Panty Liners Market Size

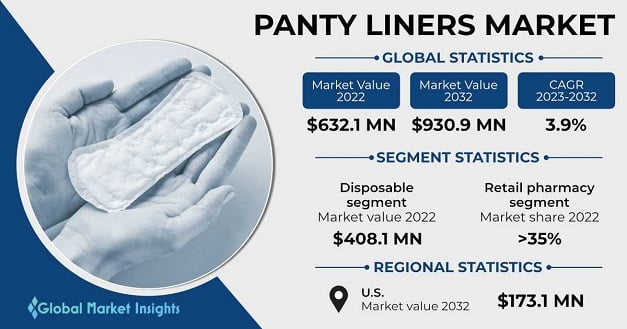

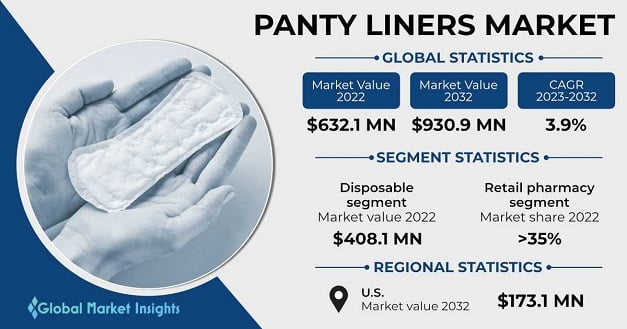

Panty Liners Market size was valued at USD 632.1 million in 2022 and is projected to reach at USD 930.9 million by 2032. Panty liners are thin absorbent pads that are worn in the underwear to provide protection against daily vaginal discharge, light menstrual flow, or as a backup for tampons, menstrual cups, or period panties.

Moreover, the growing awareness regarding feminine hygiene is further augmenting the market trends. Factors such as increasing disposable income, urbanization, and rising awareness about personal hygiene have contributed to the expansion of the market. In addition, with changing lifestyles, women are becoming more active and on-the-go, leading to an increased need for convenient and discreet feminine hygiene solutions. Panty liners offer a practical option for managing everyday vaginal discharge or light menstrual flow.

Hey there! You know those super important conversations and campaigns about women's health and hygiene? Well, they're a huge reason why people are buying more panty liners these days. These campaigns are all about breaking down those old-fashioned ideas about what we should and shouldn't talk about when it comes to feminine hygiene. They're helping women understand their bodies better and take care of themselves. For example, Carefree's "Fresh is Fierce" campaign is all about how panty liners make you feel confident and fresh. It's a reminder that taking care of yourself is important, and that includes taking care of your "down there" area. All these efforts are making a big difference in how people think about panty liners. They're no longer seen as just something for your "special time" but as a way to feel clean and comfortable every day. And that's only going to make the market for panty liners grow even bigger in the future.

Panty Liners Market Report Attributes

| Report Attribute |

Details |

| Base Year | 2022 |

|---|

| Panty Liners Market Size in 2022 | USD 632.1 Million |

|---|

| Forecast Period | 2023 to 2032 |

|---|

| Forecast Period 2023 to 2032 CAGR | 3.9% |

|---|

| 2032 Value Projection | USD 930.9 Million |

|---|

| Historical Data for | 2018 to 2022 |

|---|

| No. of Pages | 200 |

|---|

| Tables, Charts & Figures | 290 |

| Segments covered | Type, Distribution Channel, and Region |

|---|

| Growth Drivers | - Rapid urbanization and growing literacy rate among women

- Increasing government initiatives towards female hygiene

- Novel product launches related to panty liners

- Rising awareness regarding organic panty liners

|

|---|

| Pitfalls & Challenges | - Social challenges associated with panty liners in developing countries

- Lack of awareness regarding panty liners

|

|---|

COVID-19 Impact

COVID-19 significantly impacted the world economy and negatively affected almost every industry including the Femtech industry and several other organizations as a whole, irrespective of its size. Initially, the market suffered a setback due to the commencement of the lockdown and stringent regulations imposed by authorities during the lockdown. Due to a shortage of both non-essential and emergency medical supplies, the pandemic caused chaos in the entire medical sector. In addition, the worldwide supply chain was disrupted, impacting the production and shipping of panty liners.

Moreover, change in the consumers’ buying patterns were observed since they were unable to purchase panty liners from hospital or retail pharmacies owing to monetary and mobility constraints during the pandemic. Further, covid-19 also disrupted new product launches, which caused a negative impact on the regulatory approval of new products. However, the increasing adoption of environment friendly panty liners and the rising sales through online pharmacies countered the negative impact which the COVID-19 pandemic initially had on the market value.

Panty Liners Market Trends

The growing urbanization among countries of developing nations across the world is one of the primary factors propelling the market progression. The primary goal of all countries is to promote feminine health and hygiene, reproductive health, gender equality, among others. The World Banks’s Water Global Practice is collaborating with countries of all nations to include menstrual health and hygiene in water-related projects.

For instance, the Rural Water, Sanitation and Hygiene for Human Capital Development Project in Bangladesh aims to eradicate stigma associated with women buying various menstrual products including panty liners and promotes women empowerment. In addition, the World Bank also supports underdeveloped countries by providing them access to affordable menstrual hygienic products and encourages local businesses to further distribute these products.

Panty Liners Market Analysis

Based on type, the panty liners market is segmented into disposable and reusable. The disposable segment witnessed the largest revenue size at USD 408.1 million in 2022. Disposable panty liners offer convenience and ease of use. They are pre-packaged and individually wrapped, making them portable and easily accessible for on-the-go use. Once used, they can be conveniently disposed of, eliminating the need for washing or carrying used liners.

Moreover, disposable panty liners provide a hygienic solution for managing vaginal discharge, light menstrual flow, or as a backup for other menstrual products. They are designed to be used once and then discarded, reducing the risk of bacterial growth or infections that may occur with prolonged use of reusable products. Furthermore, disposable panty liners are thin and discreet, allowing for comfortable wear without bulkiness. They can provide a sense of confidence and protection without being noticeable under clothing.

The panty liners market is segmented by distribution channel into retail pharmacy, hospital pharmacy, e-commerce channels, brick & mortar, and supermarket/hypermarket. Retail pharmacy segment dominated the global market accounting for more than 35% business share in 2022. The demand for this segment will substantially increase due to the several advantages it offers such as personalized medical advice to customers, convenience, easy accessibility of products as well as other household items. Moreover, the growing awareness regarding menstrual disorders among the female population base is further augmenting the segment trends.

U.S. panty liners market will grow momentously to reach USD 173.1 million by 2032. The affordability of panty liners among the target population base and ongoing technological developments are primarily responsible for the growth of the U.S. market size. Further, the region's high healthcare spending on health care management and rising disposable income will propel the expansion of the North America market. Also, the substantial presence of well-established market participants and the favourable regulatory environment result in a number of product approvals and launches, particularly in the U.S.

Panty Liners Market Share

Some of the notable key industry players operating in the panty liners market include

- Procter & Gamble

- Kimberly-Clark Corporation

- Edgewell Personal Care Company

- Hengan International Group Company Limited

- Kao Corporation

- Johnson & Johnson

- Unicharm Corporation

- Daio Paper Corporation

- Essity Aktiebolag

- Ontex

- First Quality Enterprises Inc

These market participants are implementing various growth strategies such as collaborations, partnerships, acquisitions & mergers, and new product development and launches to strengthen type offerings as well as gain a competitive edge over others.

Panty Liners Industry News

- In October 2022, P&G's Always launched “50 Period Heroes” team to expand their work to help #EndPeriodPoverty initiative across the U.S. This period heroes represent organizations and people in each of the 50 states of the U.S. as well as enable access to period product to young people. Such initiatives offered awareness regarding female hygiene.

- In January 2021, Essity launched absorbent panties for incontinence and menstruation. Essity has launched several panty liners under brands such as Bodyform, Nosotras, and Libresse. Such product launches are anticipated to augment industry expansion.

Panty liners market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2018 to 2032 for the following segments

Click here to Buy Section of this Report

Market Size, By Type (USD Million)

Market Size, By Distribution Channel (USD Million)

- Retail pharmacy

- Hospital pharmacy

- E-commerce channels

- Brick & mortar

- Supermarket/hypermarket

The above information is provided for the following regions and countries

- North America

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Russia

- Poland

- Switzerland

- Norway

- Finland

- Sweden

- Denmark

- The Netherlands

- Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Taiwan

- Indonesia

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Israel