Biopsy Needle Market Size

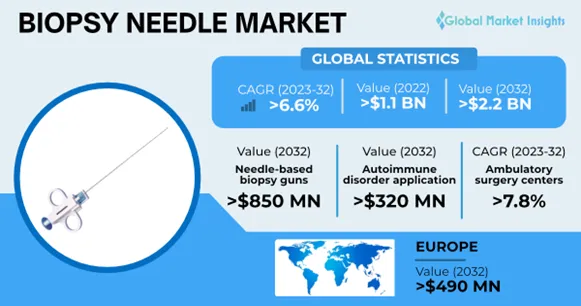

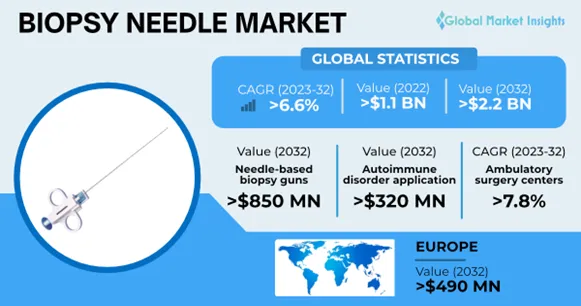

Biopsy Needle Market size was worth more than USD 1.1 billion in 2022 and is projected to witness a 6.6% CAGR from 2023-2032. The rising incidence of cancer and new technological advancements in biopsy needles will facilitate market growth. Changes in lifestyle habits and environmental factors are some of the key contributors to at least 50% of cancer cases. Other risk factors for cancer include exposure to toxic or polluted environments and harmful chemicals such as plastics, polychlorinated biphenyls among others.

The International Association of Research on Cancer estimates that the four most common types of cancer that account for approximately 40% of all cancer diagnoses include breast cancer (about 11.7%), lung cancer (approximately 11.4%), colorectal cancer (around 10%), and prostate cancer (nearly 7.3%) of all cancer diagnosis occurring globally.

Medical breakthroughs have made it possible for doctors to use fancy new tools to find and treat even the tiniest cancerous tumors. Companies that make biopsy needles, which are used to take small samples of tissue for testing, are coming up with all sorts of cool technologies. Older needles are becoming a thing of the past. Take, for example, Saga Surgical, a Swedish company that released a cutting-edge biopsy needle called the Forsvall Needle in June 2021. This needle is designed to reduce the risk of getting an infection after a biopsy. It's estimated that using this needle could save over $230 million every year just for prostate cancer emergencies.

Biopsy Needle Market Report Attributes

| Report Attribute |

Details |

| Base Year | 2022 |

|---|

| Biopsy Needle Market Size in 2022 | USD 1.11 Billion |

|---|

| Forecast Period | 2023 to 2032 |

|---|

| Forecast Period 2023 to 2032 CAGR | 6.6% |

|---|

| 2032 Value Projection | USD 2.23 Billion |

|---|

| Historical Data for | 2018 to 2022 |

|---|

| No. of Pages | 275 |

|---|

| Tables, Charts & Figures | 326 |

| Segments covered | Product, Application, End-use, and Region |

|---|

| Growth Drivers | - Rising incidence of cancer across the globe

- Technological advancements in biopsy needles

- Favorable reimbursement scenario

- Increasing awareness regarding breast cancer

|

|---|

| Pitfalls & Challenges | - Risk of complications after biopsy

- Dearth of skilled healthcare professionals

|

|---|

A lack of skilled healthcare professionals may impact the deployment and use of biopsy needles. Strong technical proficiency is necessary for a biopsy process in terms of using the equipment and interpreting the data. Due to under-trained health workers, the majority of customers are concerned about proper diagnosis, which may be an obstacle to the growth of the biopsy needle market. For instance, as per estimates, in EU28, the lack of skilled healthcare workforce is projected to reach around 4.1 million in 2030.

Biopsy Needle Market Analysis

Biopsy needle market share from needle-based biopsy guns was over USD 850 million in 2022 and is expected to witness substantial growth through 2023-2032. Technological advancements in biopsy equipment have supported the introduction of products such as needle-based biopsy guns. In comparison to surgical biopsy, needle biopsy has numerous benefits such as rapid operational speed, less expensive, and less intrusive, as well as the ability to save patients with benign lesions from surgery. These benefits are anticipated to drive segmental growth over the forecast period.

Imagine you have a microscope that can zoom into your body and look for microscopic clues about your health. That's what a biopsy needle does, and it's especially important for people with autoimmune disorders. Autoimmune disorders are like a mix-up in your body's defense system. Instead of protecting you from invaders like germs, it mistakenly attacks your own healthy cells. Diseases like Type 1 diabetes, rheumatoid arthritis, and multiple sclerosis are all examples of autoimmune conditions. Did you know that around 4% of people worldwide have an autoimmune disorder? That's a lot of people! And in the United States alone, over 50 million Americans live with one or more of these conditions. Because these disorders are becoming more common, more people need biopsies to help diagnose and manage them. This means that the demand for biopsy needles is expected to grow in the coming years, potentially reaching over $320 million by 2032.

Based on end-use, biopsy needle market share from ambulatory surgery centers is estimated to witness over 7.8% CAGR during the forecast years 2023 to 2032. Ambulatory Surgery Centers (ASCs) are becoming well-liked among doctors and patients because they are affordable and provide a wide range of medical treatments. According to the Centers for Medicare & Medicaid Services, the number of ASCs increases by 1.7% annually on average. Furthermore, the number of procedures/ services has increased by an average rate of 2.7% annually in recent years.

Europe's market for biopsy needles is expected to skyrocket, reaching an incredible 490 million dollars by 2032. This surge is driven by a sobering realityin 2020 alone, Europe witnessed over 2.7 million new cancer diagnoses and a heartbreaking 1.3 million cancer-related deaths. Countries like Ireland, the Netherlands, Belgium, Denmark, and others bear the highest burden of cancer. And guess who's leading the pack in the biopsy device market? Germany! Its strong suit lies in its wealth of highly skilled healthcare professionals, top-notch healthcare infrastructure, and homegrown industry leaders. But there's another factor fuelling this market growthEurope's aging population. As more and more people reach their twilight years, the need for biopsy needles to diagnose and treat ailments will only soar.

Biopsy Needle Market Share

Some of the leading companies in the global biopsy needle market include

- Becton

- Medtronic plc

- Boston Scientific Corporation

- FUJIFILM Holdings Corporation

- Dickinson & Company (BD)

- Becton

- Cardinal Health

- Hologic Inc

- Olympus Corporation

- Argon Medical Devices. Inc

- Devicor Medical Products, Inc.

- B. Braun Melsungen AG

- Cook Group Incorporated

- Stryker Corporation

- INRAD Inc.

These companies are focusing on the expansion of production and distribution across international borders. For instance, in January 2021, Hologic announced the acquisition of SOMATEX Medical Technologies GmbH, a leading company dedicated to developing markings for biopsy sites and localization technologies. In addition to enhancing the company's product portfolio, the acquisition provided the company with a stronger market position, helping the company grow.

Impact of the COVID-19 pandemic on biopsy needle market trends

Many industries and organizations, regardless of size, were negatively impacted by the COVID-19 pandemic, which had a substantial unfavorable influence on the global economy. Due to the start of the lockdown and the limitations enforced by authorities during the pandemic, the biopsy needle industry initially experienced a setback. The COVID-19 pandemic had a large financial impact on the healthcare sector, academic radiology departments, and radiology practices in April 2020. For instance, population breast screening programs in England ended in March 2020 as a result of the COVID-19 pandemic.

The biopsy needle market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD Million from 2018 to 2032 for the following segments

Click here to Buy Section of this Report

By Product

- Needle based biopsy guns

- Vacuum-assisted biopsy (VAB) devices

- Fine needle aspiration biopsy (FNAB) devices

- Core needle biopsy (CNB) devices

- Biopsy needles

By Application

- Cancer/tumor

- Breast

- Lung

- Prostate

- Colon

- Stomach

- Liver

- Rectum

- Cervix uteri

- Oesophagus

- Pancreas

- Leukaemia

- Other cancer

- Infectious diseases

- Autoimmune disorder

- Others

By End-use

- Hospitals

- Ambulatory surgical center

- Others

The above information is provided for the following regions and countries

- North America

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Others

- Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Others

- Middle East and Africa

- South Africa

- Saudi Arabia

- Others