Automotive Parts Packaging Market Trends

The global automotive parts packaging market was valued at USD 9.39 billion in 2024 and is projected to grow at a CAGR of 4.5% from 2025 to 2035. This upward trajectory is fueled by the consistent expansion of the automotive industry worldwide, particularly in vehicle production and aftermarket services.

Rising vehicle ownership across both mature and emerging markets is leading to increased demand for maintenance, repairs, and parts replacement. This directly drives the need for advanced packaging systems capable of protecting diverse automotive components—from compact fasteners to large-scale engine parts. The parallel growth of online automotive retail platforms is also boosting demand for tamper-resistant and durable packaging designed for secure last-mile delivery.

As automotive supply chains become more complex, manufacturers are prioritizing packaging solutions that not only ensure physical protection but also enhance logistics performance. Components often require safeguards against corrosion, static, and impact damage, leading to the adoption of packaging with volatile corrosion inhibitors (VCI), anti-static materials, and moisture resistance. Simultaneously, packaging formats are being optimized for space-saving, stackability, and integrated tracking via barcodes or RFID systems to enhance warehouse and inventory management.

Download Sample Ask for Discount Request Customization

Sustainable Packaging Gains Ground

Sustainability is playing a pivotal role in reshaping the market landscape. Automotive OEMs and Tier 1 suppliers are increasingly adopting eco-friendly and circular packaging systems. Recyclable, reusable, and returnable packaging—particularly plastic bins, crates, and pallets—are gaining popularity due to their cost efficiency over multiple cycles and environmental benefits. Companies are also investing in biodegradable or compostable material innovations in line with regulatory mandates and green initiatives.

Tech-Enabled Packaging Leads the Way

Technology is revolutionizing the packaging segment, especially for high-value automotive components. Smart packaging solutions equipped with IoT sensors, blockchain tracking, and real-time monitoring capabilities are becoming standard. These systems improve product traceability, ensure authenticity, and reduce risks such as theft or counterfeiting—crucial for global operations involving premium parts and EV batteries.

Report Scope

|

Parameter

|

Details

|

|

Study Period

|

2025–2035

|

|

Base Year

|

2024

|

|

Forecast Units

|

USD Billion

|

|

Segments Covered

|

Packaging Type, Component Type, Product Type, Region

|

|

Key Regions

|

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

|

|

Market Drivers

|

E-commerce growth, sustainable logistics, rise in vehicle ownership

|

|

Market Challenges

|

Cost of smart packaging, material recycling complexity

|

|

Opportunities

|

Smart packaging tech, returnable packaging, EV parts packaging innovations

|

Packaging Type Insights

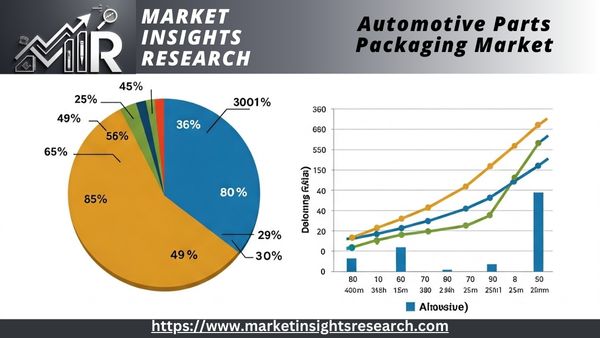

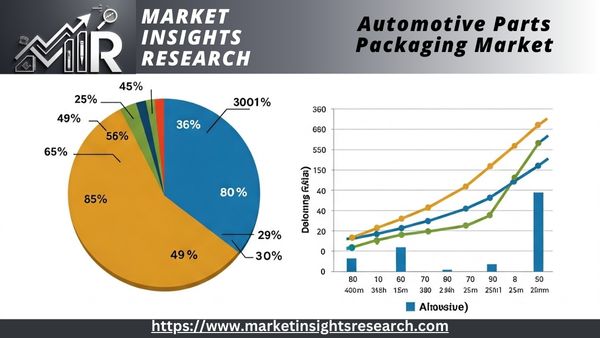

In 2024, reusable packaging captured the largest share at over 56% and is projected to grow at a CAGR of 5.0% through 2035. Containers, racks, and pallets designed for repeated use are driving this growth due to rising sustainability awareness and cost-saving potential.

Disposable packaging—often used for aftermarket and international shipments—remains relevant for short-term, lightweight transport solutions. Items like cardboard boxes and molded pulp trays are valued for their customizability and affordability, especially in e-commerce channels.

Component Type Insights

Batteries accounted for the highest revenue share at over 18% in 2024, driven by the surging demand for electric vehicles. Battery packaging must offer high structural integrity and insulation, while meeting safety and regulatory standards. As EV production scales up, so does the requirement for specialized, eco-friendly battery packaging.

Underbody components are projected to grow at the fastest rate of 5.4% CAGR. These large, irregular parts—such as suspension systems and chassis frames—require heavy-duty, impact-resistant packaging that ensures integrity during transport across global supply chains.

Product Type Insights

Corrugated products led the market in 2024, contributing over 18% of revenue and expected to expand at a CAGR of 5.2%. Their lightweight, recyclable nature makes them an ideal choice for sustainable primary and secondary packaging.

Pallets, typically made from wood, plastic, or metal, continue to see strong demand due to their compatibility with modern warehousing and automation systems, helping streamline movement and reduce product damage.

Regional Insights

The Asia Pacific region dominated the market in 2024 with a revenue share exceeding 36%, and it is forecasted to maintain the fastest CAGR of 5.1% through 2035. Countries like China, India, Japan, South Korea, and Thailand serve as global manufacturing hubs, generating high demand for sophisticated automotive packaging. Additionally, rapid growth in the aftermarket segment and expanding e-commerce in developing nations further drive packaging needs in the region.

China Automotive Parts Packaging Market Trends

China's automotive parts packaging market is experiencing sustained growth due to its unparalleled manufacturing scale and rapidly evolving automotive sector. As the world’s largest producer and consumer of automobiles, China’s demand for specialized, durable, and scalable packaging solutions spans domestic use and expansive export logistics. This demand is bolstered by national initiatives such as Made in China 2025, which emphasizes technological advancement and supply chain modernization in the automotive sector. These policies are accelerating investment in smart, sustainable packaging solutions tailored for electric vehicles, autonomous systems, and precision components.

North America Automotive Parts Packaging Market Trends

In North America, the automotive parts packaging landscape is supported by a mature industrial base and high aftermarket activity. The presence of established OEMs such as Ford, General Motors, and Tesla, along with their networks of tiered suppliers, drives the need for advanced packaging that ensures part integrity through multiple transit cycles. Just-in-time manufacturing models and lean warehousing strategies necessitate returnable, form-fit packaging systems—especially for critical components like engines and transmissions.

The U.S. market, in particular, is benefitting from the rise of automotive e-commerce platforms such as Amazon and RockAuto, which are reshaping packaging logistics for small parcel distribution. Additionally, reshoring and domestic manufacturing initiatives are boosting the demand for localized packaging innovation that aligns with operational efficiency and environmental targets.

Download Sample Ask for Discount Request Customization

Europe Automotive Parts Packaging Market Trends

Europe continues to lead in automotive innovation, with countries like Germany, France, the UK, and Italy home to premier OEMs and globally integrated supply chains. The demand for premium automotive packaging in Europe is driven by the region's commitment to high-quality manufacturing standards and cross-border logistics coordination. Germany remains the core market, supported by global leaders such as Volkswagen, Mercedes-Benz, Audi, and BMW.

The implementation of the German Packaging Act (VerpackG) has amplified the focus on environmental responsibility, steering packaging development toward reduced material use and greater recyclability. As European automotive manufacturers prioritize circular economy models, packaging providers are responding with lightweight, returnable, and recyclable solutions that meet both performance and compliance requirements.

Key Automotive Parts Packaging Company Insights

The global automotive parts packaging market is highly competitive, with a mix of multinational corporations and regional specialists. Companies differentiate themselves through innovations in material science, part-specific packaging design, and alignment with OEM sustainability strategies. Demand is rising for recyclable plastics, molded fiber alternatives, and biodegradable composites that reduce environmental impact without compromising strength or durability.

Strategic collaborations, facility expansions, and technology investments are key tactics being used to maintain market positioning. Companies are also tailoring solutions for electric vehicle components, which require specialized protection due to weight, shape, and hazardous material classifications.

Key Players in the Market

Recent Developments

-

November 2024 – Nefab, through its PolyFlex subsidiary, launched a 19,000-square-foot mold-making facility in Grand Blanc, Michigan. The facility enhances Nefab’s capability to rapidly design and prototype injection-molded packaging tools, incorporating thermoforming and tool production under one roof for faster delivery and optimized costs.

-

August 2022 – ORBIS Corporation showcased its reusable packaging solutions for electric vehicle batteries at The Battery Show in Michigan. The event highlighted how ORBIS’ packaging systems improve sustainability, product safety, and logistics efficiency across the EV supply chain, aligning with the industry's shift toward green energy solutions.

Download Sample Ask for Discount Request Customization

Automotive Parts Packaging Market Segmentation

By Packaging Type

By Component Type

By Product Type

By Region

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa