U.S. Surgical Dressings Market Size, Share & Trends Analysis Report By Product (Primary, Secondary), By Application (Ulcers, Burns, Diabetes Related Surgeries, Cardiovascular Related Surgeries), By End Use (Hospitals, Specialty Clinics), And Segment Forecasts, 2025 - 2030

Published Date: April - 2025 | Publisher: MRA | No of Pages: 230 | Industry: healthcare | Format: Report available in PDF / Excel Format

View Details Buy Now 2999 Download Sample Ask for Discount Request CustomizationU.S. Surgical Dressings Market Trends

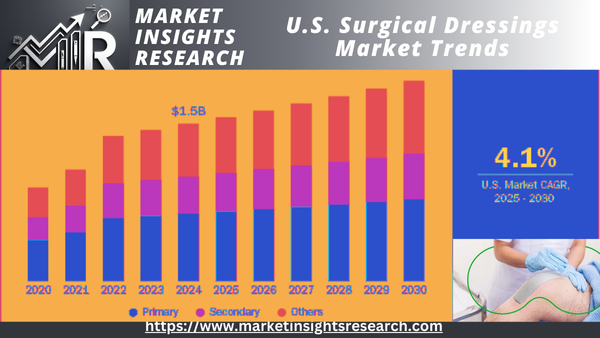

The size of the U.S. surgical dressings market was estimated at USD 1.52 billion in 2024 and is projected to grow at a CAGR of 4.09% from 2025 to 2030. Increasing numbers of surgical procedures and the increasing incidence of chronic wounds, i.e., diabetic foot ulcers & pressure ulcers, are some of the driving forces of the market. Based on information released by the Agency for Healthcare Research and Quality in February 2024, about 2.5 million individuals get pressure ulcers in the United States. In addition, technologies such as smart dressings and 3D printing are expected to enhance the performance of surgical dressings.

Download Sample Ask for Discount Request Customization

In addition, the rising incidence of organ transplant procedures considerably propels the surgical dressings market because of the increased demand for specialized wound care products after surgery. For example, according to a report by the Organ Procurement and Transplantation Network, in January 2025, approximately 48,149 transplants were conducted in the U.S., a 3.3 percent increase from the figure in 2023 and a 23.3 percent increase over the last five years in the U.S. With an increasing number of organ transplant procedures, demand is expected to go up for sophisticated wound care products like antibacterial dressings, hydrocolloids, hydrogels, and film dressings. These dressings provide maximum moisture balance, accelerate healing, and offer antimicrobial effect, all of which are crucial for patients who have undergone invasive procedures such as organ transplant.

The increasing incidence of chronic and acute wounds, such as diabetic ulcers, pressure ulcers, burns, and venous leg ulcers, is the major driver for the U.S. surgical dressings market growth. The increase is primarily attributed to the rising incidence of chronic diseases like diabetes, cardiovascular diseases, and cancer. Based on CDC statistics released in December 2023, approximately 96 million adults (38% of American adults) have prediabetes, and more than 80% do not know they have it. Diabetic foot ulcers are a typical complication of advanced diabetes, whereas pressure ulcers commonly arise in patients with cancer.

Thus, the heavy prevalence of these chronic diseases is likely to increase the need for surgical dressings to treat wound conditions resulting from surgery of these diseases.

Apart from this, cosmetic surgical procedures have seen a considerable increase. Statistics published by Discovery ABA in February 2024 indicate that approximately 26.2 million surgical and minimally invasive reconstructive and cosmetic procedures were conducted in 2022 in the U.S., a substantial 19% increase in cosmetic surgeries since 2019. Surgical dressings are used in aesthetic and plastic surgeries. Therefore, the increasing number of cosmetic surgical procedures is expected to further drive market growth during the forecast period. Market Concentration & Features

The stage of market growth is moderate, and the rate of growth is increasing. The market for surgical dressings in the U.S. is marked by a moderate level of growth due to the higher incidence of chronic diseases, growing volume of organ transplantation surgeries, higher geriatric population base, increased number of surgeries, and developments in surgical dressing technology.

The level of innovation is high with market players aiming to come up with new dressings using latest technology to improve their products and expand their product offerings. For example, in January 2024, Medline launched a new product to its lineup of next-generation advanced wound care solutions, the OptiView Transparent Dressing with HydroCore Technology. The new wound dressing is transparent, allowing caregivers to easily observe, monitor, and evaluate skin blanching while the dressing stays in position.

U.S. Surgical Dressings Industry Dynamics

The market is experiencing high levels of mergers and acquisitions, as established players are acquiring emerging companies to enhance their market presence and expand their offerings. For instance, in March 2022, Convatec Group PLC, a player offering surgical wound dressings, purchased Triad Life Sciences, Inc. to enter the wound biologics segment. Triad’s team, current portfolio, and product pipeline were transitioned to Convatec’s Advanced Surgical Dressing (AWC) business.

Regulatory agencies are important in categorizing surgical dressings to guarantee safe usage and improved results. The regulation of clinical trials, approvals, and marketing authorization for surgical dressings in the United States is under the jurisdiction of the U.S. Food and Drug Administration (FDA). For example, in April 2023, 3M announced the approval of 3M Veraflo Therapy dressings for hydromechanical removal of nonviable tissue by the U.S. FDA.

The U.S. surgical dressings market is diverse, with several players competing with each other in terms of market share. Numerous small, medium, and large firms are engaged in the business. Some of the prominent players in the industry are 3M, Smith+ Nephew, Mölnlycke Health Care AB, ConvaTec Group PLC, and Medline Industries, Inc., among others.

Report Coverage & Deliverables

PDF report & online dashboard will enable you to understand

Competitive benchmarking

Historical data & forecasts

Company revenue shares

Regional opportunities

Latest trends & dynamics

Request a Free Sample Copy

The Grand Library - BI Enabled Market Research Database

Product Insights

The major dressing segment led the market, securing 42.90% of the revenue in 2024 because of the development of materials foam, hydrocolloid, and film dressings that are designed to achieve quicker healing and minimize infection risk.In addition, hydrogel and alginate dressings are becoming increasingly popular with moisture-retentive characteristics and biodegradable products to improve patient safety and environmental sustainability. Additionally, research is revealing favorable results for primary dressings. As an example, in an October 2022 publication by MJH LiveScience, silver hydrogel dressings exhibited tremendous improvement in postoperative scars and burn patients. These favorable outcomes are expected to fuel the segment demand during the forecast period. The other segment will grow the highest CAGR during the forecast period. Other surgical dressings include different materials and products utilized to stabilize primary dressings and accelerate the healing process. These dressings are generally applied to hold, cover, and absorb more exudate from wounds, offering an additional protective layer to avoid infection and speed recovery.

Application Insights

The other application segment led the market in 2024. The other categories are brain surgeries, surgeries caused by accidents, and gastrointestinal (GI) surgeries.

All of these procedures necessitate specialized wound care because of the distinctive nature of the procedures and the possibilities of complications. Increasing numbers of road accidents and sports injuries are expected to drive the segment during the forecast period. The National Safety Council indicates sports and recreational accidents rose by 20% in 2021, 12% in 2022, and 2% in 2023. The cardiovascular surgical procedures segment shall register high growth in the period of forecast with high volumes for surgery due to heart conditions including CABG and valve replacement surgery.

Based on data released by Baystate Health in February 2024, nearly 400,000 CABG procedures are conducted in the U.S. Patients that have such surgeries frequently encounter wound care difficulties due to the type of procedures and risk of infection, delayed healing, or complication. Therefore, such patients require specialized surgical dressings to handle these wounds. Sophisticated dressings such as antimicrobial, hydrocolloid, and foam-based dressings reduce the infection risk, control exudate, and enhance healing at a faster rate, which is beneficial for CVD patients because their healing capacity might be weakened. End Use Insights The market was dominated by the hospitals segment and held the maximum revenue share of 53.98% in 2024. Hospitals tend to embrace sophisticated wound care technology and treatment for achieving maximum patient outcomes.

End Use Insights

Besides, hospitals face a large patient base with multiple chronic diseases, including diabetes, peripheral vascular diseases, and pressure ulcers, requiring extensive wound care services. Besides, the increasing number of hospitals across the country is expected to drive the demand for surgical dressings in the U.S. market. As per the statistics released by the American Hospital Association, the U.S. has 6,093 hospitals. U.S. Surgical Dressing Market Share, By End Use, 2024 (%) To know more about this report, ask for a free sample copy

Ambulatory surgery centers segment is anticipated to witness the highest CAGR through the forecast period, due to the growing number of patients visiting ambulatory surgery centers.

Along with that, increased operations of ASCs and higher levels of surgical procedures being performed there because of the several advantages including cost-efficiency, low stay duration, and encouragement of government agencies are expected to support segment growth.

In the year 2022, some 6,100 ASCs had treated about 3.3 million fee-for-service Medicare patients. Thus, with growth in the numbers of ASCs and surgeries taken, the use of wound care products is believed to increase.

Download Sample Ask for Discount Request Customization

Inpatient Reimbursement Summary And Physician Fee Schedule for Procedures Utilizing Integra Wound Matrix - 2025

|

MS-DRG |

MS-DRG Description |

MDC |

MDC Description |

Medicare National Average Payment Rate* |

|

927 |

Extensive Burns or Full Thickness Burns with Mechanical Ventilation > 96 Hours with Skin Graft |

22 |

Burns - Surgical |

USD 168,835.64 |

|

928 |

Full Thickness Burns with Skin Graft or Inhalation Injury with CC/MCC |

22 |

Burns - Surgical |

USD 47,531.02 |

|

929 |

Full Thickness Burns with Skin Graft or Inhalation Injury without CC/MCC |

22 |

Burns - Surgical |

USD 22,633.55 |

|

957 |

Other O.R. Procedures for Multiple Significant Trauma with MCC |

24 |

Multiple Significant Trauma - Surgical |

USD 53,119.30 |

|

958 |

Other O.R. Procedures for Multiple Significant Trauma with CC |

24 |

Multiple Significant Trauma - Surgical |

USD 29,247.39 |

|

959 |

Other O.R. Procedures for Multiple Significant Trauma without MCC |

24 |

Multiple Significant Trauma - Surgical |

USD 18,815.27 |

Download Sample Ask for Discount Request Customization

In the U.S., the availability of reimbursement for surgical dressings, particularly for burn procedures such as Integra Wound Matrix, plays a crucial role in driving market growth. Establishing specific MS-DRG codes and Medicare National Average Payment Rates for these procedures reduces financial barriers for healthcare providers, encouraging the adoption of advanced wound care products. This supportive reimbursement landscape enhances market access, promotes the use of high-quality dressings like Integra Wound Matrix, and boosts demand, contributing to the overall growth of the U.S. surgical dressings market.

Key U.S. Surgical Dressings Market Company Insights

Smith+Nephew, Mölnlycke Health Care AB, Convatec Group PLC, Essity, DeRoyal Industries, Inc., Coloplast Corp, 3M, INTEGRA LIFESCIENCES, Medline Industries, LP, Cardinal Health, MIMEDX Group, Inc., and Urgo Medical North America are some major players in the U.S. surgical dressing industry. Industry players are engaging in various strategic initiatives, including acquisitions, partnerships, and collaborations. Moreover, launching novel products is anticipated to boost the competitive rivalry in the U.S. surgical dressings industry.

Key U.S. Surgical Dressing Companies

- Smith+Nephew

- Mölnlycke Health Care AB

- Convatec Group PLC

- Essity

- DeRoyal Industries, Inc.

- Coloplast Corp

- 3M

- INTEGRA LIFESCIENCES

- Medline Industries, LP.

- Cardinal Health

- MIMEDX Group, Inc.

- Urgo Medical North America

Recent Developments

-

In March 2024, Integra LifeSciences Corporation launched MicroMatrix Flex in the US market. This innovative dual-syringe system facilitates the easy blending and accurate application of MicroMatrix paste in inaccessible areas, aiding in the creation of a uniform wound surface in difficult-to-treat wound sites.

-

In January 2024, Medline introduced a new product to its line of advanced wound care solutions, the OptiView Transparent Dressing with HydroCore Technology. This innovative wound dressing is designed with a clear material, enabling caregivers to conveniently inspect, monitor, and assess skin blanching while the dressing remains in place.

-

In January 2024, 3M Health Care’s Medical Solutions Division has been granted a USD 34.2 million award aimed at enhancing the management of traumatic wounds from the moment of injury to the hospital and advancing the healing process in the U.S.

U.S. Surgical Dressings Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.58 billion |

|

Revenue forecast in 2030 |

USD 1.94 billion |

|

Growth rate |

CAGR of 4.09% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis |

|

Segments covered |

Product, application, end use |

|

Country Scope |

U.S. |

|

Key companies profiled |

Smith+Nephew; Mölnlycke Health Care AB; Convatec Group PLC; Essity; DeRoyal Industries, Inc.; Coloplast Corp; 3M; INTEGRA LIFESCIENCES; Medline Industries, LP; Cardinal Health; MIMEDX Group, Inc.; Urgo Medical North America |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Download Sample Ask for Discount Request Customization

U.S. Surgical Dressings Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. surgical dressings market report based on product, application, and end use

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary

-

Foam Dressing

-

Alginate Dressing

-

Soft Silicone Dressing

-

Composite Dressing

-

Hydrogel Dressing

-

Hydrocolloid Dressing

-

Film Dressing

-

-

Secondary

-

Absorbents

-

Bandages

-

Muslin Bandage Rolls

-

Elastic Bandage Rolls

-

Triangular Bandages

-

Orthopedic Bandages

-

Elastic Plaster Bandages

-

Other Bandages

-

-

Adhesive Tapes

-

Protectives

-

Others

-

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diabetes related surgeries

-

Cardiovascular related surgeries

-

Ulcers

-

Burns

-

Transplant Sites

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Ambulatory Surgery Centers

-

Others

-

Related Reports

- Bovine Artificial Insemination Market – By Type (Services, Semen [Normal, Sexed], Equipment, Reagents & Kits), Techniq...

- Animal Feed Yeast Market - By Product (Autolyzed Yeast, Hydrolyzed Yeast, Dried Inactive Yeast, Yeast Culture, Live Yeas...

- Companion Animal Rehabilitation Services Market – By Therapy Type (Therapeutic Exercise, Hydrotherapy, Laser therapy, ...

- Pet Care Market – By Type (Pet Care Products [Product {Food, Pharmaceutical, Dietary Supplements, Hygiene}, Distributi...

- Cannabidiol (CBD) Pet Market - By Pet Type (Cats, Dogs), Product Type (Therapeutics [Oil, Tincture, Capsule, Topical], S...

- Veterinary Regenerative Medicine Market - By Animal Type (Companion, Livestock), Product Type (Stem Cell, [Autologous, A...

Table of Content

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Research Methodology

1.3. Information Procurement

1.4. Information or Data Analysis

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. U.S. Surgical Dressings Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Growing prevalence of wounds

3.2.1.2. Rising number of surgical procedures

3.2.1.3. Increasing prevalence of organ transplant surgeries

3.2.1.4. Rising burden of chronic diseases

3.2.2. Market Restraint Analysis

3.2.2.1. Product recalls

3.2.3. Market Opportunities Analysis

3.2.3.1. Growing number of clinical trials

3.2.3.2. Rising incidence of sports injuries and road accidents

3.2.3.3. Increasing development of wound centers and healthcare facilities

3.2.4. Market Challenge Analysis

3.2.4.1. Complications and risks associated with surgical dressings

3.3. U.S. Surgical Dressings Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Bargaining power of suppliers

3.3.1.2. Bargaining power of buyers

3.3.1.3. Threat of substitutes

3.3.1.4. Threat of new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political & Legal Landscape

3.3.2.2. Economic and Social Landscape

3.3.2.3. Technological landscape

Chapter 4. U.S. Surgical Dressings Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. U.S. Surgical Dressings Market Movement Analysis

4.3. U.S. Surgical Dressings Market Size & Trend Analysis, by Product, 2018 to 2030 (USD Million)

4.4. Primary

4.4.1. Primary Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.2. Foam Dressing

4.4.2.1. Foam Dressing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.3. Alginate Dressing

4.4.3.1. Alginate Dressing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.4. Soft Silicone Dressing

4.4.4.1. Soft Silicone Dressing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.5. Composite Dressing

4.4.5.1. Composite Dressing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.6. Hydrocolloid Dressing

4.4.6.1. Hydrocolloid Dressing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.7. Film Dressing

4.4.7.1. Film Dressing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.8. Hydrogel Dressing

4.4.8.1. Hydrogel Dressing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5. Secondary

4.5.1. Secondary Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.2. Absorbents

4.5.2.1. Absorbents Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.3. Bandages

4.5.3.1. Bandages Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.3.2. Muslin Bandage Rolls

4.5.3.2.1. Muslin Bandage Rolls Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.3.3. Elastic Bandage Rolls

4.5.3.3.1. Elastic Bandage Rolls Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.3.4. Triangular Bandages

4.5.3.4.1. Triangular Bandages Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.3.5. Orthopedic Bandages

4.5.3.5.1. Orthopedic Bandages Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.3.6. Elastic Plaster Bandages

4.5.3.6.1. Elastic Plaster Bandages Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.3.7. Other Bandages

4.5.3.7.1. Other Bandages Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.4. Adhesive Tapes

4.5.4.1. Adhesive Tapes Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.5. Protectives

4.5.5.1. Protectives Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.5.6. Others

4.5.6.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.6. Others

4.6.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. U.S. Surgical Dressings Market: Application Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. U.S. Surgical Dressings Market Movement Analysis

5.3. U.S. Surgical Dressings Market Size & Trend Analysis, by Application, 2018 to 2030 (USD Million)

5.4. Diabetes Related Surgeries

5.4.1. Diabetes Related Surgeries Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.5. Cardiovascular Related Surgeries

5.5.1. Cardiovascular Related Surgeries Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.6. Ulcers

5.6.1. Ulcers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.7. Burns

5.7.1. Burns Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.8. Transplant Sites

5.8.1. Transplant Sites Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.9. Others

5.9.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. U.S. Surgical Dressings Market: End Use Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. U.S. Surgical Dressings Market Movement Analysis

6.3. U.S. Surgical Dressings Market Size & Trend Analysis, by End Use, 2018 to 2030 (USD Million)

6.4. Hospitals

6.4.1. Hospitals Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5. Specialty Clinics

6.5.1. Specialty Clinics Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6. Ambulatory Surgery Centers

6.6.1. Ambulatory Surgery Centers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7. Home Healthcare

6.7.1. Home Healthcare Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.8. Others

6.8.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Competitive Landscape

7.1. Market Participant Categorization

7.2. Key Company Profiles

7.2.1. 3M

7.2.1.1. Company Overview

7.2.1.2. Financial Performance

7.2.1.3. Product Benchmarking

7.2.1.4. Strategic Initiatives

7.2.2. Smith+Nephew

7.2.2.1. Company Overview

7.2.2.2. Financial Performance

7.2.2.3. Product Benchmarking

7.2.2.4. Strategic Initiatives

7.2.3. Mölnlycke Health Care AB

7.2.3.1. Company Overview

7.2.3.2. Financial Performance

7.2.3.3. Product Benchmarking

7.2.3.4. Strategic Initiatives

7.2.4. Convatec Group PLC

7.2.4.1. Company Overview

7.2.4.2. Financial Performance

7.2.4.3. Product Benchmarking

7.2.4.4. Strategic Initiatives

7.2.5. Essity

7.2.5.1. Company Overview

7.2.5.2. Financial Performance

7.2.5.3. Product Benchmarking

7.2.5.4. Strategic Initiatives

7.2.6. DeRoyal Industries, Inc.

7.2.6.1. Company Overview

7.2.6.2. Financial Performance

7.2.6.3. Product Benchmarking

7.2.6.4. Strategic Initiatives

7.2.7. Coloplast Corp

7.2.7.1. Company Overview

7.2.7.2. Financial Performance

7.2.7.3. Product Benchmarking

7.2.7.4. Strategic Initiatives

7.2.8. INTEGRA LIFESCIENCES

7.2.8.1. Company Overview

7.2.8.2. Financial Performance

7.2.8.3. Product Benchmarking

7.2.8.4. Strategic Initiatives

7.2.9. Medline Industries, LP.

7.2.9.1. Company Overview

7.2.9.2. Financial Performance

7.2.9.3. Product Benchmarking

7.2.9.4. Strategic Initiatives

7.2.10. Cardinal Health

7.2.10.1. Company Overview

7.2.10.2. Financial Performance

7.2.10.3. Product Benchmarking

7.2.10.4. Strategic Initiatives

7.2.11. MIMEDX Group, Inc.

7.2.11.1. Company Overview

7.2.11.2. Financial Performance

7.2.11.3. Product Benchmarking

7.2.11.4. Strategic Initiatives

7.2.12. Urgo Medical North America

7.2.12.1. Company Overview

7.2.12.2. Financial Performance

7.2.12.3. Product Benchmarking

7.2.12.4. Strategic Initiatives

List Tables Figures

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviations

Table 3 U.S. Surgical Dressings Market, by Product, 2018 - 2030 (USD Million)

Table 4 U.S. Surgical Dressings Market, by Application, 2018 - 2030 (USD Million)

Table 5 U.S. Surgical Dressings Market, by End Use, 2018 - 2030 (USD Million)

Table 6 Participant’s Overview

Table 7 Financial Performance

Table 8 Product Benchmarking

Table 9 Strategic Initiatives

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Market Research Approaches

Fig. 4 Value Chain-Based Sizing & Forecasting

Fig. 5 Market Formulation & Validation

Fig. 6 U.S. Surgical Dressings Market, Market Segmentation

Fig. 7 Market Driver Analysis (Current & Future Impact)

Fig. 8 Market Restraint Analysis (Current & Future Impact)

Fig. 9 Market Opportunity Analysis (Current & Future Impact)

Fig. 10 Market Challenge Analysis (Current & Future Impact)

Fig. 11 SWOT Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 12 Porter’s Five Forces Analysis

Fig. 13 Regional Marketplace: Key Takeaways

Fig. 14 U.S. Surgical Dressings Market, for Product, 2018 - 2030 (USD Million)

Fig. 15 U.S. Surgical Dressing Market, for Primary, 2018 - 2030 (USD Million)

Fig. 16 U.S. Surgical Dressings Market, for Foam Dressing, 2018 - 2030 (USD Million)

Fig. 17 U.S. Surgical Dressings Market, for Alginate Dressing, 2018 - 2030 (USD Million)

Fig. 18 U.S. Surgical Dressings Market, for Soft Silicone Dressing, 2018 - 2030 (USD Million)

Fig. 19 U.S. Surgical Dressings Market, for Composite Dressing, 2018 - 2030 (USD Million)

Fig. 20 U.S. Surgical Dressings Market, for Hydrogel Dressing, 2018 - 2030 (USD Million)

Fig. 21 U.S. Surgical Dressings Market, for Hydrocolloid Dressing, 2018 - 2030 (USD Million)

Fig. 22 U.S. Surgical Dressings Market, for Film Dressing, 2018 - 2030 (USD Million)

Fig. 23 U.S. Surgical Dressings Market, for Secondary, 2018 - 2030 (USD Million)

Fig. 24 U.S. Surgical Dressings Market, for Absorbents, 2018 - 2030 (USD Million)

Fig. 25 U.S. Surgical Dressings Market, for Bandages, 2018 - 2030 (USD Million)

Fig. 26 U.S. Surgical Dressings Market, for Muslin Bandage Rolls, 2018 - 2030 (USD Million)

Fig. 27 U.S. Surgical Dressings Market, for Elastic Bandage Rolls, 2018 - 2030 (USD Million)

Fig. 28 U.S. Surgical Dressings Market, for Triangular Bandages, 2018 - 2030 (USD Million)

Fig. 29 U.S. Surgical Dressings Market, for Orthopedic Bandages, 2018 - 2030 (USD Million)

Fig. 30 U.S. Surgical Dressings Market, for Elastic Plaster Bandages, 2018 - 2030 (USD Million)

Fig. 31 U.S. Surgical Dressings Market, for Other Bandages, 2018 - 2030 (USD Million)

Fig. 32 U.S. Surgical Dressings Market, for Application, 2018 - 2030 (USD Million)

Fig. 33 U.S. Surgical Dressings Market, for Diabetes Related Surgeries, 2018 - 2030 (USD Million)

Fig. 34 U.S. Surgical Dressings Market, for Cardiovascular Related Surgeries, 2018 - 2030 (USD Million)

Fig. 35 U.S. Surgical Dressings Market, for Ulcers, 2018 - 2030 (USD Million)

Fig. 36 U.S. Surgical Dressings Market, for Burns, 2018 - 2030 (USD Million)

Fig. 37 U.S. Surgical Dressings Market, for Transplant Sites, 2018 - 2030 (USD Million)

Fig. 38 U.S. Surgical Dressings Market, for Others, 2018 - 2030 (USD Million)

Fig. 39 U.S. Surgical Dressings Market, for End Use, 2018 - 2030 (USD Million)

Fig. 40 U.S. Surgical Dressings Market, for Home Healthcare, 2018 - 2030 (USD Million)

Fig. 41 U.S. Surgical Dressings Market, for Hospitals, 2018 - 2030 (USD Million)

Fig. 42 U.S. Surgical Dressings Market, for Specialty Clinics, 2018 - 2030 (USD Million)

Fig. 43 U.S. Surgical Dressings Market, for Ambulatory Surgery Centers, 2018 - 2030 (USD Million)

Fig. 44 U.S. Surgical Dressings Market, for Others, 2018 - 2030 (USD Million)

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy