Lyophilization Equipment Market Size

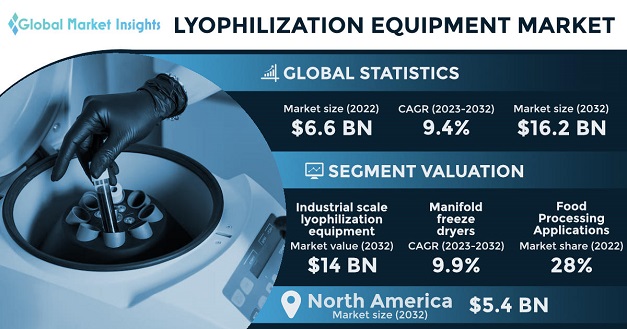

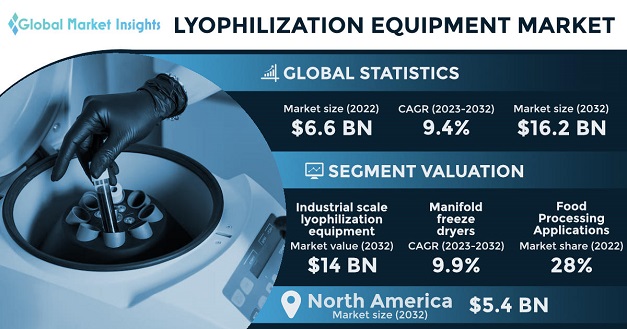

Lyophilization Equipment Market size reached USD 6.6 billion in 2022 and is projected to depict 9.4% CAGR from 2023-2032, driven by higher demand from the pharmaceutical and food processing sectors.

The growing emphasis on the development of biopharmaceuticals will drive the market expansion. In recent years, the rising popularity of protein-based medications has compelled pharmaceutical companies to come up with novel products using lyophilization to prepare samples. Processes, such as freeze-drying offer special preservation abilities in a wide range of applications. The increasing usage of lyophilizers in food preservation activities to extend shelf life, preserve vital nutrients, and improve flavour of natural food products, including vegetables, fruits, meats, and coffee will boost the market share

Lyophilization Equipment Market Report Attributes

| Report Attribute |

Details |

| Base Year | 2022 |

|---|

| Lyophilization Equipment Market Size in 2022 | USD 6.6 Billion |

|---|

| Forecast Period | 2023 to 2032 |

|---|

| Forecast Period 2023 to 2032 CAGR | 9.4% |

|---|

| 2032 Value Projection | USD 16.2 Billion |

|---|

| Historical Data for | 2018 to 2022 |

|---|

| No. of Pages | 140 |

|---|

| Tables, Charts & Figures | 245 |

| Segments covered | Product, Scale of Operation, Application, and Region |

|---|

| Growth Drivers | - Rising demand for lyophilized products

- Technological advancements in lyophilization technique

- Rapid expansion of pharmaceutical and food industry

- Growing demand for superior products with longer shelf life and stability

|

|---|

| Pitfalls & Challenges | - High setup and maintenance cost of freeze-drying equipment

- Lack of skilled workforce

|

|---|

The rising cost of lyophilization devices is one of the primary factors limiting the market progress. Though freeze-drying equipment has high commercial value, the expensive nature of this technology makes its outsourcing more popular than investing in brand-new and expensive equipment. Moreover, the procedure requires additional labor and time since the material containers must be thoroughly cleaned before the new target material is added. The rising concerns associated with the affordability of lyophilization equipment by new entrants or small businesses is also posing as a restraint for the industry development.

COVID-19 Impact

The COVID-19 pandemic had favourable effect on the lyophilization equipment market on account of the strong demand from pharmaceutical and biotechnology firms for diagnosis, treatment, and prevention. The growing focus of these companies on the development of freeze-drying technologies led to the increased production of high-performance medicines with streamlined processes. Along with traditional techniques, the rising technical advances in lyophilization equipment for the ease of production, distribution, and handling of vaccines contributed to the industry expansion.

Lyophilization Equipment Market Trends

The influx of technological innovations for increasing the scalability and quality of finished products along with the development of innovative lyophilization tools and processes are projected to boost the market size. For instance, a modern tray freeze drier was introduced for preserving the quality of food and biological reagents via primary and secondary freeze-drying for allowing the product to remain frozen in place. The advent of such cutting-edge technologies is expected to favor the market outlook.

Lyophilization Equipment Market Analysis

Based on product, the lyophilization equipment market size from the manifold freeze dryers segment is expected to observe 9.9% CAGR from 2023-2032. The substantial segment growth can be attributed to the increasing usage of these freeze dryers to produce active pharmaceutical ingredients. Manifold freeze dryers are largely deployed due to their advantages, such as cost-effectiveness and ease of operation. Moreover, the growing demand for personalized medicine, diagnostic kits, and specialty food products will propel the market trends.

On the basis of scale of operation, the industrial scale lyophilization equipment market size is anticipated to amass USD 14 billion by 2032. Industrial-scale freeze dryers are largely deployed by large-scale enterprises for the mass manufacturing of freeze-dried items. On account of their excellent efficiency, these lyophilization equipment witness widespread usage in the pharmaceutical and food industries. Furthermore, rising utilization in biotechnology applications will drive the segment growth.

Application wise, the food processing segment held 28% share of the lyophilization equipment market in 2022 and is anticipated to witness notable CAGR from 2023-2032 owing to the surging customer demand for ready-to-eat foods. The expanding rate of urbanization has steered the higher consumption of preserved foods worldwide. Lyophilization has emerged as a popular technique among food processors owing to the increased usage of freeze dryers in the production of coffee and tropical fruits. Consequently, the rapidly growing target population will accelerate the segment demand.

North America held 34% share of the lyophilization equipment market in 2022 and is estimated to reach USD 5.4 billion by 2032. Rising healthcare expenditure, vigorous R&D efforts, and innovations in biopharmaceutical manufacturing are some of the main factors driving the regional market expansion. Additionally, the strong focus of leading local companies on the development of innovative lyophilization equipment techniques to boost revenue sales will strengthen the industry outlook.

Lyophilization Equipment Market Share

Some of the leading firms operating in the lyophilization equipment market are

- GEA Group

- Labconco

- Telstar

- HOF Sonderanlagenbau GmbH

- Buchi

- Millrock Technology Inc.

- Scala Scientific and ZIRBUS Technology GmbH

These firms are taking constant efforts and making investments in marketing, new product launches, and strategic alliances for increased global presence.

Lyophilization Equipment Industry News

- In February 2022, GEA received a third agreement from Pol, a prominent food maker, to supply and install freeze-drying equipment called RAY® at the latter’s 4,000 m2 fruit and vegetable freeze-drying facility in Turkey.

The lyophilization equipment market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD Million from 2018 to 2032 for the following segments

Click here to Buy Section of this Report

Market Size, By Product

- Tray-style freeze dryers

- Manifold freeze dryers

- Rotary freeze dryers

Market Size, By Scale of Operation

- Bench-top lyophilization equipment

- Pilot-scale lyophilization equipment

- Industrial scale lyophilization equipment

Market Size, By Application

- Pharmaceutical

- Biotechnology

- Biomedical

- Food processing

- Others

The above information is provided for the following regions and countries

- North America

- Europe

- Germany

- France

- UK

- Spain

- Italy

- The Netherlands

- Sweden

- Poland

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey