Enteral Feeding Devices Market - By Product (Enteral Feeding Tubes, Enteral Feeding Pumps, Enteral Syringes, Giving Sets, Accessories), By Patient (Adult, Pediatric), By Application, By End-use & Forecast, 2021-2027

Published Date: August - 2024 | Publisher: MIR | No of Pages: 240 | Industry: Healthcare | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Sample Ask for Discount Request CustomizationEnteral Feeding Devices Market Size

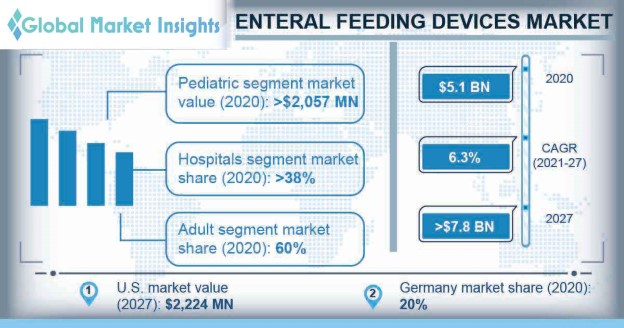

Enteral Feeding Devices Market size was valued at around USD 5.1 billion in 2020 and is estimated to grow at a CAGR of 6.3% between 2021 to 2027. Growing incidence of chronic diseases including cancer and neurological disorders such as stroke, multiple sclerosis, and dementia are stimulating the market growth. Expanding geriatric population base and rising number of people suffering from malnutrition are anticipated to increase the adoption of enteral feeding devices. In addition to this, rising prevalence of premature births in emerging economies is further expected to render significant impact, driving the market expansion.

Enteral feeding devices are used to intake food through the gastrointestinal (GI) tract with the help of a tube that passes directly to stomach or small intestine. These devices are advised for patients that have trouble ingesting vital amount of calories but can perform adequate gastrointestinal function to enable digestion and absorption. Enteral feeding devices finds extensive applications in intensive care unit (ICU), operation theatres (OT), critical care unit (CCU), and even in-home care settings.

| Report Attribute | Details |

|---|---|

| Base Year | 2020 |

| Enteral Feeding Devices Market Size in 2020 | USD 5,120.7 million |

| Forecast Period | 2021 to 2027 |

| Forecast Period 2021 to 2027 CAGR | 6.3% |

| 2027 Value Projection | USD 7,854.3 million |

| Historical Data for | 2016 to 2020 |

| No. of Pages | 300 |

| Tables, Charts & Figures | 449 |

| Segments covered | Product, Patient, Application, End-use and Region |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

However, several complications associated with the use of enteral feeding devices on patient health may negatively impact the enteral feeding devices market share. Enteral feeding mechanism has been regularly associated with digestive complications such as diarrhoea, vomiting, abdominal distention, regurgitation and constipation. Mechanical complications related to these devices include tube obstruction, and aspiration pneumonia (bronchoaspiration) among others. Enteral feeding devices can also cause malnutrition due to feed intolerance and may result in a diminished response to disease and delayed recovery.

Furthermore, the U.S. FDA closely monitors the development, approval and post-approval adverse effects related to medical devices including enteral feeding devices. Owing to complications, misconnection injuries and dislodgment of tubes resulting in accidental disabilities and even deaths, these devices are classified under Class II medical devices. Majority of the Class II devices require a premarket notification (510k) process to get approval for commercial use of the product. The 510(k) approval represents a complicated process that demonstrates safety and efficacy of the device. The U.S.FDA monitors these devices to ensure optimum regulatory standards and to reduce the associated risks and injuries related to the device.

The COVID-19 pandemic has emerged as an unprecedented health concern that has rendered significant impact on the enteral feeding devices market. The coronavirus outbreak has affected millions of people across the globe causing significant mortalities. In order to curb the further transmission of SARS-CoV-2 virus, nationwide lockdowns were imposed, and emergencies had been declared in majority of the countries. The shutdown of major sectors of the economy distorted the supply chain and restricted the movement of raw materials, further limiting the industry growth. The COVID-19 affected the healthcare industry by financial adversities on the firms and by impacting production capacity. The production facilities were operating with lower employee strength further hampering the production and supply of enteral feeding equipment.

However, the use of enteral feeding tubes, especially in-home care settings is set to surge owing to pandemic. Heavy patient inflow and growing strain on healthcare system will push the use of enteral feeding tubes in home care settings in order to meet the nutritional needs of patients without visiting hospitals. New guidelines have been issued by the National Nurses Nutrition Group, for patients as well as medical professionals offering nutritional support with help of enteral tubes. Additionally, the European Society for Clinical Nutrition and Metabolism (ESPEN) published supportive information related to nutrition for severe COVID-19 patients. The published data suggests the use of enteral feeding equipment such as feeding tubes for meeting essential nutritional intake in severe COVID-19 patients. As a result, the pandemic will have a positive impact on the industry expansion.

Growing prevalence of chronic diseases will amplify the enteral feeding devices market progression

Rising prevalence of chronic ailments will augment the need for enteral feeding equipment industry. High number of people are suffering from chronic ailments such as cancer, diabetes, neurological disorders, gastrointestinal diseases and others. For instance, according to the Centres for Disease Control and Prevention (CDC), around 9.5% of the adults in the U.S. are diagnosed with cancer and account for approximately 600,000 deaths annually. These numbers are further estimated to surge in the coming years.

Expanding geriatric population will further accelerate the incidence of neurological disorders including stroke, multiple sclerosis, and dementia resulting in huge target population base for enteral devices. According to the Global Burden of Diseases (GBD) study to assess the impact of chronic diseases, neurological disorders are leading cause of disability-adjusted life-years (DALYs). Disorders such as Alzheimer’s & associated dementia and stroke among others majorly contributed to the rising prevalence of neurological ailments. The people affected with neurological disorders require enteral feeding to meet their daily calorie requirements. Thus, the provision of nutritional intake in the form of oral supplements and enteral feeding tube helps in providing nutrition and reducing nutritional deficit among the diseased population.

Moreover, rising usage of enteral feeding approach to meet nutritional requirements of cancer patients, especially head and neck cancer patients that are at increased risk of malnutrition are driving the industry progression. Patients diagnosed with head and neck cancer, gastrointestinal cancer exhibit symptoms such as lower oral intake, difficulty in swallowing, throat swelling and pain among others, restricting the food intake. Hence, enteral feeding is advised to ensure the supply of vital nutrients to the body along with medications, fluids and oral supplements fluids among these patients to fasten the recovery.

Enteral Feeding Devices Market Analysis

The enteral feeding tubes segment accounted for USD 2.12 billion in 2020 led by the growing acceptance of enteral feeding therapy coupled with rising incidences of chronic ailments across the globe. Increasing prevalence of conditions such as pre-mature births, malnutrition, neuromuscular and neurologic ailments, cancer and digestive disorders among others have surged the demand for enteral feeding tubes. Additionally, the Global Enteral Device Supplier Association (GEDSA) has announced introduction of novel enteral connectors (ENFit) that comply with the revised ISO standards. Development of this connector has promoted patient safety and reduced the occurrence of misconnection associated with enteral feeding tubes.

The adult segment dominated more than 60% of revenue share in 2020 on account of the rising geriatric population base and high incidence of conditions challenging oral intake in adult population. According to the World Health Organization (WHO), there are approximately 727 million people belonging to 65 years and older age group and the number is poised to double by 2050, accounting for more than 1.5 billion people globally. The incidence of conditions such as cerebral vascular disorders, dysphagia, neuro-degenerative diseases is reported high amongst elderly population. These conditions result in malnutrition, thereby generating high requirement for enteral nutrition for maintaining necessary calorie intake along with other fluids and medications. Thus, rising incidence of several health conditions resulting in malnutrition and growing geriatric population will amplify the industry revenue.

The cancer segment in the enteral feeding devices market captured 45% of revenue share in 2020 impelled by the growing prevalence of cancer, specifically head & neck, gastrointestinal, lung and liver cancer among others. Cancer and its treatment cause drastic alterations including malnutrition that may develop into cancer cachexia. As per the Malnutrition Advisory Action Group of the British Association for Parenteral and Enteral Nutrition, malnutrition is prevalent in 40% to 80% of cancer patients and is highly responsible for associated morbidity and mortality. The rising prevalence of cancer is set to play anchoring role in growing demand for these devices to offer vital nutrition to cancer patients.

The enteral feeding devices market for home care segment exceeded USD 2.44 billion in 2020 owing to increasing adoption of enteral feeding devices in the home care settings. Rising pressure to limit increasing healthcare expenses, significant advancements and availability of easy to use feeding equipment and favourable reimbursement scenario for home enteral nutrition (HEN) would further fuel the segment growth. Moreover, the COVID-19 pandemic has further increased the usage of enteral feeding devices in home care settings, thereby boosting the market growth in the coming years.

U.S. dominated the North American enteral feeding devices market and is slated to reach USD 2.22 billion by 2027. The significant market share is attributable to several factors such as high acceptance of enteral feeding devices in the home care settings, rise in incidence of chronic ailments and growing number of premature births across the country. Premature births and related complications are leading cause of death among babies in the U.S. Approximately 380,000 babies in the U.S. are born as premature on annual basis and the premature birth rate is around 9.8%. Babies that survive premature birth face long-term health concerns such as cerebral palsy, stunted growth and malnutrition among others. These adverse events along with rise in chronic diseases are anticipated to impel the adoption rate of enteral feeding devices in the country.

Germany held around 20% of revenue share in 2020 across the Europe enteral feeding devices market and is projected to cross USD 440 million by 2027 due to the high number of people suffering from cancer, growing geriatric population and rising prevalence of neurological disorders in the country. As per the Globocan (Global Cancer Observatory) in 2020, the number of people diagnosed with cancer in Germany was 628,519 and the number is further expected to grow in the coming period. According to the American Gastroenterology Association, the estimated prevalence of functional gastrointestinal disorders (FGIDs) in Germany was 36.5%. Moreover, high incidence of neurological disorders, gastrointestinal diseases and burden of healthcare costs associated with these diseases will augment the product acceptance.

Enteral Feeding Devices Market Share

Some of the major companies operating in the enteral feeding devices market are

- Amsino International

- Becton Dickinson

- Boston Scientific

- ALCOR Scientific

- B Braun Melsungen

- Abbott Nutrition

- Cardinal Health

- Cook Medical

- Applied Medical Technologies

- ConMed

Vygon and Fresenius Kabi among others. These prominent leaders focus on strategic partnerships, new product launch & commercialization for business expansion. Furthermore, these participants are heavily investing in research that allows them to introduce innovative products and garner maximum revenue in the market.

Recent industry developments

- In July 2020, Baxter International and VIPUN Medical signed an agreement to commercialize the VIPUN Gastric Monitoring System. This system offers smart enteral feeding tube developed to assess the stomach motility for aiding the clinicians detect enteral feeding intolerance and provide better nutrition therapy decisions. This strategic collaboration helped the company to gain competitive advantage and strengthen its industrial position.

- In June 2020, Applied Medical Technology, Inc. announced the addition of the G-JET gastric-jejunal enteral feeding tube to G-JET product portfolio. This expansion assisted the company in driving the sales as the products offers comprehensive range of selection in enteral feeding devices.

Enteral feeding devices market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2016 to 2027, for the following segments

Click here to Buy Section of this Report

Market, By Product, 2016 - 2027 (USD Million)

- Enteral Feeding Tubes

- Nasoenteric/Nasal Feeding Tube

- Nasogastric Tube

- Nasojejunal Tube

- Abdominal/Ostotomy Feeding Tube

- Gastrostomy Tube

- Jejunostomy/Jejunal Tube

- Gastrojejunal (GJ) or Transjejunal Tube

- Nasoenteric/Nasal Feeding Tube

- Enteral Feeding Pumps

- Enteral Syringes

- Giving Sets

- Accessories

Market, By Patient, 2016 - 2027 (USD Million)

- Adult

- Pediatric

Market, By Application, 2016 - 2027 (USD Million)

- Cancer

- Head and Neck Cancer

- Gastrointestinal Cancer

- Others

- Central Nervous System (CNS) & Mental Health

- Non-malignant Gastrointestinal (GI) Disorders

- Others

Market, By End-use, 2016 - 2027 (USD Million)

- Home Care

- Hospital

- Others

The above information is provided for the following regions and countries

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Asia Pacific

- India

- China

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Related Reports

- North America Seasoning Market Size - By Type (Oregano, Paprika, Ginger, Cinnamon, Cumin, Turmeric, Garlic, Cardamom, Co...

- Veterinary Endoscopes Market – By Product Type (Flexible [Video, Fibre-optic], Rigid), Procedure Type (Gastroduodenosc...

- Pet Wearable Market Size - By Product (Smart Collar, Smart Vest, Smart Harness, Smart Camera), By Technology (RFID Devic...

- Swine Artificial Insemination Market – By Product & Service (Semen {Fresh, Frozen}, Insemination Instruments {Catheter...

- Pet Tech Market - By Product (Pet Wearables, Smart Pet Crates & Beds, Smart Pet Doors, Smart Pet Feeders & Bowls, Smart ...

- Ovine and Caprine Artificial Insemination Market – By Type (Equipment, Semen, Reagents & Kits, Services) Animal Type (...

Table of Content

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

List Tables Figures

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy