Lacrimal Devices Market Size

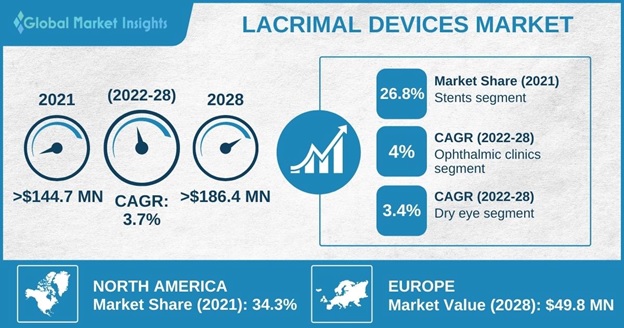

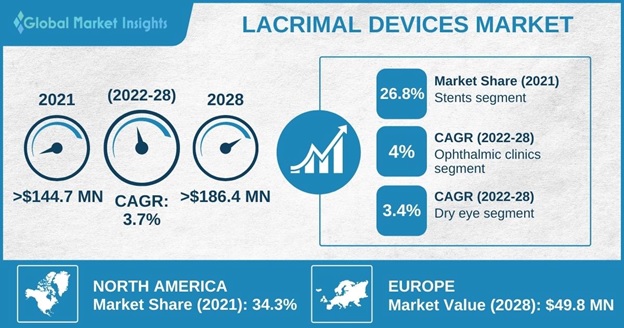

Lacrimal Devices Market size accounted for over USD 144.7 million in 2021 and is estimated to grow at 3.7% CAGR between 2022 and 2028. Rising prevalence of eye disease is expected to boost the adoption of lacrimal devices in the projected timeframe. Dacryocystitis is an infection of the lacrimal sacs or tear sacs that causes redness, pain, and discomfort in the lower corner of eye. According to the Review of Ophthalmology, development of congenital dacryocele to an acute Dacryocystitis may occur in 20 to 72.5% of patients. This has led to an increase in the demand for lacrimal devices.

Lacrimal devices are ophthalmic protective system that helps to keep eyes moist and free from dust particles. These lacrimal devices are usually constrained to lacrimal ducts and nasal punctum of the eye. Certain factors that are driving the market growth include rising demand for minimally invasive treatment and increasing patient pool of nasolacrimal duct obstruction.

Lacrimal Devices Market Report Attributes

| Report Attribute |

Details |

| Base Year | 2021 |

|---|

| Lacrimal Devices Market Size in 2021 | 144.8 Million (USD) |

|---|

| Forecast Period | 2022 to 2028 |

|---|

| Forecast Period 2022 to 2028 CAGR | 3.7% |

|---|

| 2028 Value Projection | 186.5 Million (USD) |

|---|

| Historical Data for | 2017 to 2021 |

|---|

| No. of Pages | 145 |

|---|

| Tables, Charts & Figures | 215 |

| Segments covered | Product, Application, End-use and Region |

|---|

| Growth Drivers | - Growing prevalence of eye disease

- Ease of lacrimal treatment procedures

- Technological advancements in lacrimal devices

|

|---|

| Pitfalls & Challenges | - High risk of side effects

|

|---|

The emergency of COVID-19 pandemic has disrupted every aspect of ophthalmology service and ophthalmic practice. Various companies witnessed a slowdown in product volumes in 2020 as well as faced significant challenges in exporting the products. This can be attributed to increasing number of COVID-19 infections along with restrictions, delaying or postponing of the non-essential surgical and non-invasive procedures. For instance, the American College of Surgeons provided guidelines to postpone non-emergency surgical procedures including cataract surgery, endoscopic dacryocystorhinostomy and lacrimal surgeries. This has potentially decreased the procedure volume, indicating that the COVID-19 pandemic had a negative impact on the lacrimal device market expansion.

Lacrimal Devices Market Trends

Lacrimal devices market is expected to witness significant growth owing to the development of novel products for eye surgeries. Increasing focus of market players on highly precise, upgraded, and cost-effective lacrimal devices will augment the industry statistics. For instance, in October 2019, AlphaMed received approval from U.S. FDA for its Tear Pool Dissolvable Punctum Plugs. The plugs are designed to insert into the canaliculus that temporarily restricts the natural lubricating tears from draining off the surface of the eye. Such devices will increase the product acceptance, thereby fuelling the market trends.

High risk of side effects may impede the market demand

Side effects and risk associated during the surgery or after surgery in the event of incorporation of lacrimal devices may restrain the market expansion. Various side effects associated with the lacrimal devices may cause slightly irritating sensation and inflammation in the tear ducts among others. These side effects can lead to scarring and can also damage. Furthermore, the lacrimal gland tumour surgery may also possibly cause damage to the optic nerve or retinal blood vessels. Therefore, aforementioned factors associated with lacrimal device may hinder the market growth.

Lacrimal Devices Market Analysis

The lacrimal devices market based on product is segmented into intubation sets, tubes, stents, cannula & spatula, dilators, punctal plugs and others. The stents segment accounted for 26.8% revenue share in 2021. Lacrimal stents are small tubes commonly made up of silicon. These stents are used to maintain the patency of lacrimal pathway between the nasal passage and surface of the eye. Also, these stents provide suitable circumferential force to facilitate post dacryocystorhinostomy (DCR) healing. Such advantages associated with lacrimal stents are expected to boost the market expansion in the forecast period. Additionally, lacrimal stents are successful in maintaining the patency of the drainage system in laceration of canaliculi, obstruction, and stenosis among others.

By application, the lacrimal devices market is segmented into dry eye, epiphora, glaucoma, drainage obstruction, lacrimal gland inflammation and others. Dry eye segment is expected to witness lucrative CAGR of 3.4% in the analysis timeframe. Increasing age, side effect of certain drugs like antihistamines causes dry eyes syndrome. For instance, according to the statistics of dry eye directory, in 2022, between 5-15% of population in America have dry eyes. Therefore, dry eye can cause lasting damage to the corneal surface and reduce the vision if untreated. Also, leads to the dysfunction of the lacrimal glands that also causes inflammation. Thus, increasing incidence of dry eyes disease across the globe will augment the market size.

By end-use, the lacrimal devices market is segmented into hospitals, ophthalmic clinics, diagnostic centers, and others. Hospital segment is expected to reach USD 86.4 million by 2028. The high segmental growth is attributed to developed infrastructure, availability of well-equipped along with advanced technological tools. Moreover, presence of large number of skilled doctors for effective diagnosis & treatment and nursing staff for proper care is boosting the segmental growth.

North America dominated the global lacrimal devices market with revenue share of 34.3% in 2021. Increasing incidence of eye diseases coupled with the availability of technologically advanced products is expected to propel the regional market share. Also, increasing disposable income and growing awareness for secure treatment for various eye disorders are few of the other factors boosting the North American market outlook. Furthermore, rising adoption of technological advance tools for effective surgeries and improved patient outcome coupled with presence of key market players will further enhance the market size of North America lacrimal devices.

Lacrimal Devices Market Share

Major industry players operating in the lacrimal devices market include

- FCI Ophthalmic

- Medennium

- BVI

- Lacrimedics Inc

- Rumex International Co

- Bess Medical Technology GmbH

- Kaneka Corporation

- Braintree Scientific

- JEDMED

- Walsh Medical Devices Inc

These industry players implemented various strategies such as acquisitions and mergers, collaborations, new product launch, geographical expansion etc. to capture high revenue share in the market.

Some of the recent industry developments

- In November 2021, Innovia Medical announced the acquisition of Lacrimedics Inc, an occlusion therapy device provider for treating dry eye disease. The acquisition aimed to enhance Innovia’s ophthalmic business and allow to provide ophthalmic customers with comprehensive occlusion therapy options, thereby strengthening market position.

- In June 2021, FCI Ophthalmic launched LacriJet, a self-retaining monocanalicular nasolacrimal intubation. The product help in reducing the operating time during the incubation or removal of the devices. It is indicated for congenital nasolacrimal duct obstruction (CNLDO), canalicular laceration and epiphora. This strategy will enhance their product offering as well as strengthen their business revenue.

The lacrimal devices market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2017 to 2028, for the following segments

Click here to Buy Section of this Report

By Product

- Intubation sets

- Tubes

- Stents

- Cannula & spatula

- Dilator

- Punctal plugs

- Others

By Application

- Dry eye

- Glaucoma

- Epiphora

- Drainage obstruction

- Lacrimal gland inflammation

- Others

By End-use

- Hospitals

- Ophthalmic clinics

- Diagnostic centers

- Others

The above information is provided for the following regions and countries

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE