Ultrasound Needle Guides Market Size - By Type (Disposable Needle Guides, Reusable Needle Guides), By Application (Tissue Biopsy, Fluid Aspiration, Vascular Access Procedures, Nerve Block and Regional Anesthesia), By End-use – Global Forecast 2023-2032

Published Date: August - 2024 | Publisher: MIR | No of Pages: 240 | Industry: Healthcare | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Sample Ask for Discount Request CustomizationUltrasound Needle Guides Market Size

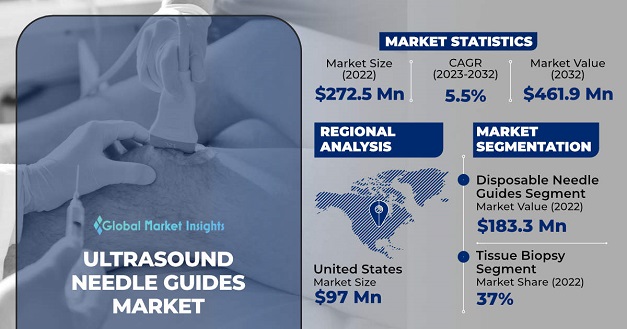

Ultrasound Needle Guides Market size was valued at USD 272.5 million in 2022 and is estimated to account for USD 461.9 million by 2032 owing to growing preference for minimally invasive biopsies.

Imagine a tool that's like a GPS for doctors, making it easier for them to perform biopsies with greater accuracy. It's called an ultrasound needle guide, and it works by providing a clear path for the biopsy needle. As ultrasound technology improves, doctors have a better view of the body and the needles they're using. This has made biopsies safer and more accurate. With today's advanced ultrasound systems, doctors can see live images and 3D scans, which helps them precisely determine where to insert the needle. That's where ultrasound needle guides come in. They show doctors a clear route for the needle, making biopsies more precise and reducing the chances of complications. As ultrasound technology continues to advance, the need for these guides is growing, helping doctors provide better care for their patients.

As the prevalence of life-threatening diseases like cancer, heart conditions, and organ failures rises, we desperately need more effective ways to detect them early. This is where biopsies, particularly ultrasound-guided biopsies, are playing a crucial role. In the United States alone, doctors predict over 1.9 million new cancer cases and a staggering 600,000 cancer-related deaths this year. Heart disease, especially heart attacks and strokes, claims the lives of approximately 18 million people worldwide annually. Alarmingly, many of these fatalities occur in people under the age of 70. With so many lives at stake, the demand for rapid and precise biopsies has never been greater. That's why doctors are increasingly turning to ultrasound-guided biopsies. This technique allows them to visualize the inside of the body using sound waves and obtain tissue samples from suspicious areas without resorting to surgery. As a result, the demand for ultrasound needle guides, essential tools in these biopsies, is skyrocketing.

Additionally, ultrasound imaging is gaining widespread adoption as a diagnostic tool for various medical procedures, including biopsies. Ultrasound-guided biopsies provide real-time visualization of the target area, allowing healthcare providers to precisely locate and sample tissues or cells of interest. Therefore, these driving factors highlight the industry's focus on improving diagnostic accuracy, patient experience, and procedural outcomes. With continuous advancements in technology and a growing emphasis on precise tissue diagnostics, the ultrasound needle guides market is estimated to witness sustained growth in the projected years.

| Report Attribute | Details |

|---|---|

| Base Year | 2022 |

| Ultrasound Needle Guides Market Size in 2022 | USD 272.5 Million |

| Forecast Period | 2023 to 2032 |

| Forecast Period 2023 to 2032 CAGR | 5.5% |

| 2032 Value Projection | USD 461.9 Million |

| Historical Data for | 2018 to 2022 |

| No. of Pages | 254 |

| Tables, Charts & Figures | 359 |

| Segments covered | Type, Application, End-use and Region |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

COVID-19 Impact

The COVID-19 pandemic initially had a negative impact on the ultrasound needle guides market, leading to a decline in demand due to delayed and cancelled procedures. However, as the situation progressed, the market experienced a boost. For instance, the increased focus on non-invasive procedures, driven by the contagious nature of the virus, created an opportunity for ultrasound-guided biopsies and subsequently, ultrasound needle guides.

Furthermore, the accelerated adoption of telemedicine opened avenues for remote guidance of procedures, potentially increasing the utilization of ultrasound needle guides. Moreover, the heightened emphasis on infection control measures highlighted the importance of sterile and single-use devices like needle guides, driving their demand. As healthcare services recovered and adapted to the changing landscape, the market for ultrasound needle guides regained momentum and catered to the need for accurate and minimally invasive biopsy procedures.

Ultrasound Needle Guides Market Trends

"Minimally invasive surgeries are the new hot thing in the medical world because they're miles better than those old-fashioned surgeries with big cuts. These surgeries involve tiny punctures, which means less pain, fewer risks, and patients can bounce back faster. Everyone is raving about these minimally invasive surgeries, and that's where ultrasound needle guides come in. They're like little GPS devices for needles, ensuring they find the exact spot during biopsies. This means better accuracy, reduced pain, and a quicker recovery. Hey, did you know that these surgeries can actually save hospitals and clinics some money? It's a double win! With all the perks, it's clear that minimally invasive procedures, like the ones using ultrasound-guided needles, are going to become even more popular down the road."

Ultrasound Needle Guides Market Analysis

The ultrasound needle guides market by type is categorized into disposable needle guides, and reusable needle guides. The disposable needle guides segment garnered USD 183.3 million revenue size in the year 2022. Disposable needle guides provide convenience and efficiency by eliminating the need for cleaning and sterilization, streamlining workflow, and saving time. Improved infection control is achieved through their single-use nature, reducing the risk of cross-contamination and infections. Furthermore, suitability for point-of-care settings, with simplified setup and ease of use, makes them ideal for clinics and smaller healthcare facilities.

Overall, the demand for disposable needle guides is driven by their convenience, improved infection control, cost-effectiveness, regulatory compliance, and suitability for various healthcare settings. Therefore, disposable needle guides are a pivotal driving factor in the market, offering various advantages and propelling the market trends.

Imagine you're in a store filled with tools to help doctors pierce the skin with needles during medical procedures. These tools come in all shapes and sizes, each designed for a different purpose. One type of tool is used for taking tiny samples of tissue for testing, like checking for cancer. These tools are super popular - in fact, they made up over a third of all tools sold last year! They're expected to become even more popular in the future. Another type of tool helps doctors drain fluids from the body, like removing pus from an infection. There are also tools that make it easier to access blood vessels for injections. And there are tools that help numb areas of the body for surgery. The most popular tools are the ones used for taking tissue samples. Why? Because they allow doctors to see exactly where they're taking the sample, making the procedure safer and more accurate. As technology advances and more people need these types of procedures, the demand for these specialized tools will only continue to grow.

Furthermore, technological advancements in ultrasound imaging improve the effectiveness and precision of the biopsy procedure, making ultrasound-guided biopsies a preferred choice for tissue sampling. These factors collectively drive the growth of the market in the tissue biopsy application segment.

Based on end-use, the ultrasound needle guides market is segmented into hospitals & clinics, ambulatory surgical centers, and others. The hospitals and clinics segment accounted for over 64.4% business share in the year 2022 and is anticipated to witness the highest growth during the forecast period. Hospitals and clinics serve as a crucial driving force in the market, with several factors interrelating to propel market growth. High procedure volume stems from the diverse range of diagnostic and interventional procedures performed within facilities. This volume creates a consistent demand for ultrasound needle guides.

Additionally, hospitals and clinics are equipped with advanced imaging facilities, including ultrasound machines, which are extensively utilized for procedures such as ultrasound-guided biopsies. This reliance on ultrasound technology drives the need for needle guides to ensure accurate and precise needle placement. Further, increasing disposable spending in developed nations will contribute considerably towards the adoption of ultrasound needle guides in hospitals thereby leading to segment expansion.

U.S. ultrasound needle guides market accounted for USD 97 million revenue size in 2022 and is predicted to witness substantial market growth over the analysis timeline. Increasing geriatric population base along with the rising incidence of cancer in the country will drive the U.S. market trends. For instance, as per the American Cancer Society, in 2021, it was estimated that over 1.9 million new cancer patients were diagnosed and around 608,570 cancer patient’s deaths in the U.S. Thus, the rising prevalence rate of numerous chronic disorders will contribute to the market revenue.

Moreover, growing awareness regarding remote patient monitoring devices for improved accuracy, portability, connectivity, and user-friendly interfaces will boost the market adoption rate. The increasing number of surgical procedures, advancements in technology, and the strong presence of industry players are few factors are estimated to boost overall market share.

Ultrasound Needle Guides Market Share

Some of the eminent market participants operating in the ultrasound needle guides market include

- Siemens Healthineers

- CIVCO Medical Solutions

- Bard Access Systems (now part of BD)

- Cook Medical

- Biopsy Sciences

- Aspen Surgical

- CIVCO AIROS

- Veran Medical Technologies

- Innovative Trauma Care

- Besmed

- PBN Medicals

These market players are undertaking several growth strategies including partnerships, collaborations, acquisitions & mergers, and new product development & launches to strengthen their product portfolio as well as gain a competitive edge over others.

Ultrasound Needle Guides Industry News

- In April 2022, Audax Private Equity's investment in Aspen Surgical provided substantial support as Aspen pursued organic growth and pursued larger-scale acquisition opportunities. This investment played a crucial role in positioning Aspen as one of the leading global providers of single-use surgical products in acute care and surgical settings.

- In March 2021, Aspen Surgical expanded its portfolio of surgical disposables and patient and staff safety products in the acute care market through the acquisition of Bluemed Medical Supplies. The integration of BlueMed's offerings further strengthened Aspen's comprehensive range of products in these business areas.

Ultrasound needle guides market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2018 to 2032 for the following segments

Click here to Buy Section of this Report

By Type (USD Million & Units)

- Disposable needle guides

- Reusable needle guides

By Application (USD Million)

- Tissue biopsy

- Fluid aspiration

- Vascular access procedures

- Nerve block and regional anesthesia

- Others

By End-use (USD Million)

- Hospitals and clinics

- Ambulatory surgical centers

- Others

The above information is provided for the following regions and countries

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Switzerland

- The Netherlands

- Denmark

- Poland

- Sweden

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- New Zealand

- Thailand

- Vietnam

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Turkey

Related Reports

- Veterinary Assistive Reproduction Technology Market – By Type (Service, Semen, Instruments), Technology (Artificial In...

- Pet Monitoring Camera Market - By Product (Interactive Cameras, Standalone Cameras), By Distribution Channel (Online, Of...

- Pet Mobility Aids Market – By Product (Wheelchairs, Harnesses & Slings, Splints & Braces, Ramps & Steps, Prosthetics),...

- North America Seasoning Market Size - By Type (Oregano, Paprika, Ginger, Cinnamon, Cumin, Turmeric, Garlic, Cardamom, Co...

- Veterinary Endoscopes Market – By Product Type (Flexible [Video, Fibre-optic], Rigid), Procedure Type (Gastroduodenosc...

- Pet Wearable Market Size - By Product (Smart Collar, Smart Vest, Smart Harness, Smart Camera), By Technology (RFID Devic...

Table of Content

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

List Tables Figures

To get a detailed Table of content/ Table of Figures/ Methodology Please contact our sales person at ( chris@marketinsightsresearch.com )

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy