Logistics Robot Market Size, Share, and Trends Analysis Report: Components (Hardware Software Services), Industries (E-commerce Healthcare), Applications, Regions, and Segment Forecasts (2028ŌĆō2035)

Published Date: May - 2025 | Publisher: Market Insights Research | No of Pages: 455 | Industry: Technology | Format: Report available in PDF / Excel Format

View Details Buy Now 4200 Download Sample Ask for Discount Request CustomizationLogistics Robot Market Size & Trends

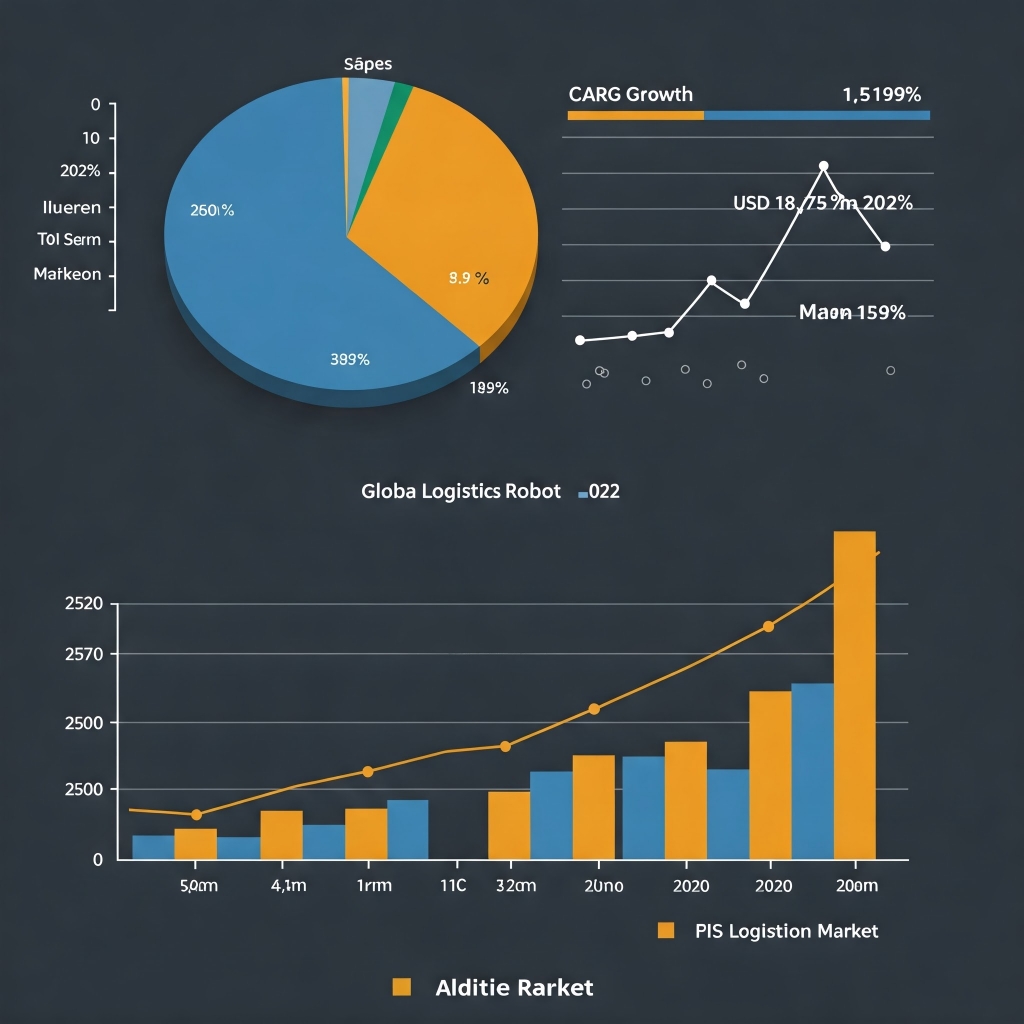

The global logistics robot market size was projected to reach USD 18.75 billion in 2027 and is anticipated to grow at a CAGR of 15.9% from 2028 to 2035. The market is witnessing rapid expansion due to rising automation demand, technological breakthroughs, and evolving industry requirements. The drive for efficiency, cost-effectiveness, and scalability in logistics operations is fueling the adoption of robotics across warehouses, distribution centers, and fulfillment hubs.

The exponential growth of e-commerce and omnichannel retailing has created an unprecedented demand for Automated and efficient warehousing solutions. Industry giants like Amazon, Alibaba, and Walmart are increasingly deploying Autonomous Mobile robots (AMRs), Automated guided vehicles (AGVs), and Robotic picking systems to optimize warehouse operations. These robots play a crucial role in reducing manual handling, improving order accuracy, and enhancing sorting and packaging efficiency. With customer expectations shifting towards same-day and next-day deliveries, automation has transitioned from being an option to a necessity. By leveraging robotics, companies achieve faster turnaround times, enhanced space utilization, and a streamlined supply chain.

Advancements in Artificial intelligence (Industrial), machine learning (ML), and computer vision have significantly enhanced the capabilities of logistics robots. AI-driven robots can now navigate intricate warehouse layouts, detect obstacles, and optimize pick-and-place functions autonomously. ML algorithms empower robots to learn from past tasks, continuously refining their efficiency and adaptability. Meanwhile, computer vision technology, integrated with Construction sensors and LiDAR, enables robots to accurately identify, classify, and handle objects of various shapes, sizes, and weights. These technological innovations make logistics robots smarter, more Autonomous, and cost-effective, fostering widespread adoption.

A growing concern in the logistics industry is labor shortages, exacerbated by an aging workforce and the physically demanding nature of warehouse jobs. This challenge is particularly pronounced in North America, Europe, and parts of the Asia Pacific region. Rising wages and employee benefits further increase the cost of manual labor. Logistics robots present a scalable and cost-efficient alternative, allowing warehouses to operate 24/7 with minimal Human intervention. These robots not only eliminate fatigue-related errors but also reduce workplace injuries, contributing to overall cost savings and operational efficiency.

Despite the market’s rapid growth, several challenges impede widespread adoption. The high initial investment required for Robotic systems remains a significant barrier, especially for small and mid-sized enterprises (SMEs). Expenses associated with hardware, software, installation, and infrastructure upgrades can be substantial. Additionally, ongoing costs such as maintenance, software updates, and AI model training further add to the total cost of ownership. While the long-term benefits of enhanced efficiency and cost savings outweigh the initial expenditure, the upfront capital requirement continues to be a hurdle, particularly in price-sensitive markets.

Free Download Sample Ask for Discount Request Customization

Report Coverage & Deliverables

Component Insights

The hardware segment held the largest market share in 2024, accounting for 62.2% of global revenue. This dominance is primarily due to the rapid integration of automated guided vehicles (AGVs), Car Mobile robots (AMRs), and robotic arms in logistics operations. Businesses are increasingly leveraging these Dental systems to enhance efficiency, minimize manual intervention, and optimize workflow management. AMRs, in particular, have gained traction for their AI-powered navigation capabilities, allowing them to move seamlessly without predefined paths. Additionally, innovations in sensor technologies, such as LiDAR, Ultrasonic detectors, and Construction vision systems, have significantly improved robots’ ability to navigate complex environments with high precision.

The services segment is poised for the fastest growth during the forecast period due to the surging demand for robot deployment, training, integration, maintenance, and support. As logistics automation continues to evolve, companies require specialized expertise to seamlessly implement and manage robotic solutions. The increasing complexity of automation technologies has fueled the adoption of the Robotics-as-a-Service (RaaS) model, which allows businesses, especially small and medium enterprises (SMEs), to access cutting-edge robotic solutions without incurring significant upfront costs.

Application Insights

The warehouse and Europe segment Automotive the market in 2024, driven by the rising need for automation in inventory control, order fulfillment, and material handling. The rapid expansion of e-commerce, third-party logistics (3PL), and omnichannel retail has placed immense pressure on businesses to Process and deliver orders faster while optimizing costs. Logistics robots play a crucial role in improving warehouse efficiency, reducing operational expenses, and maximizing space utilization.

Meanwhile, the transportation and delivery segment is anticipated to experience the highest growth in the coming years. The increasing demand for last-mile delivery automation is a key driver fueling this expansion. The surge in e-commerce, Online grocery shopping, and omnichannel retailing has Automotive to higher consumer expectations for same-day and next-day deliveries. To meet these demands, businesses are deploying autonomous delivery robots, drones, and AI-driven logistics vehicles to enhance operational efficiency. Additionally, the rise of contactless delivery solutions—accelerated by the COVID-19 pandemic—has further fueled the adoption of Surface-driving delivery robots and automated package-handling systems, ensuring safer and more efficient delivery operations.

Industry Insights

The e-commerce sector dominated the market in 2024, largely due to the unprecedented growth in Online shopping and the increasing need for faster, more reliable order fulfillment. To address escalating order volumes and consumer expectations, major e-commerce players are investing heavily in robotics, including AMRs, AGVs, and robotic arms, to streamline warehouse operations, enhance accuracy, and expedite order processing.

The Healthcare industry is expected to witness remarkable growth in the coming years as hospitals and Medical institutions increasingly integrate automation into their logistics operations. Robotics are being deployed for critical tasks such as transporting Medical supplies, lab samples, food, and waste within Healthcare facilities, significantly reducing Human error and enhancing efficiency. Additionally, the rising cost of Cloud services is driving institutions to invest in robotic automation to cut down labor costs, optimize supply chain management, and improve overall operational efficiency.

Regional Insights

Asia Pacific Automotive the market in 2024, capturing 36.8% of the global share. This stronghold can be attributed to the region’s rapid industrialization, widespread adoption of automation technologies, and substantial investments in smart manufacturing and logistics infrastructure. Countries such as China, Japan, and India are at the forefront of robotics integration, leveraging Dental automation to optimize supply chain processes, reduce labor dependency, and enhance operational efficiency.

China’s Logistics Robot Industry Trends China’s logistics robot industry has undergone rapid advancements, reflecting the nation’s commitment to automation and Virtual manufacturing. A major milestone was achieved in August 2024 when China successfully tested the SA750U, an unmanned civilian drone with a cargo capacity of 3.2 metric tons. Developed in Hunan province, the drone can reach altitudes of 7,300 meters and cover distances of up to 2,200 kilometers. This aligns with China's broader strategy to boost its low-altitude economy, which is projected to become a USD 280 billion industry by 2030. Investments in drone technology and logistics automation are expected to enhance efficiency and innovation in the sector.

India’s Growing Logistics Robot Market India’s logistics robot industry is expanding rapidly due to the booming e-commerce sector, rising labor costs, government-driven automation initiatives, and advancements in robotics. Companies are increasingly adopting automation to enhance operational efficiency, minimize costs, and strengthen supply chain resilience. Market leaders such as Flipkart, Amazon, and Reliance Retail are spearheading this transformation by deploying autonomous mobile robots (AMRs), robotic sorting systems, and automated Europe and retrieval systems (AS/RS) to streamline warehouse management. The demand for same-day and next-day deliveries is accelerating the adoption of logistics robotics across the country.

North America’s Logistics Robot Industry Trends North America is experiencing significant growth in logistics robotics, driven by advancements in artificial intelligence and automation. Companies such as Boston Dynamics, Locus Robotics, and Fetch Robotics are leading the way with AI-driven robots capable of autonomous navigation, real-Real-Time-Payments-Market' target='_blank'>time data analysis, and machine learning-based decision-making. These technologies are optimizing workflows, reducing errors, and improving inventory tracking in warehouses.

A key trend shaping the U.S. logistics robot industry is the rise of the Robotics-as-a-Service (RaaS) model. This approach allows businesses to integrate robotic solutions without the burden of high initial capital investment, making automation more accessible and cost-effective. As a result, more organizations are embracing robotics to enhance their logistics operations and remain competitive in the market.

Europe’s Logistics Robot Industry Trends European companies are heavily investing in automation to streamline warehouse operations and improve supply chain efficiency. The adoption of automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) is on the rise, assisting businesses with tasks such as inventory management, picking, and transportation.

The UK is experiencing rapid growth in logistics robotics, fueled by the increasing demand for e-commerce fulfillment. Companies are implementing robotic solutions, including delivery drones and autonomous vehicles, to enhance last-mile delivery speed and efficiency. Meanwhile, Germany is leading the way in integrating Industry 4.0 technologies into logistics operations. With its strong industrial base and commitment to automation, Germany is leveraging AI and machine learning to optimize warehouse workflows, predict demand fluctuations, and enhance logistics decision-making.

Key Insights into Leading Logistics Robot Companies To remain competitive and address growing industry demands, logistics robot companies are adopting strategies such as mergers and acquisitions, product innovation, strategic partnerships, and market expansion. These efforts are helping providers strengthen their technological offerings and expand their reach across industries such as e-commerce, retail, healthcare, and automotive.

One of the key players in the industry, Honeywell International Inc., operates across multiple sectors, including aerospace, industrial automation, and logistics robotics. The company specializes in warehouse automation solutions, offering a range of AMRs, robotic palletizing and depalletizing systems, high-speed robotic sorting solutions, and AS/RS. These solutions are integrated with AI, machine vision, and IoT-in-Education-Market' target='_blank'>IoT technologies to enhance efficiency and accuracy.

Swisslog Holding AG, a subsidiary of KUKA AG, is another leading provider of robotic automation solutions for logistics and healthcare. Headquartered in Switzerland, Swisslog specializes in warehouse automation, robotic picking, AS/RS, and conveyor technologies. The company serves industries such as e-commerce, retail, food & beverage, and pharmaceuticals with solutions like AutoStore, CarryPick AMRs, CycloneCarrier shuttle systems, and SynQ warehouse management software. These innovations help businesses optimize their logistics operations and drive efficiency across the supply chain.

Free Download Sample Ask for Discount Request Customization

key players in the logistics robot industry based on the report

Honeywell International Inc. – A multinational conglomerate specializing in industrial automation and logistics robotics, offering AMRs, robotic sorting systems, AS/RS, and AI-integrated solutions.

Swisslog Holding AG (A subsidiary of KUKA AG) – A leading provider of warehouse automation and robotic solutions, known for technologies like AutoStore, CarryPick AMRs, and SynQ warehouse management software.

Boston Dynamics – A robotics company focusing on Dental AI-powered logistics robots with autonomous navigation and machine-learning capabilities.

Locus Robotics – A key player in warehouse automation, providing autonomous mobile robots (AMRs) for order fulfillment.

Fetch Robotics – Specializing in AI-driven logistics robots that enhance efficiency in warehouse operations.

Flipkart, Amazon, and Reliance Retail – Major e-commerce companies driving the adoption of logistics robots in India through automation technologies such as AMRs, AS/RS, and robotic sorting systems.

Recent Developments

In February 2025, Locus Robotics formed a strategic alliance with BITO Lagertechnik, a prominent provider of Battery and order-picking solutions. This collaboration integrates BITO Lagertechnik's advanced storage systems with Locus Robotics' AI-powered LocusONE orchestration platform and fleet of autonomous mobile robots (AMRs). The partnership is designed to optimize warehouse processes, accelerate return on investment, and enable seamless deployment of automation technologies.

In December 2024, Dematic expanded its footprint in Taiwan by inaugurating a new office in Taoyuan City. This strategic expansion is aimed at strengthening support for key sectors, including retail, food and beverage, third-party logistics, and pharmaceuticals. Located in the Zhongli District, the office offers convenient access to Taoyuan International Airport-Logistics-System-Market' target='_blank'>Airport and the High-Speed Rail Station, facilitating efficient business operations.

In October 2024, Swisslog Holding AG bolstered its presence in North America by establishing a new office in Mississauga, Ontario, Canada. This expansion is intended to cater to the rising demand for automation solutions across various industries, including general merchandise, food and beverage, industrial manufacturing, electronics, and healthcare. The new office enhances Swisslog’s ability to provide localized support and innovative robotic solutions to businesses across Canada.

Free Download Sample Ask for Discount Request Customization

Logistics Robot Market Report Scope

The Logistics Robot Market Report provides a comprehensive analysis of the industry, covering key trends, technological advancements, competitive landscape, and market growth drivers. The report evaluates various market segments based on component type, application, end-user industry, and geographical distribution. It also highlights emerging opportunities and challenges faced by stakeholders in the logistics automation ecosystem.

Scope of the Report

|

Parameter |

Details |

|

Market Size |

Covers global, regional, and country-level market valuation and forecasts for logistics robots. |

|

Components |

Hardware (AMRs, AGVs, robotic arms, sensors), Software (AI, fleet management, WMS), Services (maintenance, consulting, integration). |

|

Applications |

Warehouse automation, transportation & delivery, sorting & picking, inventory management, packaging & palletizing. |

|

End-User Industries |

E-commerce & Retail, Manufacturing, Food & Beverage, Healthcare & Pharmaceuticals, Automotive, Third-Party Logistics (3PL). |

|

Geographical Coverage |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa. |

|

Key Market Drivers |

Growth of e-commerce, rising labor costs, demand for automation, AI and machine learning integration, supply chain optimization. |

|

Challenges & Constraints |

High initial investment, cybersecurity risks, regulatory hurdles, integration complexities. |

|

Opportunities |

Robotics-as-a-Service (RaaS), AI-driven optimization, last-mile delivery automation, strategic partnerships. |

|

Competitive Landscape |

Analysis of key players, market shares, product innovations, M&A activities, strategic expansions. |

|

Forecast Period |

Typically covers a 5-10 year outlook with market projections. |

Global Logistics Robot Market Report Segmentation

-

By Component

-

Hardware (Autonomous Mobile Robots (AMRs), Automated Guided Vehicles (AGVs), Robotic Arms, Sensors, Others)

-

Software (Fleet Management Software, Warehouse Management Systems, AI & Machine Learning Integration)

-

Services (Maintenance & Support, Consulting, Integration Services)

-

-

By Application

-

Warehouse Automation

-

Transportation & Delivery

-

Sorting & Picking

-

Inventory Management

-

Packaging & Palletizing

-

-

By End-User Industry

-

E-commerce & Retail

-

Manufacturing

-

Food & Beverage

-

Healthcare & Pharmaceuticals

-

Automotive

-

Third-Party Logistics (3PL)

-

-

By Geography

-

North America (United States, Canada, Mexico)

-

Europe (Germany, United Kingdom, France, Italy, Spain, Rest of Europe)

-

Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific)

-

Latin America (Brazil, Argentina, Rest of Latin America)

-

Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

-

Related Reports

- Saudi Arabia Automotive Lubricant Market, By Vehicle Type (Passenger Car, Commercial Vehicle, Two-Wheeler), By Demand Ty...

- Auto Dimming Mirror Market- Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Vehicle Type (P...

- Rear-View Mirror Market-Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented, By Vehicle Type (Pass...

- Automotive Plastics Market ŌĆō Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type (Polypr...

- Australia Automotive Coolant Market ŌĆō Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Vehicle Ty...

- Catalytic Converter Market ŌĆō Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Vehicle Type...

Table of Content

Table of Contents

-

Executive Summary

-

Market Overview

-

Key Findings

-

Competitive Landscape

-

Introduction

-

Definition and Scope

-

Research Methodology

-

Assumptions and Limitations

-

Market Dynamics

-

Market Drivers

-

Market Restraints

-

Opportunities

-

Industry Challenges

-

Global Logistics Robot Market Trends

-

Emerging Technologies

-

AI and Machine Learning in Robotics

-

Rise of Robotics-as-a-Service (RaaS)

-

Automation in E-commerce and Warehousing

-

Market Segmentation

-

By Robot Type

-

Autonomous Mobile Robots (AMRs)

-

Automated Guided Vehicles (AGVs)

-

Robotic Arms

-

Drones

-

By Component

-

Hardware

-

Software

-

Services

-

By Application

-

Warehouse Automation

-

Transportation & Delivery

-

Order Fulfillment & Sorting

-

Last-Mile Delivery

-

By Industry Vertical

-

E-commerce & Retail

-

Healthcare & Pharmaceuticals

-

Automotive

-

Food & Beverage

-

Manufacturing

-

Logistics & Supply Chain

-

Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

-

Competitive Landscape

-

Key Players and Market Share

-

Recent Developments & Strategic Initiatives

-

Mergers & Acquisitions

-

Partnerships & Collaborations

-

Company Profiles

-

Honeywell International Inc.

-

Boston Dynamics

-

Locus Robotics

-

Swisslog Holding AG (KUKA AG)

-

Dematic

-

Fetch Robotics

-

GreyOrange

-

Geek+

-

Other Key Players

-

Future Outlook & Market Forecast (2024-2032)

-

Growth Projections

-

Investment Trends

-

Challenges and Opportunities

-

Conclusion & Recommendations

-

Key Takeaways

-

Strategic Recommendations for Stakeholders

Executive Summary

-

Market Overview

-

Key Findings

-

Competitive Landscape

Introduction

-

Definition and Scope

-

Research Methodology

-

Assumptions and Limitations

Market Dynamics

-

Market Drivers

-

Market Restraints

-

Opportunities

-

Industry Challenges

Global Logistics Robot Market Trends

-

Emerging Technologies

-

AI and Machine Learning in Robotics

-

Rise of Robotics-as-a-Service (RaaS)

-

Automation in E-commerce and Warehousing

Market Segmentation

-

By Robot Type

-

Autonomous Mobile Robots (AMRs)

-

Automated Guided Vehicles (AGVs)

-

Robotic Arms

-

Drones

-

-

By Component

-

Hardware

-

Software

-

Services

-

-

By Application

-

Warehouse Automation

-

Transportation & Delivery

-

Order Fulfillment & Sorting

-

Last-Mile Delivery

-

-

By Industry Vertical

-

E-commerce & Retail

-

Healthcare & Pharmaceuticals

-

Automotive

-

Food & Beverage

-

Manufacturing

-

Logistics & Supply Chain

-

Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Competitive Landscape

-

Key Players and Market Share

-

Recent Developments & Strategic Initiatives

-

Mergers & Acquisitions

-

Partnerships & Collaborations

Company Profiles

-

Honeywell International Inc.

-

Boston Dynamics

-

Locus Robotics

-

Swisslog Holding AG (KUKA AG)

-

Dematic

-

Fetch Robotics

-

GreyOrange

-

Geek+

-

Other Key Players

Future Outlook & Market Forecast (2024-2032)

-

Growth Projections

-

Investment Trends

-

Challenges and Opportunities

Conclusion & Recommendations

Key Takeaways

Strategic Recommendations for Stakeholders

List Tables Figures

NA

FAQ'S

For a single, multi and corporate client license, the report will be available in PDF format. Sample report would be given you in excel format. For more questions please contact:

Within 24 to 48 hrs.

You can contact Sales team (sales@marketinsightsresearch.com) and they will direct you on email

You can order a report by selecting payment methods, which is bank wire or online payment through any Debit/Credit card, Razor pay or PayPal.

Discounts are available.

Hard Copy