Exercise Bands Market Size

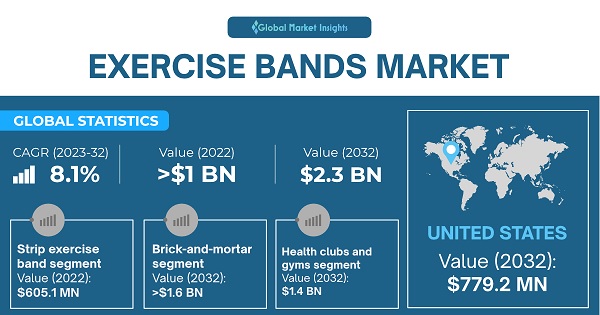

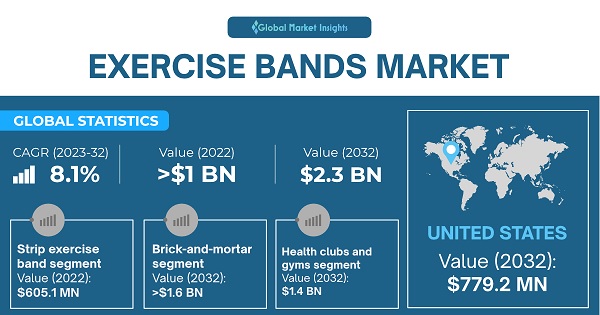

Exercise Bands Market size was valued at over USD 1 billion in 2022 and it is anticipated to reach around USD 2.3 billion by 2032. Growing popularity of online fitness programs, innovations and product development, increasing focus on fitness and wellness and rising awareness of physical and mental health benefits are among the key variables augmenting the industry growth.

Exercise bands are versatile tools that can be used by people of all fitness levels and ages. They offer a wide range of resistance levels, allowing users to adjust the intensity of their workouts. Additionally, exercise bands are accessible to a broader population, including those with limited mobility or injuries, making them an attractive option for rehabilitation and physical therapy purposes.

Exercise Bands Market Report Attributes

| Report Attribute |

Details |

| Base Year | 2022 |

|---|

| Exercise Bands Market Size in 2022 | USD 1 Billion |

|---|

| Forecast Period | 2023 to 2032 |

|---|

| Forecast Period 2023 to 2032 CAGR | 8.1% |

|---|

| 2032 Value Projection | USD 2.3 Billion |

|---|

| Historical Data for | 2018 to 2022 |

|---|

| No. of Pages | 190 |

|---|

| Tables, Charts & Figures | 356 |

| Segments covered | Product Type, Distribution Channel, End-use and Region |

|---|

| Growth Drivers | - Increasing awareness towards physical fitness

- Rising demand for patient rehabilitation

- Increasing adoption of at home physical practices and smart exercise bands

- Rise in number of gyms and fitness centers

|

|---|

| Pitfalls & Challenges | - Availability of counterfeit products

|

|---|

Moreover, compared to traditional gym equipment and weights, exercise bands are relatively inexpensive. They provide a cost-effective solution for individuals who want to incorporate strength training into their fitness routines without investing in expensive equipment. The affordability of exercise bands makes them accessible to a larger consumer base. Thus, such aforementioned factors are set to cumulatively drive the market progression.

Exercise bands, also known as resistance bands or fitness bands, are flexible bands made of rubber or latex that are used for strength training, stretching, and physical therapy exercises. They are versatile and lightweight, making them portable and convenient for use at home, the gym, or while traveling. These bands are commonly used in rehabilitation and physical therapy settings to aid in injury recovery and improve muscle strength and flexibility.

Lower durability, availability of counterfeit products and alternative fitness equipment, and safety concerns are among the several factors that are expected to hamper the market share. Improper technique, excessive stretching, or using bands with inappropriate resistance levels can lead to strain, muscle pulls, or even accidents. Additionally, some individuals may prefer traditional free weights, weight machines, or other gym equipment for their strength training needs. The availability and preference for these alternatives may impede the growth potential of the market.

COVID-19 Impact

The recent outbreak of COVID-19 had a negative impact on the exercise bands market revenue in 2020. Fitness facilities, including gyms, fitness studios, and rehabilitation centers, faced closures or restrictions during the pandemic. The disruption in these sectors had a negative impact on the demand for exercise bands for commercial purposes. Furthermore, manufacturers of exercise bands faced supply chain disruptions and operational challenges during the pandemic.

Further, the closure of retail stores and limitations on in-person shopping affected the sales of exercise bands through traditional brick-and-mortar channels. However, the demand for at-home fitness practices surged the product demand, thereby, contributing to market development. Further, the decline in number of COVID-19 cases allowed the reopening of physical fitness centers hence supporting to market expansion.

Exercise Bands Market Trends

During the COVID-19 pandemic, with gym closures and restrictions on outdoor activities, many individuals turned to at-home workouts to maintain their fitness routines. For instance, according to a survey conducted by RunRepeat in 2020, around 59% of respondents reported exercising at home more often during the pandemic. Hence, the convenience and accessibility of at-home workouts have driven the demand for home fitness equipment, including exercise bands.

Additionally, the smart exercise bands can track workout metrics such as heart rate, calories burned, and repetitions, providing users with data to monitor their progress and optimize their training. Smart exercise bands offer real-time feedback, personalized training programs, and the ability to connect with fitness apps or platforms, enhancing user engagement and motivation.

Exercise Bands Market Analysis

Based on product type, the exercise bands market is bifurcated into strip exercise band and tube exercise band. The strip exercise band segment accounted for major revenue share and was valued at around USD 605.1 million in 2022. Strip exercise bands are relatively simple to use, making them accessible to users of various fitness levels and ages. The user-friendly nature of strip exercise bands contributes to their popularity and widespread adoption. They are highly versatile and can be used for a wide range of exercises and workouts including strength training, stretching, resistance exercises, and rehabilitation purposes among others.

Based on distribution channel, the exercise bands market is segmented into E-commerce, and brick and mortar. The brick-and-mortar segment is anticipated to reach over USD 1.6 billion in 2032. Customers can visit the store, select the exercise bands of their choice, and make the purchase without waiting for shipping or delivery. Brick and mortar stores allow customers to physically inspect the exercise bands before making a purchase. These stores often have knowledgeable staff who can provide personalized assistance and guide customers in selecting the right exercise bands based on their fitness goals, fitness level, and specific needs.

Based on end-use, the exercise bands market is segmented into individual users, health clubs and gyms, and others. The health clubs and gyms segment is anticipated to reach around USD 1.4 billion in 2032. Exercise bands are well-suited for group fitness classes offered in health clubs and gyms. Instructors can incorporate exercise bands into various class formats such as Pilates, yoga, strength training, and boot camps among others. Exercise bands are generally more affordable compared to traditional gym equipment or machines.

Additionally, exercise bands are commonly used in rehabilitation programs and injury prevention exercises. Health clubs and gyms that provide rehabilitative services or cater to individuals with specific fitness needs can benefit from incorporating exercise bands into their offerings. Hence, owing to afore-mentioned pointers, the market is predicted to record healthy growth.

The U.S. is expected to reach around USD 779.2 million in 2032 in the global exercise bands market. The influence of social media platforms, fitness influencers, and online communities has contributed to the demand for exercise bands. Exercise bands offer a convenient and accessible solution for individuals looking to incorporate resistance training into their fitness routines. They are lightweight, portable, and can be easily used at home, in the gym, or while traveling.

Moreover, the rise in popularity of home workouts and online fitness programs, especially during the COVID-19 pandemic, has led to an increased demand for exercise bands. The growing awareness of the importance of physical fitness and overall wellness has driven the demand for exercise bands in the U.S.

Exercise Bands Market Share

Few of the leading players operating in the exercise bands market include

- Performance Health, LLC

- Black Mountain Products Inc.

- Decathlon SA

- Fit Simplify

- Perform Better Inc.

- Rougue Fitness

- Xtreme Bands

- Bodylastics International Inc.

The key market players are involved in developments including product launches, R&D related to materials of resistance bands and mergers and acquisition, among other strategies to further improve their revenue generating prospectus.

Exercise Bands Industry News

- In September 2021, Straffr, a German start-up focusing on smart fitness gears, launched its smart resistance band. It connects to the companion app via Bluetooth and starts tracking once the user start exercising. The real-time feedback allows user a better health related information. Such product development will enable company to improve its business prospects.

- In May 2021, TUT Fitness Group Limited received four patents from the U.S. Patent Office (USPTO) related to its application of resistance band technology to home gym equipment. This technology is suitable for the home fitness sector and can replace bulky & expensive heavy metal weights, allowing gym equipment designs to become smaller, more home-friendly and portable. This technology approval assisted the company in augmenting its revenue growth.

Exercise bands market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) and volume (Units) from 2018 to 2032, for the following segments

Click here to Buy Section of this Report

By Product Type, 2018 - 2032 (USD Million & Units)

- Strip exercise band

- Tube exercise band

By Distribution Channel, 2018 - 2032 (USD Million)

- E-commerce

- Brick and mortar

By End-use, 2018 - 2032 (USD Million)

- Individual users

- Health clubs and gyms

- Others

The above information is provided for the following regions and countries

- North America

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Poland

- Sweden

- The Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Indonesia

- Philippines

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Columbia

- Peru

- Chile

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Israel

- Iran