrethroid Pesticide Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Cyperme...

Table of Content

Table of Contents

1. EXECUTIVE SUMMARY

1.1. Market Overview

1.2. Key Findings

1.3. Market Segmentation

1.4. Competitive Landscape

1.5. Challenges and Opportunities

1.6. Future Outlook

2. MARKET INTRODUCTION

2.1. Definition

2.2. Scope of the study

2.2.1. Research Objective

2.2.2. Assumption

2.2.3. Limitations

3. RESEARCH METHODOLOGY

3.1. Overview

3.2. Data Mining

3.3. Secondary Research

3.4. Primary Research

3.4.1. Primary Interviews and Information Gathering Process

3.4.2. Breakdown of Primary Respondents

3.5. Forecasting Model

3.6. Market Size Estimation

3.6.1. Bottom-Up Approach

3.6.2. Top-Down Approach

3.7. Data Triangulation

3.8. Validation

4. MARKET DYNAMICS

4.1. Overview

4.2. Drivers

4.3. Restraints

4.4. Opportunities

5. MARKET FACTOR ANALYSIS

5.1. Value chain Analysis

5.2. Porter's Five Forces Analysis

5.2.1. Bargaining Power of Suppliers

5.2.2. Bargaining Power of Buyers

5.2.3. Threat of New Entrants

5.2.4. Threat of Substitutes

5.2.5. Intensity of Rivalry

5.3. COVID-19 Impact Analysis

5.3.1. Market Impact Analysis

5.3.2. Regional Impact

5.3.3. Opportunity and Threat Analysis

6. TRACE MINERALS IN FEED MARKET, BY TYPE (USD BILLION)

6.1. Copper

6.2. Zinc

6.3. Iron

6.4. Manganese

6.5. Selenium

7. TRACE MINERALS IN FEED MARKET, BY ANIMAL TYPE (USD BILLION)

7.1. Ruminants

7.2. Poultry

7.3. Swine

7.4. Aquaculture

7.5. Equine

8. TRACE MINERALS IN FEED MARKET, BY FORM (USD BILLION)

8.1. Organic

8.2. Inorganic

8.3. Chelated

8.4. Nano

9. TRACE MINERALS IN FEED MARKET, BY ADDITIVE FUNCTION (USD BILLION)

9.1. Nutritional Supplement

9.2. Growth Promoter

9.3. Disease Resistance

10. TRACE MINERALS IN FEED MARKET, BY REGIONAL (USD BILLION)

10.1. North America

10.1.1. US

10.1.2. Canada

10.2. Europe

10.2.1. Germany

10.2.2. UK

10.2.3. France

10.2.4. Russia

10.2.5. Italy

10.2.6. Spain

10.2.7. Rest of Europe

10.3. APAC

10.3.1. China

10.3.2. India

10.3.3. Japan

10.3.4. South Korea

10.3.5. Malaysia

10.3.6. Thailand

10.3.7. Indonesia

10.3.8. Rest of APAC

10.4. South America

10.4.1. Brazil

10.4.2. Mexico

10.4.3. Argentina

10.4.4. Rest of South America

10.5. MEA

10.5.1. GCC Countries

10.5.2. South Africa

10.5.3. Rest of MEA

11. COMPETITIVE LANDSCAPE

11.1. Overview

11.2. Competitive Analysis

11.3. Market share Analysis

11.4. Major Growth Strategy in the Trace Minerals in Feed Market

11.5. Competitive Benchmarking

11.6. Leading Players in Terms of Number of Developments in the Trace Minerals in Feed Market

11.7. Key developments and growth strategies

11.7.1. New Product Launch/Service Deployment

11.7.2. Merger & Acquisitions

11.7.3. Joint Ventures

11.8. Major Players Financial Matrix

11.8.1. Sales and Operating Income

11.8.2. Major Players R&D Expenditure. 2023

12. COMPANY PROFILES

12.1. Kemin Industries

12.1.1. Financial Overview

12.1.2. Products Offered

12.1.3. Key Developments

12.1.4. SWOT Analysis

12.1.5. Key Strategies

12.2. Alltech

12.2.1. Financial Overview

12.2.2. Products Offered

12.2.3. Key Developments

12.2.4. SWOT Analysis

12.2.5. Key Strategies

12.3. Royal DSM

12.3.1. Financial Overview

12.3.2. Products Offered

12.3.3. Key Developments

12.3.4. SWOT Analysis

12.3.5. Key Strategies

12.4. Archer Daniels Midland

12.4.1. Financial Overview

12.4.2. Products Offered

12.4.3. Key Developments

12.4.4. SWOT Analysis

12.4.5. Key Strategies

12.5. Cargill

12.5.1. Financial Overview

12.5.2. Products Offered

12.5.3. Key Developments

12.5.4. SWOT Analysis

12.5.5. Key Strategies

12.6. Nutreco

12.6.1. Financial Overview

12.6.2. Products Offered

12.6.3. Key Developments

12.6.4. SWOT Analysis

12.6.5. Key Strategies

12.7. Lallemand

12.7.1. Financial Overview

12.7.2. Products Offered

12.7.3. Key Developments

12.7.4. SWOT Analysis

12.7.5. Key Strategies

12.8. Evonik Industries

12.8.1. Financial Overview

12.8.2. Products Offered

12.8.3. Key Developments

12.8.4. SWOT Analysis

12.8.5. Key Strategies

12.9. Delacon

12.9.1. Financial Overview

12.9.2. Products Offered

12.9.3. Key Developments

12.9.4. SWOT Analysis

12.9.5. Key Strategies

12.10. BASF

12.10.1. Financial Overview

12.10.2. Products Offered

12.10.3. Key Developments

12.10.4. SWOT Analysis

12.10.5. Key Strategies

12.11. Novus International

12.11.1. Financial Overview

12.11.2. Products Offered

12.11.3. Key Developments

12.11.4. SWOT Analysis

12.11.5. Key Strategies

12.12. Trouw Nutrition

12.12.1. Financial Overview

12.12.2. Products Offered

12.12.3. Key Developments

12.12.4. SWOT Analysis

12.12.5. Key Strategies

12.13. Zinpro

12.13.1. Financial Overview

12.13.2. Products Offered

12.13.3. Key Developments

12.13.4. SWOT Analysis

12.13.5. Key Strategies

12.14. Phibro Animal Health

12.14.1. Financial Overview

12.14.2. Products Offered

12.14.3. Key Developments

12.14.4. SWOT Analysis

12.14.5. Key Strategies

12.15. Pancosma

12.15.1. Financial Overview

12.15.2. Products Offered

12.15.3. Key Developments

12.15.4. SWOT Analysis

12.15.5. Key Strategies

13. APPENDIX

13.1. References

13.2. Related Reports

List Tables Figures

List of Tables and Figures

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy