Circulating Tumor Cells (CTC) Market - By Technology (CTC Detection & Enrichment, CTC Direct Detection), Application (Research, Clinical), Product (Devices or Systems, Kits & Assays), End-use (Research & Academic Institutes) & Forecast 2023 - 2032

Published Date: August - 2024 | Publisher: MIR | No of Pages: 240 | Industry: Healthcare | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Sample Ask for Discount Request CustomizationCirculating Tumor Cells Market Size

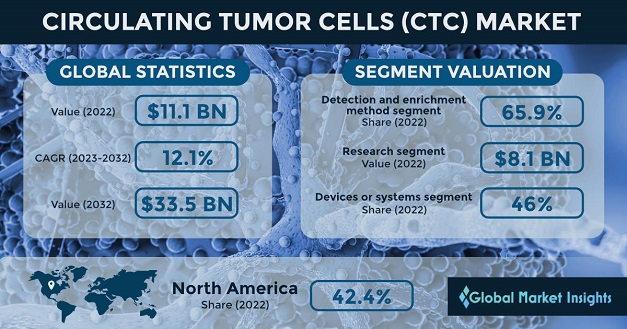

Circulating Tumor Cells Market size accounted for USD 11.1 billion in 2022 and is estimated to grow at a CAGR of 12.1% to reach USD 33.5 billion by 2032. The rising incidence of cancer across the globe has led to an increased demand for effective diagnostic and treatment solutions.

CTCs hold immense potential for early cancer detection, monitoring treatment response, and predicting disease progression. Also, advancements in technology and the development of innovative CTC detection and isolation techniques have greatly enhanced the accuracy and reliability of CTC-based diagnostics. Furthermore, the growing focus on personalized medicine and targeted therapies has created a need for precise and real-time information about tumor characteristics, that can be obtained through CTC analysis. Therefore, the integration of CTC-based assays in clinical trials and the increasing adoption of liquid biopsy approaches in routine cancer care are further fuelling the market growth.

Circulating Tumor Cells (CTCs) are cancer cells that have detached from a solid tumor and entered the bloodstream or lymphatic system. These cells can travel through the circulatory system to distant parts of the body, potentially leading to the formation of secondary tumors, known as metastases, in other organs or tissues.

| Report Attribute | Details |

|---|---|

| Base Year | 2022 |

| Circulating Tumor Cells (CTC) Market Size in 2022 | USD 11.1 Billion |

| Forecast Period | 2023 to 2032 |

| Forecast Period 2023 to 2032 CAGR | 12.1% |

| 2032 Value Projection | USD 33.5 Billion |

| Historical Data for | 2018 to 2022 |

| No. of Pages | 350 |

| Tables, Charts & Figures | 63,734 |

| Segments covered | Technology, Application, Product, Specimen, End-use, and Region |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

COVID-19 Impact

The COVID-19 pandemic had a significant impact on the circulating tumor cells market. The pandemic caused disruptions in healthcare systems worldwide, leading to delays in cancer screenings, diagnosis, and treatment. This, in turn, affected the demand for CTC-based tests and technologies. Moreover, restrictions on non-essential medical procedures and reduced patient visits to healthcare facilities resulted in a decline in the adoption of CTC-based assays.

Additionally, the financial constraints faced by healthcare institutions and the prioritization of resources towards COVID-19-related care further impacted the market. However, as the world gradually recovered from the pandemic, the CTC market is expected to regain momentum as the importance of early cancer detection and personalized treatment strategies becomes increasingly recognized.

Circulating Tumor Cells Market Trends

The rise in cancer cases worldwide is a concerning trend, but it has also opened up a significant market opportunity for companies developing cancer diagnostics and monitoring tools. According to the American Cancer Society, there were nearly 2 million new cancer cases in the United States alone in 2022, and over 600,000 deaths. As the number of people living with cancer increases, so does the need for better ways to detect, monitor, and treat it. One area of particular interest is CTC-based assays and technologies. CTCs are cells that have been shed from tumors and can be found in the bloodstream. They are a valuable source of information about a patient's cancer, including the type of cancer, its stage, and its molecular profile. CTC-based technologies can be used to detect and enumerate CTCs, as well as to perform molecular characterization on them. This information can be used to guide treatment decisions, monitor the effectiveness of treatment, and develop new therapies. The growing interest in liquid biopsy approaches, such as CTC-based technologies, is also fueling the demand for these technologies. Liquid biopsies are less invasive than traditional tissue biopsies, and they can be repeated more frequently, making them a valuable tool for monitoring cancer patients in real time. As the number of cancer cases continues to rise, the market for CTC-based technologies is expected to grow significantly. Companies that are able to develop innovative products and solutions in this area will be well-positioned to capitalize on this opportunity.

Circulating Tumor Cells Market Restraint

Limited awareness and adoption of CTCs can hamper the market expansion. Due to various factors such as lack of awareness among healthcare professionals, limited availability of CTC-based tests, and high costs associated with their implementation, many healthcare providers and patients remain unaware of the benefits and potential applications of CTC technology. This lack of awareness and understanding has hindered the widespread adoption of CTC-based diagnostics and therapies, thereby hindering the growth and development of the market.

Circulating Tumor Cells Market Analysis

Technology has led to breakthroughs in the study of Circulating Tumor Cells (CTCs), which hold valuable information about cancer. This technology can be broadly categorized into1. CTC Detection and Enrichment Methods These methods help isolate CTCs from a patient's blood sample. They can be further divided into immunocapture (using specific antibodies), size-based separation, density-based separation, or a combination of these methods. 2. CTC Direct Detection Methods These methods directly detect CTCs without prior enrichment. 3. CTC Analysis Once CTCs are detected or enriched, they can be analyzed at the cellular level to uncover important information about tumor characteristics, such as its spread and resistance to treatment. The CTC Detection and Enrichment segment dominated the market in 2022, accounting for over 65% of revenue. This is primarily due to the ability of these methods to provide insights into tumor diversity, spread, and resistance, guiding personalized treatment decisions. They enable researchers and doctors to study CTCs up close, leading to a better understanding of cancer biology and the development of targeted therapies.

Moreover, CTCs offer a non-invasive alternative to traditional tissue biopsies, allowing regular monitoring of disease progression and enabling the early detection of tumor metastasis. With several ongoing advancements in CTC detection technologies along with aforementioned advantages, the segment is anticipated to witness high growth over the forecast period.

CTCs (circulating tumor cells) are like microscopic spies, floating in our blood, that can tell us a lot about cancer. That's why they're used in two main waysresearch and treating cancer. In research, CTCs are like little detectives, helping scientists understand how cancer starts and grows. They've also become super important in testing out new drugs and treatments. In fact, this research segment was worth a whopping $8.1 billion in 2022! CTCs are also real lifesavers in the clinic. Because they can tell us how a cancer is responding to treatment, doctors can keep a close eye on patients and make changes as needed. And since CTCs can catch signs of cancer spreading early on, it means doctors can intervene faster, helping patients live longer, healthier lives. With all the exciting discoveries being made about CTCs and their role in cancer research, we can expect even more advancements in the future.

When it comes to circulating tumor cells (CTCs), the market is divided into three main types of productsdevices or systems, kits & assays, and consumables. In 2022, devices and systems took the biggest slice of the market, accounting for a whopping 46%. And they're only expected to keep growing over the next few years. This surge in popularity is all thanks to how helpful these devices and systems are in finding CTCs. They're being used more and more to diagnose cancer, figure out how it's progressing, and keep an eye on how well treatment is working. And it's all because they're so good at finding CTCs in blood samples. These devices and systems are sensitive, specific, and efficient, meaning they can spot and capture CTCs even when there aren't many of them. They're also easy to use, can handle large samples, and work well with other equipment. No wonder they're becoming so popular!

Based on specimen, the circulating tumor cells market is categorized into blood, bone marrow, and other body fluids. The blood segment held highest market share of 47.6% in 2022. Blood is the most widely used for detecting and analysing circulating tumor cells (CTCs). As CTCs are shed into the bloodstream by tumors, blood samples offer a non-invasive means to capture these cells, providing valuable insights into cancer progression and treatment response.

Moreover, blood is an ideal source for early detection and monitoring of metastasis. The relatively high concentration of CTCs in blood samples compared to other bodily fluids further enhances their detection, facilitating detailed genetic and molecular analysis to guide personalized treatment strategies. Therefore, high utilization of blood for studying CTCs is anticipated to promote high segment progression.

Based on end-use, the circulating tumor cells market is categorized into research and academic institutes, hospital and clinics, and diagnostic centers. The research and academic institute segment held considerable market share in 2022. Growing utilization of CTCs in research and academic institutes for cancer related research is enhancing the segment growth. Similarly, growing cases of cancer globally is surging the demand for research, thereby supplementing the segmental revenue.

North America circulating tumor cells market accounted for 42.4% business share in 2022 and is anticipated to grow at a considerable growth rate during the forecast timeframe. Increasing prevalence of cancer in the region coupled with advancements in diagnostic technologies as well as rising awareness among healthcare professionals has contributed to the flourishing CTCs market. Also, robust healthcare infrastructure, coupled with significant investments in research and development, has paved the way for innovative CTC detection and analysis techniques.

Moreover, the region's strong emphasis on precision medicine and targeted therapies has further accelerated the demand for CTC-based diagnostics and monitoring tools. Further, with a growing number of pharmaceutical companies and biotechnology firms actively engaged in CTC research, North America continues to be a key hub for advancements in this field, thereby driving the regional market demand.

Circulating Tumor Cells Market Share

Major market players operating in the circulating tumor cells market include

- Thermo Fisher Scientific Inc.

- QIAGEN

- Precision for Medicine

- BIOCEPT, Inc.

- Fluxion Biosciences, Inc.

- Greiner Bio One International GmbH

- Ikonisys Inc.

- Miltenyi Biotec

- IVDiagnostics

- BioFluidica

- Biolidics Limited

- Creativ MicroTech, Inc.

- LungLife AI, Inc.

- Rarecells Diagnostics

- ScreenCell

- Sysmex Corporation

- STEMCELL Technologies, Inc.

These industry players majorly adopt various strategies including collaborations, acquisitions, mergers, and partnerships to create a global footprint and sustain market competition.

Circulating Tumor Cells Industry News

- In November 2019, Biolidics signed a definitive agreement with Sysmex for the joint development of laboratory-developed tests (LDT) to diagnose cancer. This strategy helped the two companies combine their technologies and aid in the development of novel products.

- In March 2018, Biocept and Thermo Fisher Scientific entered a technology and commercial collaboration. This strategy helped the companies to develop best-in-class products by integrating Biocept's Target Selector technology with Thermo Fisher's Ion Torrent NGS platform and Oncomine liquid biopsy-based NGS panels. Thus, helping the two players to widen their product offerings.

The circulating tumor cells market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2018 to 2032, for the following segments

Click here to Buy Section of this Report

By Technology

- CTC Detection and Enrichment Method

- Immunocapture

- Positive Selection

- Negative Selection

- Size-based Separation

- Membrane-based

- Microfluidic-based

- Density-based Separation

- Combined Methods

- Immunocapture

- CTC Direct Detection Methods

- SERS (Surface-enhanced Raman Spectroscopy)

- Microscopy

- Other Direct Detection Methods

- CTC Analysis

By Application

- Research

- Cancer Stem Cell & Tumorogenesis Research

- Drug/Therapy Development

- Clinical

- Screening and Monitoring

- Risk Assessment

By Product

- Devices or Systems

- Kits & assays

- Consumables

By Specimen

- Blood

- Bone Marrow

- Other Body Fluids

By End-use

- Research and Academic Institutes

- Hospital and Clinics

- Diagnostic Centers

The above information is provided for the following regions and countries

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- Rest of MEA

Related Reports

- Pet Mobility Aids Market – By Product (Wheelchairs, Harnesses & Slings, Splints & Braces, Ramps & Steps, Prosthetics),...

- North America Seasoning Market Size - By Type (Oregano, Paprika, Ginger, Cinnamon, Cumin, Turmeric, Garlic, Cardamom, Co...

- Veterinary Endoscopes Market – By Product Type (Flexible [Video, Fibre-optic], Rigid), Procedure Type (Gastroduodenosc...

- Pet Wearable Market Size - By Product (Smart Collar, Smart Vest, Smart Harness, Smart Camera), By Technology (RFID Devic...

- Swine Artificial Insemination Market – By Product & Service (Semen {Fresh, Frozen}, Insemination Instruments {Catheter...

- Pet Tech Market - By Product (Pet Wearables, Smart Pet Crates & Beds, Smart Pet Doors, Smart Pet Feeders & Bowls, Smart ...

Table of Content

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

List Tables Figures

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy