Fabry Disease Treatment Market Size

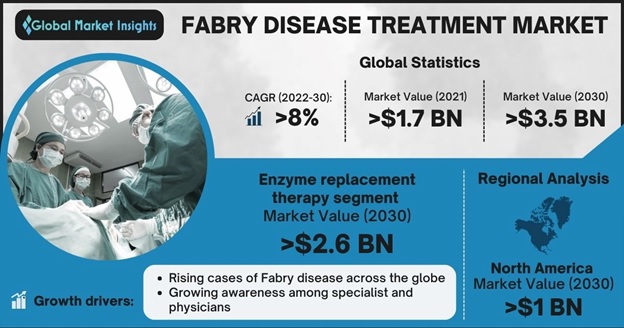

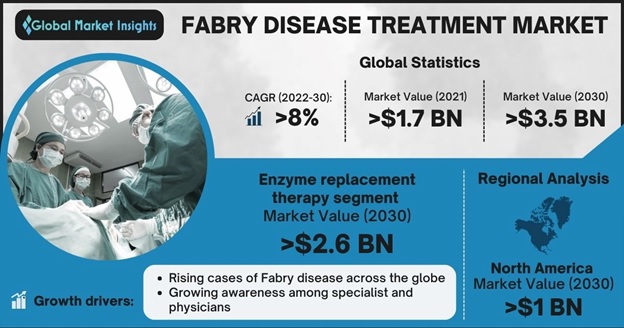

Fabry Disease Treatment Market was valued at over USD 1.7 billion in 2021. Driven by the increasing burden of heart and other organ-related problems in late-onset Fabry disease patients, the industry is expected to depict a CAGR of over 8% from 2022 to 2030.

The incidence rate of Fabry disease continues to rise worldwide. Chaperone and ERT (enzyme replacement therapy) are common therapeutic approaches designed to improve the clinical symptoms of patients with this genetic disease. The type 1 classic and late-onset Fabry disease symptoms, which are three times to ten times more common than the classic type, are becoming prevalent, especially among men.

Based on recent research, Fabry disease is also emerging as the second most common genetic metabolic storage disease, often resulting in progressive organ damage or failure and premature death. Heart problems in patients with Fabry disease include the enlargement of heart muscles due to extra effort required to pump blood. This condition is common among patients with late-onset Fabry disease aged 40 years or above. The rapidly aging population is thus expected to accelerate Fabry disease diagnosis and treatment, stimulating industry statistics.

Fabry Disease Treatment Market Report Attributes

| Report Attribute |

Details |

| Base Year | 2021 |

|---|

| Fabry Disease Treatment Market Size in 2021 | USD 1,794.6 million |

|---|

| Forecast Period | 2022 to 2030 |

|---|

| Forecast Period 2022 to 2030 CAGR | 8% |

|---|

| 2030 Value Projection | USD 3,553.6 million |

|---|

| Historical Data for | 2017 to 2021 |

|---|

| No. of Pages | 109 |

|---|

| Tables, Charts & Figures | 136 |

| Segments covered | Treatment Type and Region |

|---|

| Growth Drivers | - Rising cases of Fabry disease across the globe

- Growing awareness among specialist and physicians

- Advancements in Fabry disease treatment therapies

- Rising health awareness and demand for early-stage diagnosis

|

|---|

| Pitfalls & Challenges | |

|---|

High treatment costs to hamper industry expansion

The rising financial burden of patients with rare genetic diseases including Fabry and the high costs of treatment may restrain the Fabry disease treatment market development. For example, the cost of enzyme replacement therapy can increase by up to USD 200,000 or more each year. Additionally, Galafold (migalastat), an oral chaperone therapy offered by Amicus Therapeutics Inc. is priced at USD 315,000 per year. These factors are projected to restrict the development of Fabry disease treatment centers to a certain extent.

Fabry Disease Treatment Market Analysis

Based on treatment type, the Fabry disease treatment market is segregated into ERT (enzyme replacement therapy) and chaperone therapy. The enzyme replacement therapy segment is projected to record a revenue of over USD 2.6 billion by 2030, considering the prominent role of this therapy in target disease treatment. ERT is designed to help identify the underlying causes of the disease and assist in the breakdown of fatty molecules. Replagal enzyme replacement therapy, for example, was designed to replace the human alpha-galactosidase A, which is a common deficiency observed in Fabry disease patients. Strong application scope and development of innovative treatments will thus stimulate segmental expansion over the estimated timeframe.

North America Fabry disease treatment market is expected to register a revenue of more than USD 1 billion by 2030. This can be credited to the novel product launch initiatives by industry players and the growing disease prevalence. Based on the population estimates of the Census Bureau, over 11,000 people are diagnosed with Fabry disease in the United States. In the region, ERT and chaperone treatment have also become viable options for the management of Fabry disease-induced complications, further influencing regional industry dynamics.

Fabry Disease Treatment Market Share

- JCR Pharmaceuticals Co Ltd

- Takeda

- Amicus Therapeutics

- Sanofi

- ISU Abaxis

are some of the key players operating in the Fabry disease treatment market. These companies are witnessing product approvals from regulatory players, which will enable them to expand their customer base and presence in the global market. For instance, in August 2021, Amicus Therapeutics announced the European Commission’s approval of its Galafold (migalastat) treatment for adolescent Fabry disease patients. This treatment was designed for patients aged 12 years and older with Fabry disease and an amenable mutation. This move was aimed at enabling the company to strengthen its foothold in the market.

Impact of COVID-19 Pandemic

The COVID-19 pandemic has asserted a profound impact on the healthcare industry, including institutions such as Fabry disease treatment centers, especially during the initial months of the outbreak. However, rapid technological advancement and the acceptance of digital tech such as telemedicine have supported the gradual recovery of the healthcare industry and in turn, enabled progress in disease diagnosis. Furthermore, the adoption of Fabry disease treatment in homecare settings has increased, creating a strong outlook for the industry even during the pandemic.

The Fabry disease treatment market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2017 to 2030 for the following segments

Click here to Buy Section of this Report

By Treatment Type

- Enzyme Replacement Therapy (ERT)

- By Drug Type

- Agalsidase Alpha

- Agalsidase Beta

- By End-use

- Physician office

- Home settings

- Chaperone Therapy

The above information is provided for the following regions and countries

- North America

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- ROW