U.S. Ophthalmic Sutures Market Size

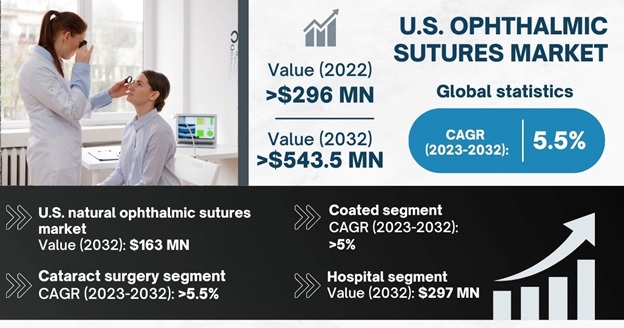

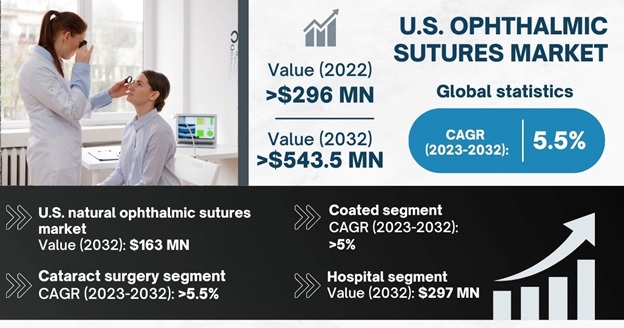

U.S. Ophthalmic Sutures Market Size was valued at more than USD 296 million in 2022 and is expected to observe a 5.5% CAGR through 2032. Growing prevalence of eye diseases in the U.S. is anticipated to expedite the market growth in the coming years.

Disorders such as cataract, glaucoma, and detached retina have added to the eye disease burden in the region. As per the National Eye Institute, around 24 million Americans are presently suffering from cataract and an estimated 38.7 million will be affected by the disease by 2030. Usually, surgeries are recommended to treat such severe eye diseases to improve vision. Hence, these diseases are contributing to the demand for ophthalmic suture products that provide optimum outcomes in related surgical procedures.

U.S. Ophthalmic Sutures Market Report Attributes

| Report Attribute |

Details |

| Base Year | 2022 |

|---|

| U.S. Ophthalmic Sutures Market Size in 2022 | USD 296.5 million |

|---|

| Forecast Period | 2023 to 2032 |

|---|

| Forecast Period 2023 to 2032 CAGR | 5.5% |

|---|

| 2032 Value Projection | USD 543.6 million |

|---|

| Historical Data for | 2018 to 2022 |

|---|

| No. of Pages | 90 |

|---|

| Tables, Charts & Figures | 74 |

| Segments covered | Type, Materials, Coating, Material Structure, Absorption, Application, End-use, and Region. |

|---|

| Growth Drivers | - Growing prevalence of eye disease

- Technological advancements

- Growing prevalence of diabetes leading to ophthalmic disorders

- Favorable government initiatives

- Growing demand and preference for minimally invasive surgeries

|

|---|

| Pitfalls & Challenges | - Postoperative complications associated with ophthalmic procedures

- Lack of skilled ophthalmologist

|

|---|

Postoperative complications associated with ophthalmic procedures to hamper U.S. ophthalmic sutures market progression

The postoperative complications related to ophthalmic surgeries may have a negative impact on the industry growth. Lack of proper training and essential expertise can be very risky for the patient undergoing surgery. The possible complications include bleeding, inflammation inside the eye, retinal detachment, infection, etc. According to the American Academy of Ophthalmology, immediate complications related to eye surgeries are allergic reactions to the antibiotic drop, discomfort and swelling of the eyelid, and increased intraocular pressure, among others.

U.S. Ophthalmic Sutures Market Analysis

U.S. natural ophthalmic sutures market share is expected to reach around USD 163 million through 2032. These sutures offer adequate strength, can perform self-degradation absorption, and possess non-irritating and carcinogenic characteristics. Moreover, these natural sutures are easy to produce at low cost along with mass production. Natural ophthalmic sutures are considerably recommended in related surgical procedures attributable to good absorption, strong pull, and support wound healing characteristics. Hence, the regional product demand will be influenced by these distinct product traits.

As a patient, you may not realize that the tiny stitches used in your surgery play a big role in your recovery. In the coming years, we can expect to see more of these stitches come with a special coating that makes them smoother, easier to use, and more resistant to infection. This coating helps the stitches slide through tissue more easily, which reduces friction and makes it less painful for you. It also makes the stitches more flexible, so they can conform to the shape of your body and provide better support. But that's not all. This coating can also be infused with antibiotics, which help prevent infections that can develop around the stitches. This is especially important for people who have a weakened immune system or who are at high risk of infection. So far, these coated stitches seem to be doing a pretty good job of keeping bad bacteria at bay. This means they have the potential to become powerful weapons in the fight against surgical site infections, which can be a serious problem.

The industry size from the cataract surgery segment is anticipated to record more than 5.5% CAGR through 2032. Growing occurrence of cataract disease is driving the market growth. For instance, in 2021, around 10,000 U.S. cataract surgeons performed around 4 million procedures in the U.S. Some of the key variables driving the market growth are rising accessibility to innovative technologies that boost the quality of cataract surgery coupled with the presence of board-certified skilled surgeons. Moreover, continuous advancements and development in ophthalmic sutures used in these procedures will positively impact the industry expansion.

U.S. ophthalmic sutures market share from the hospital segment held dominant market share in 2022 and is projected to touch USD 297 million through 2032. Increasing number of ophthalmic surgical procedures performed at hospital settings will foster the segmental progression. Moreover, surging number of patients that require critical care along with rising availability of better healthcare infrastructure will propel the market growth. The ease of access to a wide range of surgical treatments, medical evaluation for various ailments, and hygienic conditions in the country are some factors contributing to the industry progression.

U.S. Ophthalmic Sutures Market Share

Some prominent companies operating in the regional market include ;

- Medtronic

- Mani

- Corzamedical

- Teleflex Incorporated

- Ethicon

- B Braun Melsungen AG

- DemeTECH Corporation

These players are turning to various strategies for increased global presence. In June 2021, Ethicon announced the approval for the use of Ethicon Plus Sutures in surgeries within the National Health Service (NHS). These sutures provide antibacterial protection and are recommended as part of a bundle of care for preventing surgical site infection in the NHS for people that need wound closure after a surgical procedure. This recommendation represents a significant milestone for Ethicon and will help the company in strategically expanding into international markets.

COVID-19 Impact

The COVID-19 pandemic hit the eye surgery industry in the US hard in 2020. With the virus spreading like wildfire and people scared to get any medical treatment outside of emergencies, fewer people were getting eye surgeries. To make matters worse, the US government declared a national emergency and banned all non-essential surgeries, both in hospitals and clinics. It's estimated that over 4 million elective surgeries were canceled in just 12 weeks at the peak of the pandemic. This had a major impact on the growth of the eye surgery industry across the country.

U.S. ophthalmic sutures market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD Million from 2018 to 2032 for the following segments

Click here to Buy Section of this Report

By Type

By Material

- Nylon

- Polyproplene

- Silk

- PGA

- Others

By Coating

By Material Structure

- Monofilament

- Multifilament/Braided

By Absorption

- Absorbable

- Non-absorbable

By Application

- Cataract Surgery

- Corneal Transplantation Surgery

- Glucoma Surgery

- Vitrectomy

- Oculoplastic surgery

- Others

By End-use

- Hospitals

- Ambulatory Surgical Centers

- Others