Germany Accident Insurance Market Size (Gross Written Premium, New Business Premium), Share & Trends Analysis Report By Insurance Type (Public, Private), By Policy Type (Corporate, Retail Policy), By Distribution Channel, And Segment Forecasts

Published Date: April - 2025 | Publisher: MRA | No of Pages: 220 | Industry: healthcare | Format: Report available in PDF / Excel Format

View Details Buy Now 2999 Download Sample Ask for Discount Request CustomizationGermany Accident Insurance Market Trends

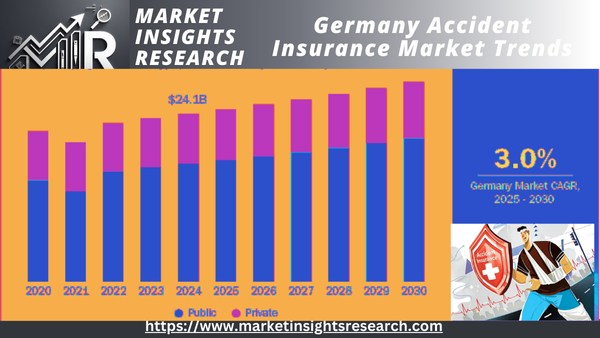

The size of Germany's accident insurance market in terms of Gross Written Premium (GWP) was estimated at USD 24.11 billion in 2024 and is expected to advance at the rate of CAGR 3.0% from 2025 to 2030. And the market size in terms of New Business Premium (NBP) was estimated at USD 2.33 billion in 2024 and is expected to grow at a CAGR of 2.4% from 2025 to 2030.

Download Sample Ask for Discount Request Customization

Growing awareness of personal health and safety, positive regulatory framework, and technological progress & digitalization are the drivers of market growth.

The growth in traffic accidents is one of the key drivers of the accident insurance market in Germany. With large network roads and a high number of vehicles, road safety is still an area of importance. The cost of repairs and medical treatment after an accident is a motivation for one to take up accident insurance to cover against unpredictable expenses. With the number of registered vehicles still on the rise, especially with the embracing of electric vehicles, so does the need for specialized insurance coverage covering particular risks. For example, based on the data released by the Statistisches Bundesamt (Destatis), over 49 million passenger vehicles are on the roads in Germany. Moreover, an estimated 2,800 individuals lost their lives in Germany in road accidents in 2022.

Moreover, new technologies are revolutionizing Germany's accident insurance business by optimizing operational efficiency and customer experience. Digitalization enables insurance companies to provide streamlined services via online channels, making it simpler to purchase policies and make claims. Advanced analytics, machine learning, and IoT are being leveraged to evaluate risks more precisely and customize policies in response. For example, Allianz utilizes AI-driven analytics & real-time dashboards to track claims patterns, provider performance, and fraud detection. Additionally, Debeka is incorporating predictive analytics into its underwriting, enabling it to evaluate future risk patterns more effectively and adjust premiums in response. In addition, insurers are creating niche products for electric vehicles and autonomous driving systems, indicating the industry's flexibility to respond to technological changes.

|

Type of traffic participation |

2024 |

2023 |

2022 |

2021 |

|

Passenger cars |

3,10,295 |

3,17,764 |

3,09,332 |

2,83,352 |

|

Bicycle without electronic assist |

73,558 |

77,706 |

82,453 |

73,167 |

|

Pedestrians |

30,513 |

31,268 |

29,407 |

25,070 |

|

Motorcycles with official sign |

27,933 |

26,514 |

26,872 |

24,223 |

|

Pedelec |

27,312 |

24,973 |

24,004 |

17,959 |

|

Goods road motor vehicles |

24,914 |

26,229 |

26,650 |

25,679 |

|

Personal light electric vehicles (E-Scooter) |

12,027 |

9,544 |

8,443 |

5.615 |

|

Motorcycles with insurance sign |

11,854 |

11,783 |

12,889 |

10,868 |

|

Buses and coaches |

6,128 |

6,015 |

5,738 |

4,731 |

Download Sample Ask for Discount Request Customization

Market Concentration & Characteristics

The figure below shows the link between industry characteristics, industry concentration, and industry players. The X-axis is the market concentration ranging from low to high. The Y-axis is the market characteristics represented as industry competition, level of innovation, extent of mergers & acquisition activities, regulatory influence, product substitutes, and geographic expansion. For example, the Germany accident insurance industry is fragmented, The German accident insurance markets are organized under a highly fragmented and competitive structure. The degree of innovation is moderate, but the impact of regulations on the industry and the scope of partnership and acquisition activities is high. The geographic expansion of the industry is, however, moderate.

The level of innovation in the accident insurance business in Germany is considerably moderate, fueled by digitalization, regulatory changes, and customized insurance offerings. Artificial intelligence and automation are used to enhance underwriting accuracy and speed up claims handling, cutting settlement periods from weeks to days. Online customer portals and mobile apps ensure transparency, where policyholders can handle coverage, file claims, and monitor claim status easily.

The sector is witnessing a moderate rate of merger and acquisition deals conducted by a number of important players. This is because of the ambition to make its presence felt in the sector, improve tech capabilities, and consolidate in a fast-expanding market. For example, in September 2022, Allianz X GmbH acquired simplesurance GmbH to advance its insurance technology.

The laws in the German accident insurance market are mainly regulated through the Seventh Book of the Social Code (SGB VII), which lays out the framework of statutory accident insurance. Statutory accident insurance is compulsory for workers, providing them with protection in case of occupational injuries and safety standards in many industries.

Many market participants are diversifying their business by spreading to new geographies to boost their market foothold and build their product bouquet.

Germany Accident Insurance Market by Gross Written Premiums (GWP)

Insurance Type Insights

Public insurance had the highest revenue share of 70.32% in 2024. Moreover, the segment is projected to register the highest CAGR growth over the forecast period. This is because statutory accident insurance institutions are present, necessitating employers to include coverage for employees. This all-round coverage is controlled by Berufsgenossenschaften (professional associations) and Unfallkassen (accident funds), which are sectoral statutory insurance companies. Additionally, statutory accident insurance covers several risks linked with occupational accidents, journey accidents, and occupational diseases, resulting in high premium rates to finance medical care, rehabilitation, and pension benefits. The system operates on a pay-as-you-go basis, with premiums determined based on industry-specific risk classifications and prior claims history, ensuring sustainability and revenue adequacy. Unlike private accident insurance, which remains voluntary and complementary, public accident insurance benefits from legal enforcement and scale economics.

Private insurance segment is likely to post noteworthy growth during the forecast period as private insurance companies are meeting the growing demand with customized and flexible accident insurance solutions. Such insurance is significant for non-employed people or those without statutory insurance coverage, offering them financial security in case of unexpected accidents. Private accident insurance provides total protection for accidents outside the jurisdiction of statutory insurance. This is accidents that occur in leisure time, when abroad, or domestically and are not insured under statutory insurance. Nonetheless, the increasing age population in Germany and urban lifestyles shape demand for private accident insurance. Due to the extended lifespan and longer years of work before retirement, individuals become increasingly keen on availing more expansive protection against accidents away from workplaces.

Policy Type Insights

The corporate policy segment accounted for the highest revenue share of 68.84% in 2024 and is expected to progress at the highest CAGR during the forecast period. The corporate accident insurance includes employer-offered accident insurance policies for on-job coverage, group insurance policies, and corporate liability accident coverage. The policies are renewed annually and are part of bigger corporate insurance portfolios, which ensures insurers have stable, repeatable revenues. For example, ERGO is particularly focused on corporate accident insurance, including employer-sponsored policies and industrial accident solutions.

The retail policy category is anticipated to develop at a high growth rate in the future years. Statutory accident insurance covers only occupational accidents, and corporate policies are only for workers of participating firms, whereas individual retail policies are bought voluntarily by consumers who desire full, 24/7 coverage - accidents while on vacation, sports, household chores, and travel, driving market growth.

Private Accident Insurance Market (GWP), by Distribution Channel Insights

The multi-company broker segment held the highest revenue share of 45.24% in 2024 due to its capacity to provide consumers and corporate customers extensive, customized access to a variety of insurers and competitive policy choices. In contrast to tied agents who act as representatives of a single insurer, multi-company brokers are independent and work with an extensive panel of insurance companies. This allows them to compare and suggest the most appropriate accident insurance products, be it for individuals looking for customized policies or companies buying group coverage for workers.

The credit institutions segment is expected to expand at the highest rate over the forecast period. This expansion is driven by these institutions' wide customer base, trust factor, and bundling opportunities. Banks are actively involved in distributing group accident insurance policies to small and medium-sized enterprises (SMEs). By capitalizing on existing banking relationships, they provide integrated financial solutions encompassing accident cover for employees, thereby further driving premium inflows.

Download Sample Ask for Discount Request Customization

Key Germany Accident Insurance Company Insights

Key players operating in the Germany accident insurance market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Germany Accident Insurance Companies

- Allianz SE

- Debeka Krankenversicherungsvere A.G.

- Generali Deutschland

- R+V Versicherung AG

- AXA Konzern AG

- ERGO

- DKV

- Signal Iduna

Product and Service Benchmarking

|

Sr. No. |

Company |

Product/ Service |

Coverage Details |

Average Premium (USD) |

Target Client |

|

|

Generali Deutschland |

Accident Insurance |

Comprehensive protection against the financial consequences of accidents, including at home and leisure. |

18.19-20.91 |

Individuals at risk of accidents, such as manual laborers, athletes, or anyone with a physically active lifestyle. |

|

Accident Assistance XXL |

Optional coverage for organizing and covering the costs of additional assistance services such as meal services, shopping, or household help. |

12.73-14.64 |

|||

|

|

R+V Versicherung AG |

Accident Insurance |

Comprehensive coverage for accidents, including medical expenses, hospitalization benefits, daily allowances for incapacity, death benefit, disability benefits, and rehabilitation. |

15-20 |

Individuals at risk of accidents, such as manual laborers, athletes, or anyone with a physically active lifestyle. |

Download Sample Ask for Discount Request Customization

Recent Developments

-

In July 2022, Zurich Beteiligungs-AG, the German subsidiary of Zurich Insurance Group (Zurich) partnered with Cognizant to enhance its digital service offerings to its clients and partners. This partnership further leveraged Zurich Germany's artificial intelligence (AI), data, software engineering and cloud capabilities.

"Zurich is on an ongoing journey of 'accelerated digital evolution' to meet the rapidly changing needs of our customers and partners and creating a more intimate connection with them. Cognizant has proven itself as a knowledgeable and reliable strategic partner, and we look forward to further capitalizing on its industry expertise to help us advance our digital transformation,"

-Jens Becker, chief information officer, Zurich Germany.

Germany Accident Insurance in Terms of GWP Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 24.76 billion |

|

Revenue forecast in 2030 |

USD 28.71 billion |

|

Growth rate |

CAGR of 3.00% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Insurance type, policy type, distribution channel |

|

Country scope |

Germany |

|

Key companies profiled |

Allianz SE; Debeka Krankenversicherungsvere A.G.; Generali Deutschland; R+V Versicherung AG; AXA Konzern AG; ERGO; DKV; Signal Iduna |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Download Sample Ask for Discount Request Customization

Germany Accident Insurance in Terms of NBP Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.37 billion |

|

Revenue forecast in 2030 |

USD 2.67 billion |

|

Growth rate |

CAGR of 2.40% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Insurance type |

|

Country scope |

Germany |

|

Key companies profiled |

Allianz SE; Debeka Krankenversicherungsvere A.G.; Generali Deutschland; R+V Versicherung AG; AXA Konzern AG; ERGO; DKV; Signal Iduna |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Download Sample Ask for Discount Request Customization

Germany Accident Insurance Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Germany accident insurance market report based on insurance type, policy type, and distribution channel.

-

Insurance Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Germany Accident Insurance Market (Gross Written Premiums (GWP))

-

Public

-

Corporate Policy

-

Retail Policy

-

Germany Public Accident Insurance Market (GWP), by Distribution Channel Outlook (Revenue USD Billion, 2018 - 2030)

-

Employer-based Enrollment

-

Self-enrollment for Special Groups

-

-

-

Private

-

Corporate Policy

-

Retail Policy

-

Germany Private Accident Insurance Market (GWP), by Distribution Channel Outlook (Revenue USD Billion, 2018 - 2030)

-

Single Company Broker

-

Multi-Company Broker

-

Credit Institutions

-

Direct Sales

-

Other Sales

-

-

-

Germany Accident Insurance Market (New Business Premiums (NBP))

-

Public

-

Private

-

-

-

Policy Type Outlook (Revenue USD Billion, 2018 - 2030)

-

Corporate Policy

-

Retail Policy

-

-

Distribution Channel Outlook (Revenue USD Billion, 2018 - 2030)

-

Traditional Distribution Channels

-

Digital/ Online Distribution Channels

-

Related Reports

- Pet DNA Testing Market – By Pet Type (Dogs, Cats), Testing Type (Genetic Diseases, Breed Identification, Trait Analysi...

- Veterinary Endotracheal Tubes Market – By Product Type (Cuffed, Uncuffed), Animal Type (Dogs, Cats), Material (Polyvin...

- Pet Fitness Care Market - By Component (Services [Physio Assessments, Agility & Gym Sessions, Aquatic Sessions, Outdoor ...

- Veterinary Infusion Pumps Market – By Product (Syringe, Volumetric, Ambulatory, Implantable), Animal type (Companion, ...

- Veterinary CRO and CDMO Market – By Animal Type (Companion, Livestock), Service Type (CRO, [Clinical Trials, Quality A...

- Pet Sitting Services Market – By Service (In-home Pet Sitting Services, Drop-in Visits, Boarding Services, Daycare Ser...

Table of Content

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Segment scope

1.1.2. Country scope

1.1.3. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. GVR’s internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.3.5. Details of primary research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Commodity flow analysis (Model 1)

1.6.1.1. Approach 1: Commodity flow approach

1.7. Research Assumptions

1.8. List of Secondary Sources

1.9. List of Primary Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Germany Accident Insurance Market Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.2. Market restraint analysis

3.2.3. Industry challenges

3.3. Germany Accident Insurance: Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.2. PESTLE Analysis

3.4. Regulatory Landscape

3.5. Market Outlook and Key Trends

3.6. Market Penetration (Estimated insurance volumes as % of GDP compared to other geographies).

3.7. Customer Segmentation

3.8. Distribution Channel Analysis

Chapter 4. Insurance Type Analysis

4.1. Insurance Type Segment Dashboard

4.2. Germany Accident Insurance Market: Insurance Type Movement Analysis

4.3. Germany Accident Insurance Market Size & Trend Analysis (GWP) and (NBP), by Insurance Type, 2018 - 2030 (USD Billion)

4.4. Public

4.4.1. Public Market, 2018 - 2030 (USD Billion)

4.4.2. Germany Public Accident Insurance Market (GWP), by Distribution Channel, 2018 - 2030 (USD Billion)

4.4.2.1. Employer-Based Enrollment

4.4.2.1.1. Employer-Based Enrollment Market, 2018 - 2030 (USD Billion)

4.4.2.2. Self-Enrollment for Special Groups

4.4.2.2.1. Self-Enrollment for Special Market, 2018 - 2030 (USD Billion)

4.5. Private

4.5.1. Private Market, 2018 - 2030 (USD Billion)

4.5.2. Germany Private Accident Insurance Market (GWP), by Distribution Channel, 2018 - 2030 (USD Billion)

4.5.2.1. Single Company Broker

4.5.2.1.1. Single Company Broker Market, 2018 - 2030 (USD Billion)

4.5.2.2. Multi-Company Broker

4.5.2.2.1. Multi-Company Broker Funds Market, 2018 - 2030 (USD Billion)

4.5.2.3. Credit Institutions

4.5.2.3.1. Credit Institutions Market, 2018 - 2030 (USD Billion)

4.5.2.4. Direct Sales

4.5.2.4.1. Direct Sales Market, 2018 - 2030 (USD Billion)

4.5.2.5. Other Sales

4.5.2.5.1. Other Sales Market, 2018 - 2030 (USD Billion)

Chapter 5. Germany Accident Insurance Market (GWP) Segment Analysis, By Policy Type, 2018 - 2030 (USD Billion)

5.1. Policy Type Segment Dashboard

5.2. Germany Accident Insurance Market: Policy Type Movement Analysis

5.3. Germany Accident Insurance Market (GWP) Size & Trend Analysis, by Policy Type, 2018 - 2030 (USD Billion)

5.4. Corporate Policy

5.4.1. Corporate Policy Market, 2018 - 2030 (USD Billion)

5.5. Retail Policy

5.5.1. Retail Policy Market, 2018 - 2030 (USD Billion)

Chapter 6. Competitive Landscape

6.1. Recent Developments & Impact Analysis, By Key Market Participants

6.2. Company Categorization

6.3. Estimated Company Market Share Analysis, 2018 -2023

6.4. Company Profiles

6.4.1. Allianz SE

6.4.1.1. Company overview

6.4.1.2. Financial performance

6.4.1.3. Product/Coverage benchmarking

6.4.1.4. Strategic initiatives

6.4.2. Debeka Krankenversicherungsvere A.G.

6.4.2.1. Company overview

6.4.2.2. Financial performance

6.4.2.3. Product/Coverage benchmarking

6.4.2.4. Strategic initiatives

6.4.3. Generali Deutschland

6.4.3.1. Company overview

6.4.3.2. Financial performance

6.4.3.3. Product/Coverage benchmarking

6.4.3.4. Strategic initiatives

6.4.4. R+V Versicherung AG

6.4.4.1. Company overview

6.4.4.2. Financial performance

6.4.4.3. Product/Coverage benchmarking

6.4.4.4. Strategic initiatives

6.4.5. AXA Konzern AG

6.4.5.1. Company overview

6.4.5.2. Financial performance

6.4.5.3. Product/Coverage benchmarking

6.4.5.4. Strategic initiatives

6.4.6. ERGO

6.4.6.1. Company overview

6.4.6.2. Financial performance

6.4.6.3. Product/Coverage benchmarking

6.4.6.4. Strategic initiatives

6.4.7. DKV

6.4.7.1. Company overview

6.4.7.2. Financial performance

6.4.7.3. Product/Coverage benchmarking

6.4.7.4. Strategic initiatives

6.4.8. Signal Iduna

6.4.8.1. Company overview

6.4.8.2. Financial performance

6.4.8.3. Product/Coverage benchmarking

6.4.8.4. Strategic initiatives

List Tables Figures

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviations

Table 3 Germany accident insurance market, by insurance type, 2018 - 2030 (USD Billion)

Table 4 Germany public accident insurance market (GWP), by policy type, 2018 - 2030 (USD Billion)

Table 5 Germany public accident insurance market (GWP), by distribution channel, 2018 - 2030 (USD Billion)

Table 6 Germany private accident insurance market (GWP), by policy type, 2018 - 2030 (USD Billion)

Table 7 Germany private accident insurance market (GWP), by distribution channel, 2018 - 2030 (USD Billion)

Table 8 Germany accident insurance market (NBP), by insurance type, 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Market research process

Fig. 2 Information procurement

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value chain-based sizing & forecasting

Fig. 6 Market formulation & validation

Fig. 7 Model details

Fig. 8 Germany accident insurance market segmentation

Fig. 9 Market snapshot

Fig. 10 Segment snapshot

Fig. 11 Competitive landscape snapshot

Fig. 12 Market dynamics

Fig. 13 Market driver relevance analysis (current & future impact)

Fig. 14 Market restraint relevance analysis (current & future impact)

Fig. 15 PESTLE analysis

Fig. 16 Porter’s five forces analysis

Fig. 17 Germany accident insurance market: Insurance type outlook and key takeaways

Fig. 18 Germany accident insurance Market: Insurance type movement analysis

Fig. 19 Public market revenue, 2018 - 2030 (USD Billion)

Fig. 20 Germany public accident insurance market (GWP), by corporate policy market revenue, 2018 - 2030 (USD Billion)

Fig. 21 Germany public accident insurance market (GWP), by retail policy market revenue, 2018 - 2030 (USD Billion)

Fig. 22 Germany public accident insurance market (GWP), by distribution channel market revenue, 2018 - 2030 (USD Billion)

Fig. 23 Germany public accident insurance market (GWP), by employer-based enrollment market revenue, 2018 - 2030 (USD Billion)

Fig. 24 Germany public accident insurance market (GWP), by direct enrollment via public accident insurance funds market revenue, 2018 - 2030 (USD Billion)

Fig. 25 Germany private accident insurance market (GWP), by corporate policy market revenue, 2018 - 2030 (USD Billion)

Fig. 26 Germany private accident insurance market (GWP), by retail policy market revenue, 2018 - 2030 (USD Billion)

Fig. 27 Germany private accident insurance market (GWP), by distribution channel market revenue, 2018 - 2030 (USD Billion)

Fig. 28 Germany private accident insurance market (GWP), by single company broker market revenue, 2018 - 2030 (USD Billion)

Fig. 29 Germany private accident insurance market (GWP), by multi-company broker market revenue, 2018 - 2030 (USD Billion)

Fig. 30 Germany private accident insurance market (GWP), by credit institutions market revenue, 2018 - 2030 (USD Billion)

Fig. 31 Germany private accident insurance market (GWP), by direct sales market revenue, 2018 - 2030 (USD Billion)

Fig. 32 Germany private accident insurance market (GWP), by other sales market revenue, 2018 - 2030 (USD Billion)

Fig. 33 Germany accident insurance market (GWP): Policy type outlook and key takeaways

Fig. 34 Germany accident insurance market (GWP): Policy type movement analysis

Fig. 35 Corporate policy market revenue, 2018 - 2030 (USD Billion)

Fig. 36 Retail policy market revenue, 2018 - 2030 (USD Billion)

Fig. 37 Germany accident insurance market (NBP): Corporate policy outlook and key takeaways

Fig. 38 Germany accident insurance market (NBP): Corporate policy movement analysis

Fig. 39 Public accident insurance (NBP) market revenue, 2018 - 2030 (USD Billion)

Fig. 40 Private accident insurance (NBP) market revenue, 2018 - 2030 (USD Billion)

Fig. 41 Company categorization

Fig. 42 Company market position analysis

Fig. 43 Estimated Company market share analysis, 2018 -2023

Fig. 44 Strategy mapping

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy