U.S. Peptide Therapeutics Market - By Type (Branded, Generic), By Application (Metabolic, Cancer, Cardiovascular, Gastrointestinal), By Route of Administration (Parenteral, Oral), By Distribution Channel (Hospital, Retail)- Forecast 2023 to 2032

U.S. Peptide Therapeutics Market - By Type (Branded, Generic), By Application (Metabolic, Cancer, Cardiovascular, Gastrointestinal), By Route of Administration (Parenteral, Oral), By Distribution Channel (Hospital, Retail)- Forecast 2023 to 2032

Published Date: July - 2024 | Publisher: MIR | No of Pages: 240 | Industry: Healthcare | Format: Report available in PDF / Excel Format

View Details Buy Now 2890 Download Free Sample Ask for Discount Request CustomizationU.S. Peptide Therapeutics Market Size

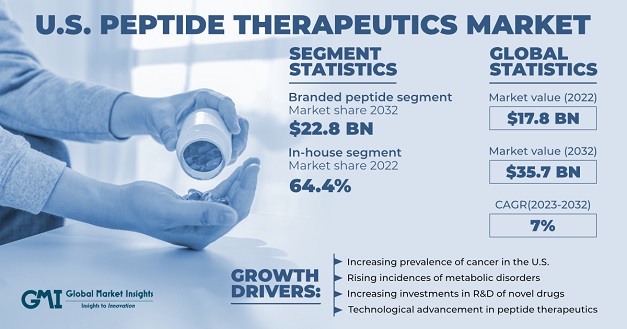

U.S Peptide Therapeutics Market was valued to be around USD 17.8 billion in 2022 and is projected to witness massive growth at a CAGR of around 7% from 2023 to 2032. The factors driving the market growth are increasing prevalence of chronic disorders, rising healthcare expenditure, technological advancements, and growing disposable income in the country.

Moreover, rising incidences of metabolic disorders, cancer, cardiovascular disorders, gastrointestinal disorders, and central nervous system disorders are increasing the demand for effective peptide therapeutics for such conditions.

Peptides consist of short chains of amino acids connected by peptide bonds. Peptide therapeutics serve as crucial replacement therapies that supplement peptide hormones when there are insufficient endogenous levels. Peptides bind to specific surface receptors and their ligands on cells, thus aiding in the treatment of diseases by influencing the cell membrane.

| Report Attribute | Details |

|---|---|

| Base Year | 2022 |

| U.S. Peptide Therapeutics Market Size in 2022 | USD 17.8 Billion |

| Forecast Period | 2023 to 2032 |

| Forecast Period 2023 to 2032 CAGR | 7% |

| 2032 Value Projection | USD 35.7 Billion |

| Historical Data for | 2018 to 2022 |

| No. of Pages | 140 |

| Tables, Charts & Figures | 82 |

| Segments covered | Type, Application, Route of administration, Manufacturer type, Synthesis technology, Distribution channel |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

COVID-19 Impact

The U.S. peptide therapeutics market saw moderate COVID-19 impact. Key players developed peptide-based COVID-19 treatments, leading to clinical trials for numerous vaccines. Supply chain disruptions caused shortages in peptide drug manufacturing. Pharmaceutical firms redirected resources to COVID-19 research, affecting peptide studies in universities and businesses. The pandemic accelerated telemedicine adoption, revealing supply chain vulnerabilities. Antiviral peptide demand rose for COVID-19 and future outbreaks. As COVID-19 cases declined, surgical care resumption and increased procedural volumes aided peptide therapeutics recovery, signalling market growth despite initial challenges.

U.S. Peptide Therapeutics Market Trends

As more and more people develop metabolic disorders, the demand for treatments is growing. These disorders, which include diabetes, obesity, and rare genetic conditions, affect how our bodies use energy. Diabetes, especially type 2 diabetes, is a major problem worldwide. It's often caused by a combination of inactivity, unhealthy eating, and genes. Drugs called peptide-based medications, like GLP-1 receptor agonists, have become important in helping people with diabetes control their blood sugar levels. In the United States alone, around 37.3 million people have diabetes, which is more than 11% of the population. Out of those, about 28.7 million have been diagnosed.

Overall, the demand for innovative and personalized treatments for metabolic disorders is fostering research and development efforts, ultimately leading to the creation of novel peptide-based therapies to address the unmet medical needs of patients with metabolic disorders.

U.S. Peptide Therapeutics Market Analysis

Based on type, the U.S. peptide therapeutic market is subdivided into branded and generic peptide. The branded peptide segment accounted for majority revenue share in 2022 and is expected to reach USD 22.83 billion by 2032. The largest share of this segment can be attributed to several factors, including the higher number of prescriptions for branded drugs, the perceived quality and efficacy of branded peptide therapeutics compared to generics, patient preferences for branded products, and insurance coverage.

Additionally, the market growth is driven by the efforts of pharmaceutical players to launch new drugs. Some of the prominent players in the peptide therapeutics market are focusing on expanding the application areas for their existing peptide therapeutics.

The U.S. market for peptide therapeutics is a big one, and it's growing fast. This is because peptides are being used to treat a wide range of conditions, including metabolic and endocrine disorders, cancer, cardiovascular disorders, gastrointestinal disorders, central nervous system disorders, respiratory disorders, pain, renal disorders, dermatology, and more. Of all these, metabolic and endocrine disorders made up the biggest chunk of the market in 2022. This is because these disorders, like diabetes, obesity, and lipid metabolism disorders, are incredibly common. And the market is growing because more and more people are being diagnosed with these conditions. Obesity is a particularly big problem in the U.S., and it's leading to a surge in the development of new treatments for obesity-related metabolic disorders. Peptide therapeutics that help people control their appetite and manage their weight are being developed to address this growing health concern.

Based on route of administration the U.S. peptide therapeutics market is subdivided parenteral, oral, and other routes of administration. Among the route of administrations segment, parenteral segment held highest revenue share of market in 2022. This attributes to the factors like fast drug delivery, high adoption rate, and ease of administration. A noteworthy trend in subcutaneous injections is the development of self-administration devices designed for user-friendliness. Examples of these devices are autoinjectors and pen injectors, which make it more convenient for patients to self-administer peptide therapies at home, thereby enhancing treatment adherence and convenience.

Additionally, the parenteral method allows for the administration of multiple peptides or peptide-based medicines in a single injection. This capability is particularly crucial in the treatment of complex diseases like diabetes and cancer, where multiple therapeutic targets can be addressed simultaneously. Moreover, parenteral delivery is being explored using minimally invasive injectable technologies such as microneedle arrays, which offer reduced pain and increased patient acceptability.

Based on manufacturer type, the U.S. peptide therapeutics market is classified into in-house and outsourced. The in-house segment dominated the market with the highest market share of around 64.4% in 2022. Key players in the industry are increasingly focusing on developing peptide therapeutics in-house due to the high costs associated with outsourcing and stringent regulatory requirements. Moreover, these companies are making substantial investments in establishing Good Manufacturing Practice (GMP)-compliant peptide production facilities. These facilities are designed to adhere to rigorous quality and safety standards, ensuring the production of safe and effective peptide therapies.

Furthermore, many companies are expanding their in-house manufacturing capabilities to meet the rising demand for peptide-based therapies. This expansion includes the incorporation of new production lines, equipment, and the hiring of additional personnel. Additionally, as peptides progress through the preclinical and clinical development stages, in-house facilities offer the ability to scale up manufacturing. This scalability ensures a seamless transition from research to commercial production.

Based on synthesis technology, the U.S. peptide therapeutics market is subdivided into liquid-phase peptide synthesis, solid-phase peptide synthesis, and hybrid technology. The liquid-phase peptide synthesis segment held the majority of market share in 2022. Automation has significantly enhanced the efficiency, precision, and repeatability of Liquid Phase Peptide Synthesis (LPPS). Automated peptide synthesizers are becoming increasingly sophisticated, enabling high-throughput peptide production for research, development, and commercial manufacturing. Additionally, the downsizing of LPPS processes reduces the consumption of reagents and solvents, rendering the process more environmentally friendly and cost-efficient.

Based on distribution channel, the U.S. peptide therapeutics market is segmented into hospital, retail, and online pharmacies. The hospital pharmacies segment dominated the U.S. peptide market in 2022. Hospital pharmacies typically maintain a well-stocked inventory of essential medications, including peptide drugs. This immediate availability is critical in a hospital setting where timely administration of medications is often vital for patient care. Hospital pharmacies collaborate closely with physicians, including specialized care teams, to optimize the use of peptide treatment options and give information on dose, administration, and monitoring.

Also, certain hospital pharmacists are prepared to create specialized peptide formulations, such as modified doses or specific peptide combinations, to address the needs of individual patients. However, these above trends reflect the evolving significance of hospital pharmacies in the peptide therapeutics industry, with a focus on optimizing patient care, improving treatment results, and assuring the safe and efficient administration of peptide-based treatments in a hospital setting.

U.S. Peptide Therapeutics Market Share

The key players in peptide therapeutics market are

- Pfizer, Inc.

- Amgen, Inc.

- Eli Lilly and Company

- Sanofi

- AstraZeneca plc

- AbbVie, and GlaxoSmithKline plc.

These companies are implementing several strategies such as collaborations, acquisitions, partnerships, mergers, and product launches, etc. to maintain a competitive edge in the industry.

U.S. Peptide Therapeutics Industry News

- In June 2023, Eli Lily acquired Dice Therapeutics to bulk up its treatment portfolio for immune-related diseases including the production of peptides. This acquisition will further expand the peptide and polypeptide therapeutics portfolio.

- In April 2022, AbbVie Inc., and Plexium, Inc., announced an exclusive strategic collaboration to develop and commercialize novel Targeted Protein Degradation (TPD) therapeutics for neurological conditions. This collaboration combined the proteins and peptides segment of these companies and helped to increase the product reach, thus, generating more revenue.

The U.S. peptide therapeutics market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2018 to 2032 for the following segments

Click here to Buy Section of this Report

By Type

- Branded peptides

- Generic peptides

By Application

- Metabolic and endocrine disorders

- Cancer

- Cardiovascular disorders

- Gastrointestinal disorders

- Central nervous system disorders

- Respiratory disorders

- Pain management

- Renal disorders

- Dermatology

- Other applications

By Route of Administration

- Parenteral

- Oral

- Other routes of administration

By Manufacturer Type

- In-house

- Outsourced

By Synthesis Technology

- Liquid phase peptide synthesis (LPPS)

- Solid phase peptide synthesis (SPPS)

- Hybrid Technology

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

Related Reports

- Veterinary Infusion Pumps Market – By Product (Syringe, Volumetric, Ambulatory, Implantable), Animal type (Companion, ...

- Veterinary CRO and CDMO Market – By Animal Type (Companion, Livestock), Service Type (CRO, [Clinical Trials, Quality A...

- Pet Sitting Services Market – By Service (In-home Pet Sitting Services, Drop-in Visits, Boarding Services, Daycare Ser...

- Veterinary Video Endoscopes Market – By Product (Equipment, PACS Software), Animal Type (Small, Large), Application (D...

- Pet Herbal Supplements Market – By Product Type (Multivitamins & Minerals, Omega 3 Fatty Acids), Application (Digestiv...

- Equine Artificial Insemination Market Size - By Component (Services, Semen [Fresh, Chilled, Frozen], Equipment, Reagents...

Table of Content

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy